Bitcoin price faces ‘final resistance’ as the weekly close threatens to retest $22,000. Research warns that Bitcoin bulls have a lot to do to maintain newly gained support. However, the failure could still cause the BTC price to drop below $20,000.

Analyst warns of $20,000 destiny for Bitcoin!

cryptocoin.com As you follow, Bitcoin continued to move in a narrow range over the weekend. BTC has remained almost stable since its sudden drop on March 3, triggered by a margin call amid uncertainty over Silvergate Bank. A crypto analyst said, “Bitcoin has closed every 4-hour candle in the $41 range since the crash. The series is broken now,” he shared.

Since the breakdown, #Bitcoin has closed each 4 hour candle within a $41 range. pic.twitter.com/1Enija1Qgf

— Daan Crypto Trades (@DaanCrypto) March 4, 2023

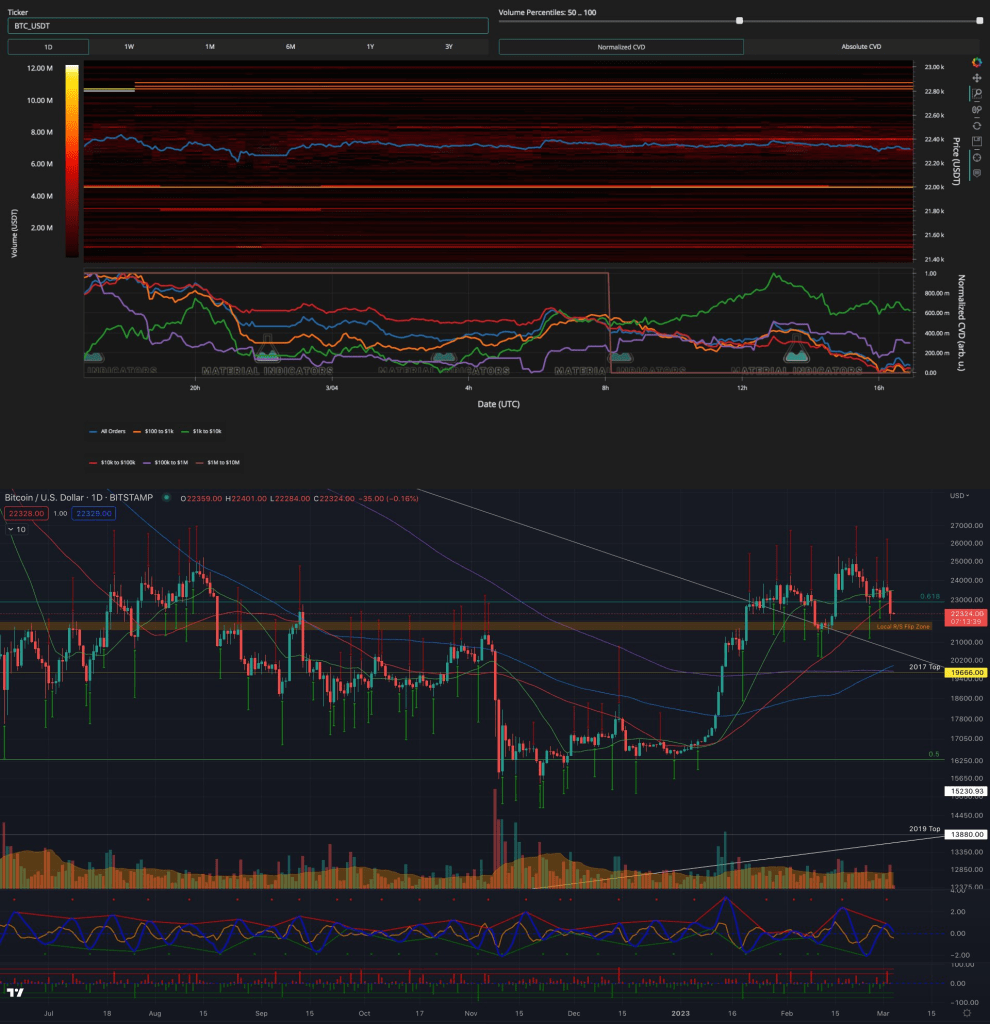

While avoiding further losses, the analysis warns that Bitcoin could easily fall much more if a nearby support level fails to hold. Monitoring resource Material Indicators says BTC price action has ‘lost key technical support’ and the only thing bulls can hold onto is $22,000 at the last resistance/support (R/S) shift. In this context, “The local R/S Flip zone is the last stop between retesting on the trendline. Meanwhile, Trend Precognition shows a downtrend. We’ll see if that changes after the W close,” he explains.

The charts below show the trendline and BTC order book on Binance with $22,000 selling liquidity.

BTC charts / Source: Material Indicators / Twitter

BTC charts / Source: Material Indicators / TwitterMichaël van de Poppe, founder and CEO of trade firm Eight, warns that $20,000 may not help stop immigration if $21,300 is also not held. In a post on March 4, the analyst says:

The critical thing for Bitcoin is to hold the $21.3k area. If we lose that, we will see another bounce back to $19.5 and altcoins down 15-25%.

However, Van de Poppe is still generally more optimistic, suggesting that $40,000 may still appear ‘in a few months’. In a later post, he advises, “Lesson to be learned from the story: Dollar-Cost Average and you have to have the balls to buy when you are not confident.”

“An overwhelming sense of decline”

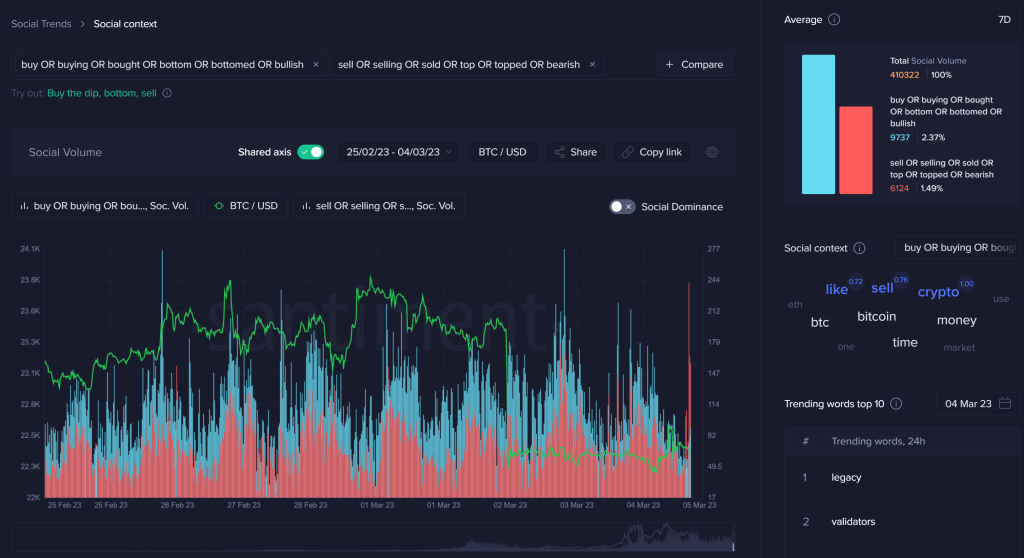

With Silvergate’s potential bankruptcy still a hot topic, research firm Santiment questions why the market reaction has been so fierce. In a special post on the phenomenon, analysts uncover what they describe as “an unusually high amount of negative comments about the markets.”

“It is particularly interesting that #cryptocrash is a trending hashtag on the platform, even though Bitcoin’s slight 5% pullback occurred more than three days ago,” they comment on Twitter user behavior. Based on this, they make the following comment to analysts:

Typically, you can take advantage of this level of negativity in the markets, and such an overwhelming downtrend can lead to a nice bounce to silence critics.

Twitter data graph with selected crypto terms / Source: Santiment

Twitter data graph with selected crypto terms / Source: Santiment