Bitcoin’s (BTC) upswing has come to a screeching halt at a price level that proved to be a tough nut to crack last year.

The leading cryptocurrency by market cap picked up a strong bid at the start of the year and has gained nearly 50% since then, outperforming major traditional risk assets. However, the bullish momentum has stalled since Feb. 16, with the cryptocurrency failing multiple times to secure a foothold above the $25,000 mark. The said level offered stiff resistance in August, following which the cryptocurrency revisited lows around $18,000.

According to Laurent Kssis, a crypto trading adviser at CEC Capital, a breakout above $25,000 hinges on the performance of technology companies.

“Tech firms performed horrendously last year, and it’s all down to how well they recover in the first quarter. That’s why BTC is not pushing further,” Kssis told CoinDesk. Technology stocks will announce the first-quarter earnings after March.

Bitcoin tends to move in synch with Wall Street’s tech-heavy Nasdaq index. Recently, the 90-day correlation coefficient between the two strengthened to 0.75. Nasdaq fell by 2.4% last week, pausing a four-week winning streak that offered positive cues to high-risk assets like bitcoin.

Kssis added that crypto traders are currently parking money in world’s biggest dollar-pegged stablecoin tether (USDT) and the bitcoin rally will resume once that trend ends.

“The market is patiently awaiting realized profits that are parked in USDT right now to pile back into bitcoin and ether. This is why we ran out of breath to break $25,000,” Kssis said. “When BTC is rallying, USDT dominance tends to thin out.”

Data from charting platform TradingView show, tether’s dominance, or the stablecoin’s share of the total crypto market valuation, has steadied around 6.5% since late January, a sign of traders rotating money into the stablecoin, as Kssis said. USDT’s dominance fell from nearly 9% to 6.5% in January as bitcoin rallied.

Bitcoin’s rally stalls at $25,000, the level that capped the August 2022 bounce. (CoinDesk/TradingView) (CoinDesk/TradingView)

According to Paris-based crypto data provider Kaiko, heightened regulatory risks have dented sentiment in the market, and “volatility is unlikely to go away.”

Last week, the U.S. regulatory agencies specifically called out Paxos for its BUSD product and not Pax dollar, hinting at an indirect action against Binance, the world’s largest cryptocurrency exchange by trading volumes. BUSD is a Binance-branded dollar-pegged stablecoin issued by Paxos.

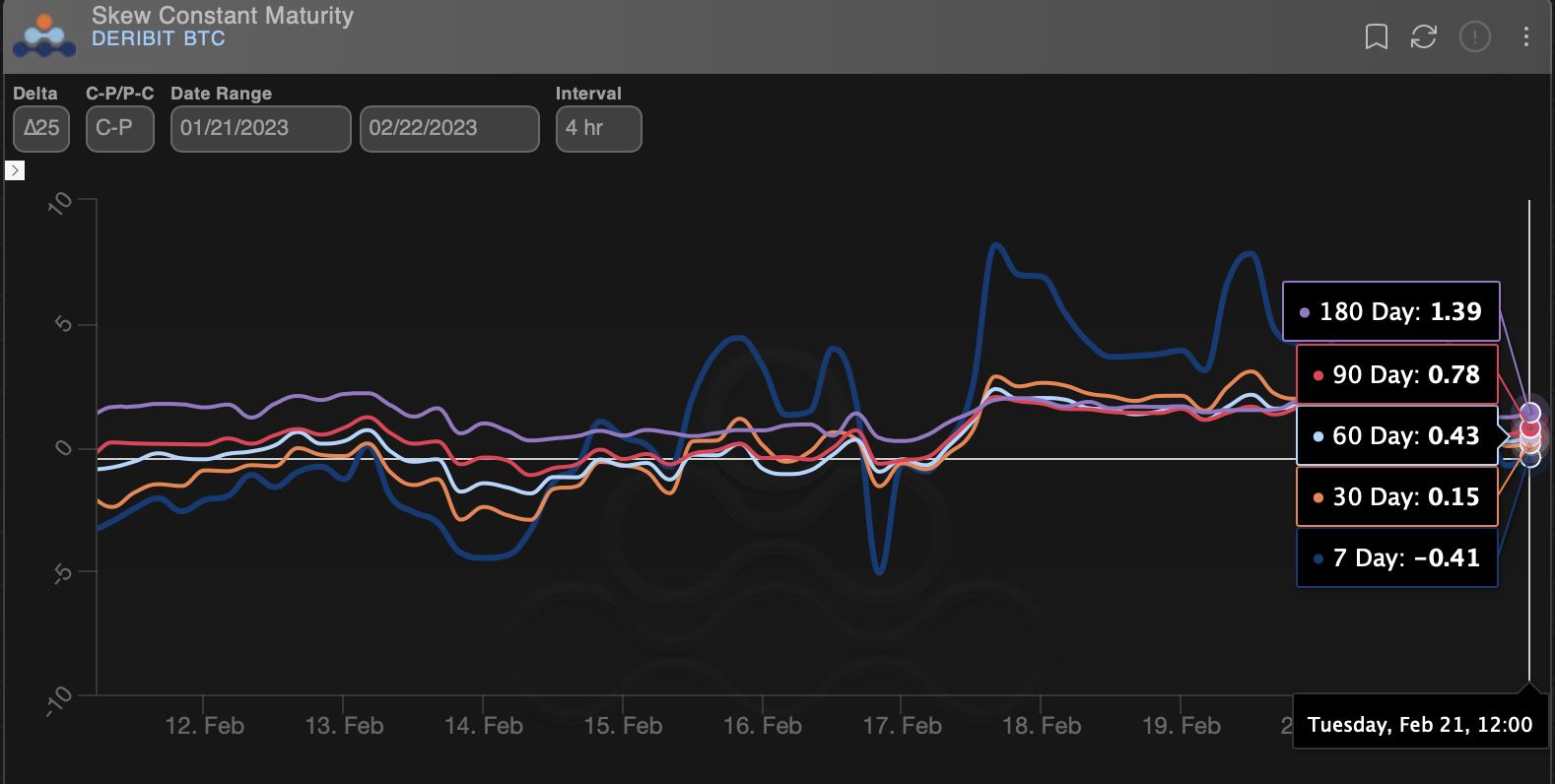

Since then, long-term and short-term call-put skews have retreated to zero, indicating a neutral sentiment in the options market. Call-put skews measure the cost of bullish call options relative to bearish put options and are widely tracked to gauge sentiment among sophisticated institutional players and retail investors.

“The options market had been demonstrating bullish leanings but now maintain a neutral outlook on the market,” analysts at crypto exchange Bitfinex said in a report shared with CoinDesk. “Investors now place roughly equal value on put and call options.”

Call-put skews have reverted to zero, indicating a bullish-to-neutral shift in the market sentiment. (Amberdata) (Amberdata)

Besides, there is evidence of investors pulling money out of crypto funds. Per data tracked by CoinShares, digital asset investment products saw outflows totaling $32 million last week, the largest since late December 2022. Bitcoin funds alone bled nearly $25 million, while short bitcoin funds saw an inflow of $3.7 million.

Griffin Blofin, a volatility trader from crypto asset management firm Blofin, said concerns about sticky inflation have resurfaced since last week, stalling the rally in risk assets.

“The expectation of an inflation rebound has appeared in many markets. Both the U.S. January CPI and the latest U.K. PMI data point to a relatively strong economy, raising the possibility of a resurgence of overheating. The above means that the Federal Reserve and the European Central Bank must maintain a hawkish policy and even return to the pace of each interest rate hike of 50 basis points,” Ardern told CoinDesk.

At press time, the fed funds futures show a 15% chance of the central bank lifting rates by 50 basis points next month, while in Europe, a similar-sized hike in March is all but priced in.

Meanwhile, bitcoin changed hands at $24,650. Some market participants expect a potential breakout above the technical resistance at $25,000 to bring a sharp rally.

“We have tested the 25k resistance multiple times over the past week and failed. Hearing the view from our clients that we could gap higher if we meaningfully break the range,” Paradigm said in a Telegram broadcast late Monday.