Expectations for more rate hikes by the US Federal Reserve to curb peak inflation are rising. This causes the dollar to gain more strength. Under these pressures, gold prices fell to the lowest level in more than three weeks on Monday. Analysts interpret the market and share their forecasts:

“The rise in the dollar will weigh on the gold market”

Spot gold was trading at $1,735, down 0.65% at press time. The yellow metal also hit $1,731 during the day, its lowest level since July 28. U.S. gold futures fell 08.6% to $1,747.8. Clifford Bennett, chief economist at ACY Securities, comments:

The resumption of the rise in the US dollar will of course weigh on the gold market. But it seems more in line with the simultaneous selling seen in bonds, stocks and currencies. Wherever there are false hopes, such as the Federal Reserve slowing down, those expectations quickly evaporate.

This week’s focus: Jackson Hole

cryptocoin.com As you follow, the dollar has reached a one-month high against its rivals. Thus, it made gold more expensive for buyers of other currencies. In addition, the benchmark 10-year Treasury rates rose to a one-month high. This, in turn, increased the opportunity cost of holding non-profitable gold.

The Fed will raise interest rates by 50 basis points in September, according to economists surveyed by Reuters. The move will come amid peak inflation and growing recession concerns. Traders are currently pricing in about a 46.5% chance of a 75bps rate hike in September following the latest hawkish statements from Fed officials. On the other hand, they give a 53.5% chance of a 50 basis point increase. This week’s focus will be on Fed Chairman Jerome Powell’s speech in Jackson Hole on Friday.

“The recovery in the dollar has put heavy pressure on gold”

Gold’s month-long rally hit the wall this week. This was due to the yellow metal’s loss of $1,800 due to high Treasury rates and the pressure of the rising dollar. Craig Erlam, senior market strategist at OANDA, comments:

Gold fell on Friday as the dollar continued to see strong support. The recovery in the dollar has put heavy pressure on the yellow metal, which has already profited after hitting $1,800.

“The demand for bullion will increase when there is a perception that the yellow metal is approaching the bottom”

According to Insignia Consultants research director Chintan Karnani, if spot gold trades below $1,750, it is possible to sell more on Monday. In this context, the analyst makes the following statement:

Physical gold demand in Asia will need to see a massive spike next week for gold prices to reverse and retest $1,800. Demand will only increase when there is a perception that gold prices are about to bottom out.

“Extra pullback on horizon for gold”

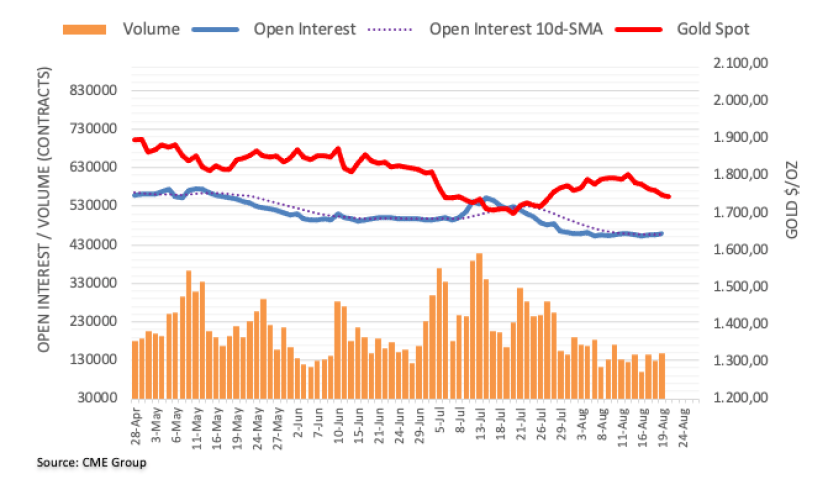

Open interest on gold futures markets rose for the third consecutive session on Friday. This time around 1.5 thousand contracts increased, according to preliminary data from CME Group. Volume followed suit. Nearly 17.3 thousand contracts increased, taking the erratic performance to another session.

Market analyst Pablo Piovano notes that gold extended its leg down for another session on Friday. Also, according to the analyst, the move took place in the fund of increasing open interest and volume. This opens the door for a possible drop to the weekly low of $1,711 (July 27).