Former BitMex CEO Artur Hayes shared his Bitcoin predictions in his current analysis. Known for his predictions, the executive analyzes when Bitcoin sales will end. Here are Hayes’ notes for this week…

Artur Hayes predicts that Bitcoin sales will end on this date

The former CEO claims in a recent blog post on Medium that Bitcoin has probably bottomed out. Hayes says the forced sale of Bitcoin by central lenders and Bitcoin miners is likely to end. Those who, in his view, should sell their crypto, have already done so. Since most centralized cryptocurrency lenders are currently in the red, they no longer offer loans or collateral to liquidate. According to Hayes, Bitcoin’s ‘reserve’ status will allow it to rescue the ecosystem from the shadows.

Hayes also addressed the naivete of crypto investors who have no idea how a centralized exchange works. In recent bankruptcy filings, lenders assumed these trading businesses were making themselves super-smart arbitrage deals that were unaffected by market volatility. But that is no longer the case. Investors are now aware that powerful companies can be destroyed.

Companies have no more Bitcoin to sell

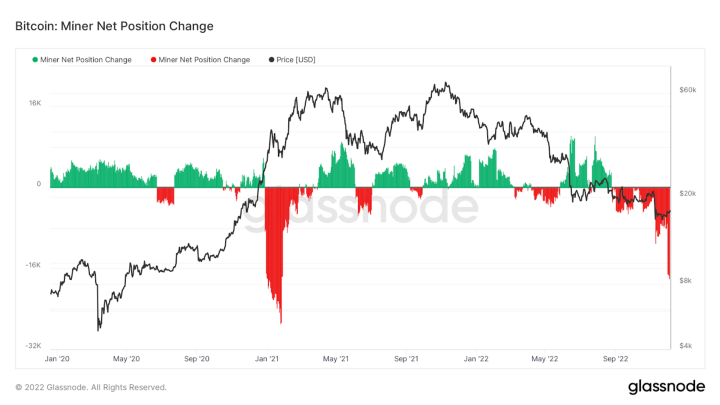

In the midst of the above crisis, it saw hefty sales in Bitcoin by all the major trading firms. Hayes is now confident that these organizations don’t have any extra Bitcoins to sell. He also observes that Bitcoin miners take out loans and are forced to liquidate their BTC holdings to pay off their debts when the bear market starts. As a result, the Bitcoin holdings of miners and companies dwindled. Glassnode creates a great chart that shows the net 30-day change in the amount of Bitcoin held by miners. The next charts analyze how these waves of crypto credit crunch affect miners and what they do in response.

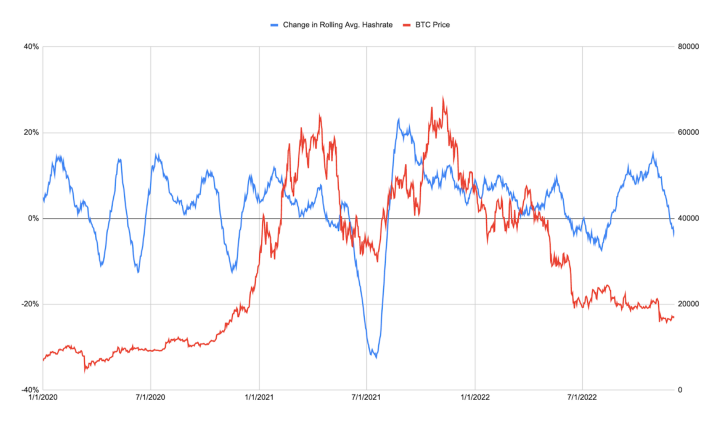

Since the start of the financial crisis in the summer, miners have been a significant net seller of Bitcoin. They need to do this to keep their massive fiat debt current. Even if they don’t have debt, they still have to pay for electricity, and since the price of Bitcoin is so low, they have to sell even more to keep the plant running. Some miners died or had to downsize their operations. This is evidenced by the fluctuation in hashrate.

“Bitcoin and all other risky markets will go higher”

cryptocoin.com As you can follow from , the miners are having a hard time. Arthur Hayes, on the other hand, believes that BTC is on the rise once again. In their most recent analysis, he reported that the Fed’s tightening policies had a lot to do with the spike:

I don’t know when or if the Fed will start printing money again. However, I believe the US Treasury market will become dysfunctional at some point in 2023 due to the Fed’s tightening monetary policies. At this point, I expect the Fed to open the printer bank and then explode – Bitcoin and all other risky markets will go higher.