Bitcoin (BTC) and the broader crypto market rallied after Fed Chairman Jerome Powell’s remarks at the Economic Club of Washington. The gold market also turned north as it perceived Powell’s speeches as dove.

BTC and the crypto market soar after Powell’s speech

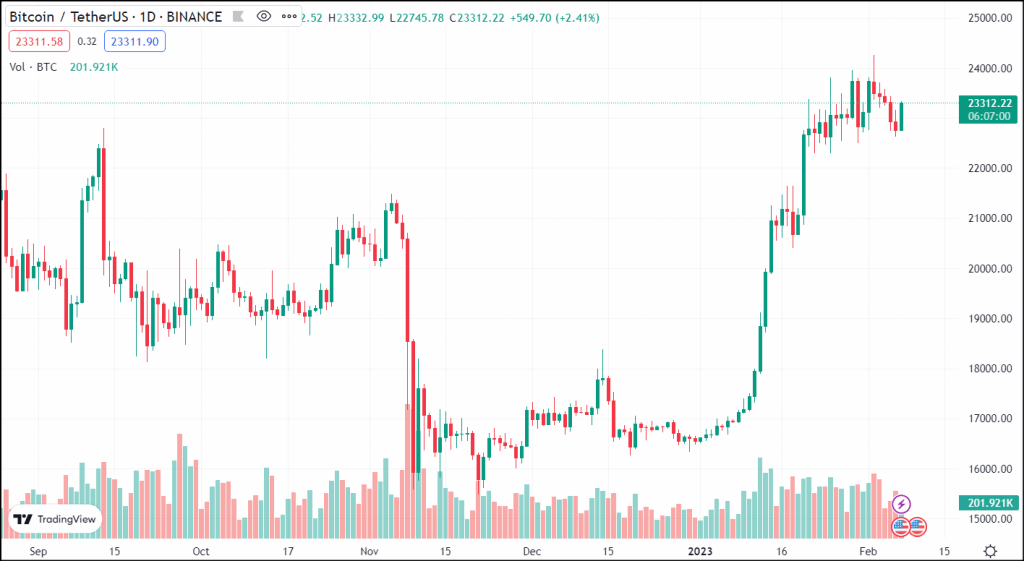

The crypto market headed north on Tuesday after Federal Reserve Chairman Jerome Powell answered macroeconomic questions about the United States at the Economic Club of Washington. The statements made by the Fed Chairman received a positive reaction from the financial markets, as evidenced by the 0.65% increase in the S&P 500 Index. In contrast, the ever-fluctuating crypto market witnessed a 0.66% increase, with market cap reaching $1.08 trillion. As a result of the announcement, the leading cryptocurrency Bitcoin (BTC) rose from $ 22,960 to $ 23,311, while the price of the leading altcoin Ethereum (ETH) rose from $ 1,616 to $ 1,666.

Minutes after the announcement, XRP, SOL, DOGE and LINK also experienced a decent price increase, as did BTC. However, Shiba Inu (SHIB), Fantom (FTM), Optimism (OPT), Terra (LUNA) and Quant (QNT), which are among the top 150 cryptocurrencies by market cap, have been the most affected in the past hours, with some of them more than 3%. experienced a decline.

Powell wants to reach inflation target by 2024

David Rubenstein, co-founder of the Carlyle Group, wasted no time being interviewed. He began by asking whether the Federal Reserve’s decision to increase the reference Federal funds rate by just 25 basis points could be changed as a result of last Friday’s job boom report, which showed 517,000 job gains. Powell said the news is unlikely to lead to a change.

Talking about the current situation in the country, Powell noted that the US economy is clearly slowing from historically high growth rates in 2021, reflecting the reopening of the economy after the pandemic recession. While the latest economic data are mixed and mostly positive, Powell thinks the economy is showing strong momentum. According to the Fed Chair, the labor market is particularly strong with 517,000 new jobs added for January.

powell

powellUS Fed President Jerome Powell gave a speech at the Economics Club in Washington DC, where he made statements about the state of the economy. Jerome Powell said the FOMC wanted to send the message of the disinflation phase even though it’s in the early stages of the process. He noted that the Fed is considering increasing interest rates to keep inflation under control. When asked whether the FOMC would have raised 25 basis points had he known the data in the employment report, he said the Fed’s stance was that rate hikes were appropriate. Powell stated that the target of reducing inflation to 2% will continue and 2023 may see significant decreases in inflation. However, he also stressed that the process may take a little longer. He added that if the data continues to come out stronger than expected, the Fed will definitely raise rates further.

Powell’s statements were followed closely by the market. Traders were looking not only for the Fed’s outlook for the next few months, but also for the unprecedented job market growth reported last week by the U.S. Bureau of Labor Statistics. After Powell’s statements, gold prices headed north from their low levels during the day. At press time, spot gold was trading at $1,870, up 0.17%.

Here are highlights from Powell’s speech today

- Asked whether the 3% target is ideal, the Fed Chairman said the target to reduce inflation to 2% would remain the same. This means that policy tightening can continue until the 2% target is met.

- Powell noted that 2023 could see a significant drop in inflation, an encouraging sign for the crypto market.

- However, the disinflationary process is likely to take longer than expected. Powell stressed that if the data continues to come out stronger than expected, the Fed will definitely raise rates more.

- Despite the decrease in inflation in the goods sector, the fact that there is still no decline in the housing sector questions the hopes that inflation will decrease.

- When asked about his thoughts on whether the economy is in control with inflation and the geopolitical scenario with the Ukraine war, he said the Fed mainly considers the supply and demand chain with the United States.

- Regarding the concerns of the economy, which is in danger of debt default, Powell stated that Congress decides what the debt ceiling should be.

- Interestingly, Powell announced that he received a salary of $190,000 in his capacity as Chairman of the Federal Reserve System.

- Powell rides his bike, plays the guitar and reads novels to relieve stress!