The data shows that Ethereum (ETH) options traders are less bearish than before. Also, the margin-based markets recently witnessed some traders going ultra long at 491,000 ETH. Crypto analyst Marcel Pechman evaluates Ethereum’s metrics and looks for bottom signs.

Ethereum (ETH)’s locked total value (TVL) increased

cryptocoin.com As you follow, Etherrum price has increased by 16% since July 1st. Also, the leading altcoin has outperformed the leading crypto Bitcoin (BTC) in the past 7 days. Meanwhile, investors are hopeful that the Ethereum network’s transition to Proof-of-Stake (PoS) consensus will be a bullish catalyst. It is possible to say that the move is partly driven by investors who adhere to this hope.

The next steps of this smart contract include ‘Merge’, formerly known as ETH 2.0. The final trial on the Goerli test net is expected to take place in July before the Ethereum main net gets the green light to upgrade.

Since Terra’s ecosystem collapsed in mid-May, Ethereum’s locked aggregate value (TVL) has increased. The flight to quality in the decentralized finance (DeFi) industry has greatly benefited Ethereum. Because Ethereum has strong security and battle-tested implementations, including MakerDAO.

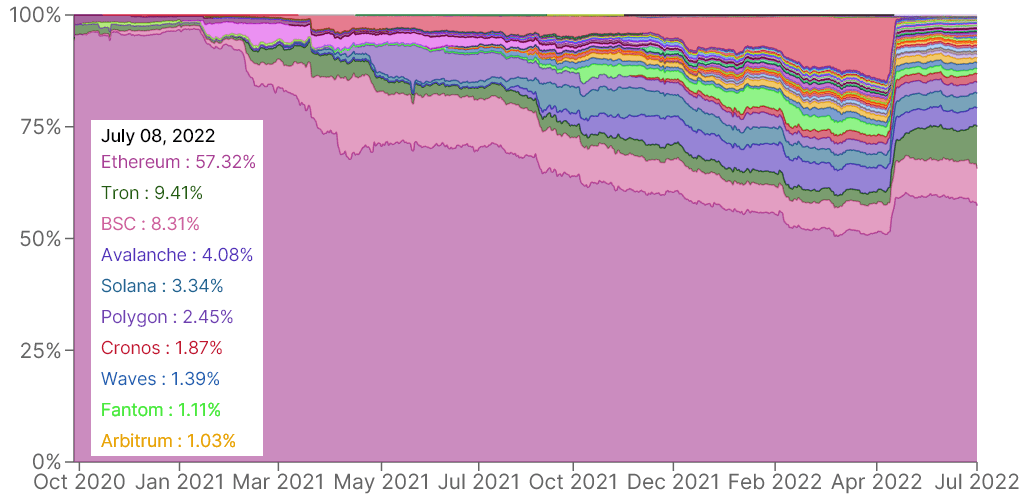

Total locked value (TVL) market share / Source: Defi Lama

Total locked value (TVL) market share / Source: Defi LamaAccording to data from Defi Llama, Ethereum currently has a 57% market share of TVL, up from 51% on April 8. Despite this gain, the current $35 billion deposits in networks’ smart contracts seem small compared to the $100 billion seen in December 2021.

Further supporting the decline in decentralized application usage on Ethereum has resulted in a reduction in median transfer fees, or gas costs, which is currently $1.32. That figure is the lowest since mid-December 2020, when the network’s TVL was $13 billion. However, some of the movement is due to increased use of layer-2 solutions like Polygon and Arbitrum.

Ethereum options traders flirt with neutral range

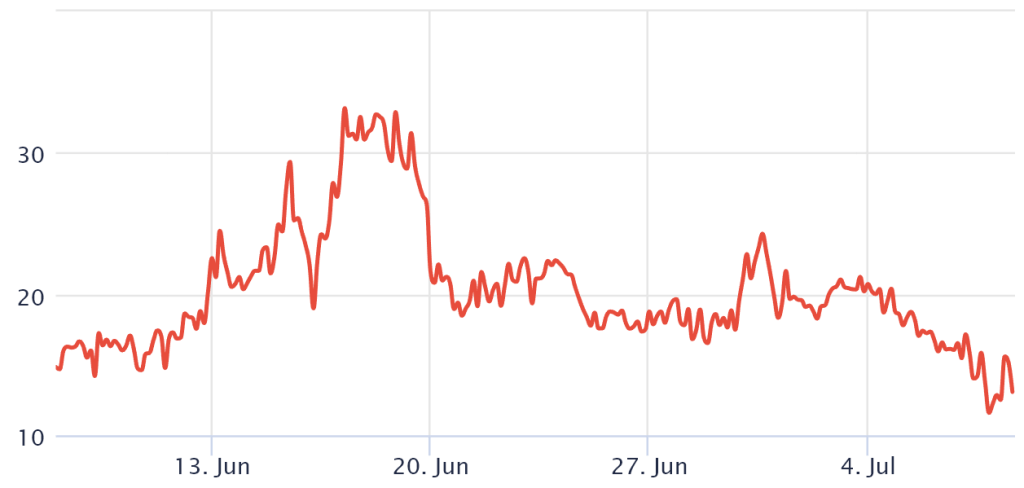

Investors look to Ether’s derivatives market data to understand how whales and market makers are positioned. In this sense, the 25% delta skew is an important sign when professional traders overcharge for up or down protection.

If traders wait for the ETH price to rise, the skewness indicator will move to -12% or lower, reflecting generalized excitement. On the other hand, a skewness above 12% indicates reluctance to take bearish strategies typical of bear markets.

ETH 30-day options 25% delta curvature / Source: Laevitas.ch

ETH 30-day options 25% delta curvature / Source: Laevitas.chEthereum completed a 19% rally in four days. At this point, the curvature indicator briefly touched the neutral-bearing range on July 7. However, these options traders soon switched to a more conservative approach. In this way, it gave a higher probability of market decline as the skewness moved to the current 13% level. In short, the higher the index, the less inclined traders are to price the downside risk.

Margin traders are extremely bullish

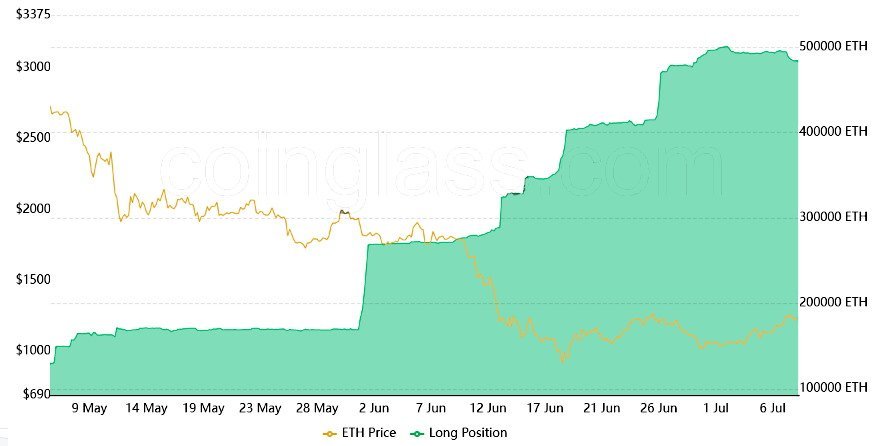

We look at the margin markets to confirm whether these movements are limited to the particular options instrument. Lending allows investors to leverage their position to buy more cryptocurrencies. When these savvy traders open margin longs, their gains (and potential losses) depend on the ETH price increase.

Bitfinex margin traders are known for creating position contracts of 100,000 ETH or higher in a very short time, which demonstrates the involvement of whales and large arbitrage tables.

Bitfinex ETH margin long / Source: Coinglass

Bitfinex ETH margin long / Source: CoinglassInterestingly, these margin traders have greatly increased their longs since June 13. The current 491,000 contracts are close to an 8-month high. These data show that these traders are not expecting any catastrophic price action below $900.

There is no significant change in the option risk metrics of professional traders. Despite this, margin investors continue to rise. Also, they don’t want to reduce their long positions despite the ‘crypto winter’. These whales and market makers are likely to be convinced that $880 on June 18 is the absolute bottom. In this case, traders may come to believe that the worst leg of the bear market is behind us.