With a 20% drop from its most recent peak, the S&P 500 now meets the definition of a bear market zone as a warning sign for Bitcoin and altcoins.

Bitcoin price reflects stock performance

Data from TradingView showed that BTC price dropped below $28,700 over the weekend and then added around $500. It appeared to be in tight range at the time of writing, after US stock indexes saw the last trading day of the week volatile, down 4.7% from the previous day’s high of $30,700. The S&P 500, which managed to reverse after initially falling at the open, was trading 20% below last year’s highs, confirming bear market trends.

The S&P 500 has officially entered a bear market pic.twitter.com/N1lrcBdziT

— Fintwit (@fintwit_news) May 20, 2022

Analysts rank these levels As

Kriptokoin.com , various sources have called for Bitcoin to drop once again, similar to last week’s capitulation event. For example, Twitter analyst PlanC argues that external shifts could push Bitcoin down significantly from current levels:

If the crypto market were in a bubble, I would say the Bitcoin floor is between $25,000 and $27.5k, but macro factors put us 22-24. There is a reasonable possibility that he will withdraw a thousand dollars. Significant black swan, 15-20k becomes a possibility.

Beyond equities, the US dollar index (DXY) consolidated after a strong pullback from a two-year high.

May can compete with 2021 for worst period

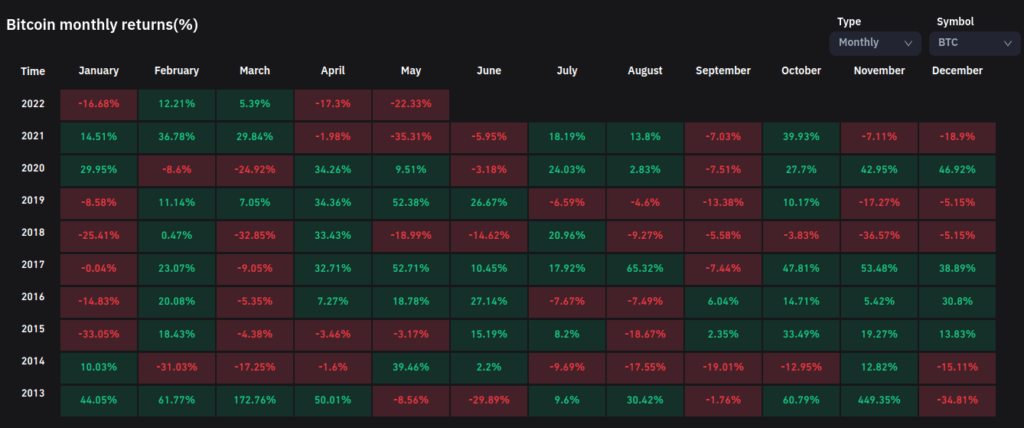

Ten days to month end BTC sees May 2022 in terms of returns risked becoming the worst in its history. Data from on-chai data source Coinglass currently shows total monthly returns of -22% for Bitcoin, the largest pullback of any year except the 2021s -35%. As the aggregated figures confirm, 2022 was also the worst-performing top five months of the year for Bitcoin since 2018.

Elsewhere, popular crypto analyst Michaël van de Poppe says he expects “green numbers for Bitcoin” next week. Crypto Tony pointed out that the up and down targets are around $27,900 and $31,000, respectively.