The long -awaited US CPI inflation came warmer with 3 %than the previous year (YOY) from 2.9 %recorded the previous month. This inflation figure, which is higher than expected, triggered market concerns about a possible collapse in the Bitcoin and Altcoin market. In particular, digital assets have recently faced a major fluctuation due to the macroeconomic concerns and the Fed’s hawk stance, which focuses on investors’ sensitivity.

Hot USA reduces hopes in the TFORE, Bitcoin and Altcoin market!

The Ministry of Labor recently reported that US CPI inflation rose from the previous month to 3 %from 2.9 %. On a monthly basis, inflation increased to 0.5 %in January in January. It is noteworthy that both data is higher than market expectations.

At the same time, the core CPI, which does not include food and energy prices, rose from 0.2 %to 0.4 %last month. On the other hand, the annual core US CPI rose to 3.3 %in December compared to 3.2 %. The Wall Street was waiting for CPI to be 3.1 %on annual basis and 0.3 %on a monthly basis.

US CPI triggered liquidations in the market

While the market was waiting for a softer inflation data for January, the price of Bitcoin rose to $ 96,000 before the CPI report. However, the consumer price index increased by 3 %compared to last year, gaining 2.9 %in December and exceeded the estimates of the economists. The CPI of January usually shows significant price changes that enterprises implement at the beginning of the year. Therefore, today’s report is a very important indicator of how successful Fed is in the efforts to control inflation. The index increased by 0.5 %compared to last month; This ratio is slightly faster than the 0.4 %increase in December and higher than the 0.3 %increase estimated by economists.

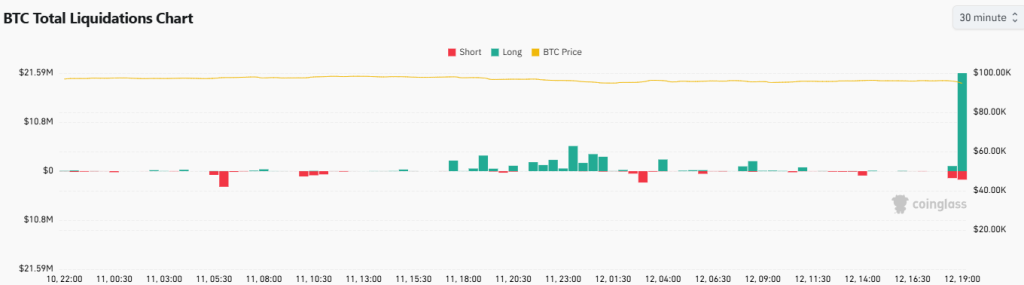

Following the last CPI report, Bitcoin’s price experienced a sharp decline. In just a few minutes, it fell from $ 96,000 to about $ 94,000. According to Coings, total Bitcoin liquidations had about $ 25 million, and buyers quickly closed the Long positions of 22 million dollars.

Analysts now estimate that this increase in inflation can slow down the last recovery in the crypto market that began after the collapse on February 3. The price of Bitcoin is expected to test the level of $ 90,000 this weekend, which will soon reduce the likelihood of reaching $ 100,000 soon.

To be aware of last -minute developments Twitter ‘ in, Facebook ‘ Instagram follow and follow Telegram And Youtube Join our channel!