Veteran market analyst Peter Brandt shared a technical pattern that Bitcoin investors should pay attention to. He said that the model carries downside risks and that the situation will be serious if completed.

Peter Brandt points out the head and shoulders pattern on the Bitcoin chart

The experienced analyst pointed out a head and shoulders formation on the daily Bitcoin (BTC) chart, noting that investors should not ignore this pattern. This pattern signals a downtrend reversal.

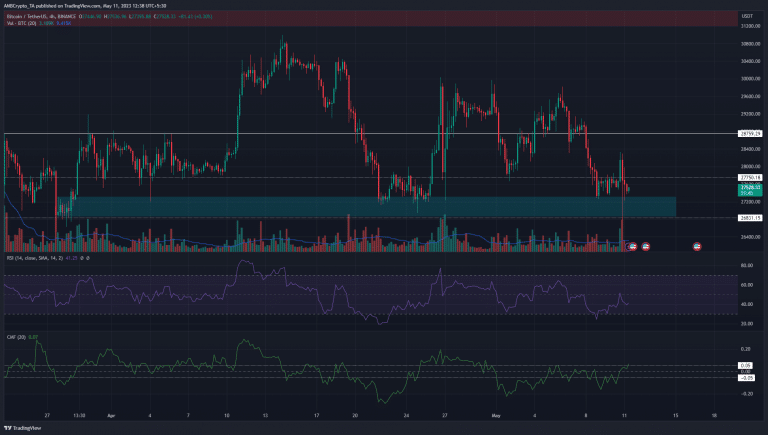

Brandt shared his own graphic showing the pattern’s formation. At this point, he warned, “If a head and shoulders formation is complete, it should be taken seriously.” The chart shows that BTC formed the left shoulder when it went from $20,000 in February to between $26,000 and $28,000 in March.

A head and shoulders should be taken seriously if it is completed $BTC pic.twitter.com/n5ZiLasmUC

— Peter Brandt (@PeterLBrandt) May 11, 2023

The ‘head’ part of the pattern formed in April amid the BTC price’s impressive rise to $31,000 on April 14. The right shoulder took shape as BTC recovered from the decline between April 19 and 24. The left shoulder formed when it went from $20,000 in February to between $26,000 and $28,000 in March.

What does it mean for BTC

A head and shoulders pattern typically indicates a potential trend reversal from bullish to bearish. This pattern consists of three peaks. First; the middle hill (“head”) is the highest. The other two peaks (“shoulders”) are lower and of roughly equal height.

The formation is defined by a collar that connects the lower parts of the shoulders. When the price drops below the support located at the neckline, it is considered a confirmation of the pattern, suggesting that the previous uptrend has exhausted itself and a new downtrend will likely form.

The end of Bitcoin’s rise?

Bitcoin’s uptrend became evident at the beginning of 2023. It then peaked in mid-April. The leading crypto is losing some of its gains from the rally. But this year it has secured a 65% gain. If the head and shoulders pattern is correct, it will mark the final stage of the BTC rally. However, let’s note that not all head and shoulder patterns are bearish.

BTC bulls witness bull trap

April’s US CPI data released on May 10 showed that inflation rates continued to decline. Markets had expected annual inflation rates to remain at 5%. However, data showed the CPI rose 4.9%, the lowest increase in 12 months since April 2021.

Following this, the reaction in the crypto space was positive for several hours. Bitcoin bounced above the $27.8k resistance. In a short time, it rose to $ 28.3 thousand. This little jump did not turn into a rally. BTC is trading below the same resistance level at the time of writing. The recent rally confirmed it was a bull trap.

The 4-hour chart above shows a strong support zone in the $26,800-27,2000 region. This was also an H4 bullish order block from late March. The bounce above $27.8k on Wednesday distorted the market structure and reversed the bullish trend. cryptocoin.comAs we have quoted, some analysts say that the latest moves are preparations for the ‘parabolic surge’.