The leading crypto Bitcoin (BTC) is stuck between $ 19 thousand and $ 20 thousand. However, according to one analyst, the Bitcoin boom is approaching ahead of the week full of important macro events.

Bears and bulls fight for BTC

cryptocoin.com As you follow, Bitcoin (BTC) has consolidated in the region for several weeks. However, it is still looking for a trigger to surpass the $20,000 level. BTC’s possible rally was partially delayed by the prevailing macroeconomic factors, due to the correlation of the leading cryptocurrency with the stock market. Meanwhile, market participants predict a possible rally is still in play. In this environment, both bulls and bears currently do not have a clear advantage as they struggle for dominance.

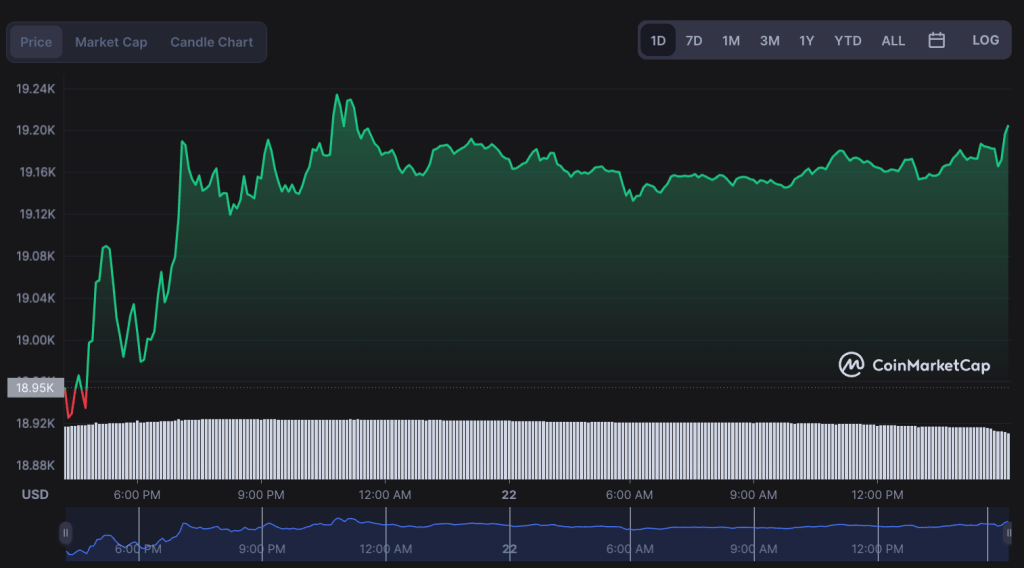

That being the case, Bitcoin has been in the green zone for the last 24 hours. It is trading at $19,200 at press time. Notably, Bitcoin’s stability around the key psychological level of $20,000 contributed to the decline in the asset’s volatility.

Bitcoin 1-day price chart / Source: CoinMarketCap

Bitcoin 1-day price chart / Source: CoinMarketCapThe latest gains came about 24 hours after BTC dropped to around $18,700. However, the price moved away from the key $18,900 support area. At the same time, according to experts, the price of Bitcoin is heavily discounted amid the extended bear market.

Bitcoin weekly candlestick chart / Source: TradingView

Bitcoin weekly candlestick chart / Source: TradingViewBitcoin technical analysis

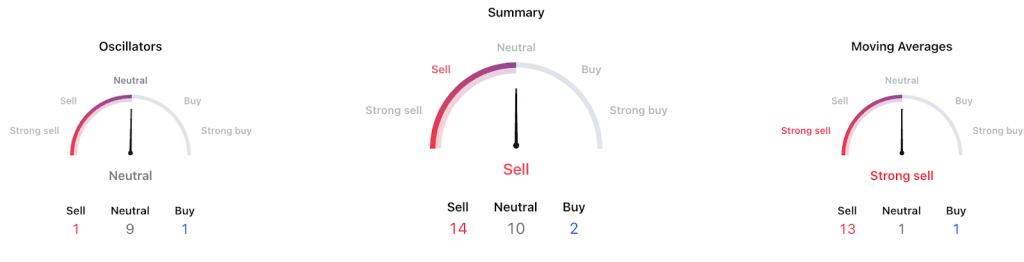

Crypto analyst Paul L goes through a technical summary based on Bitcoin’s current price. Accordingly, the ‘sell’ recommendation ranks at the top with 14. ‘Neutral’ is represented by 10. The indicator for buying the asset has only 2.

A breakdown of the techniques, a ‘strong sell’ for the moving averages (MA) at 13, neutral and buy stands at one. Elsewhere, oscillators are predominantly neutral at nine. Also, each ‘buy’ and ‘sell’ is represented by a 1.

Bitcoin technical analysis summary / Source: TradingView

Bitcoin technical analysis summary / Source: TradingViewExpert’s BTC predictions

In line with this, crypto analyst Michaël van de Poppe suggests that the potential boom of Bitcoin will be next week. He mainly suggests that this will be triggered by macroeconomic events that are likely to positively impact risk assets like BTC.

In a YouTube video released Oct. 21, Poppe says factors such as the upcoming speech by US Treasury Secretary Janet Yellen will affect returns. He states that this will likely determine Bitcoin’s next price movements. This forecast comes after the 10-year treasury yield soared to its highest level since 2008. The analyst makes the following statement:

Returning with yields, it will have an impact on risk. In particular, Bitcoin will do relatively well. Today we see that we are still making new heights. How the week ends will be decisive. Yields will drop and we’ll likely go up.

In addition, Poppe says that balance sheet data from big tech firms such as Apple, Microsoft and Amazon will potentially affect the market. In addition, he emphasizes that it will provide a chance to build positions.

He also points out that the Flash Manufacturing PMI (Purchasing Managers Index) will be key for some European countries and the US. Poppe notes that investors should pay attention to China’s GDP data and the BoJ’s outlook report.

Bitcoin price action through the eyes of Michaël van de Poppe

In Bitcoin price action, Poppe says the next position to watch out for is the $19,600 region. He emphasizes that if it flips, it will be a long-term trigger focused on $20,700 and $22,100.

Also, Poppe states that longs are clean, but if Bitcoin drops below $19,000 and bounces off $18,500, it will trigger shorts and drop to the lows of $17,600.