Is it too late to invest in Bitcoin (BTC)? Or is it still worth buying the leading cryptocurrency? The Winklevoss twins believe that Bitcoin remains one of the best investments of this decade. According to their predictions, Bitcoin will exceed $ 500,000. So what’s the logic behind these predictions?

Winklevoss twins have been investing in Bitcoin for 11 years

According to their own statements, Tyler and Cameron Winklevoss accidentally discovered Bitcoin in 2012 while on summer vacation in Ibiza. The two Americans then began to explore the cryptocurrency further. They quickly realized that BTC had a chance to become the money of the internet and solve the myriad problems of the current financial system.

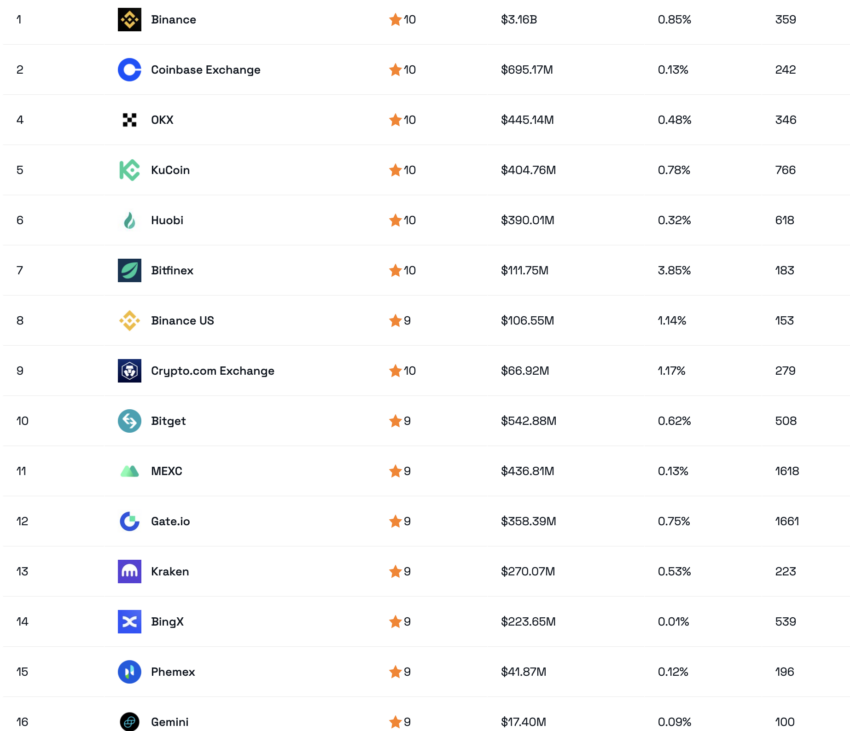

Gemini first invested in BTC when the price was below $10. As such, there is speculation that they are among the biggest Bitcoin whales. Also, the net worth of Tyler and Cameron Winklevoss is each estimated to be around $1.2 billion. The largest cryptocurrency exchange at the time, Mt. They lost a lot of BTC in Gox’s downfall. Later, they founded their own crypto exchange Gemini. The exchange, meanwhile, ranks 16th in the ranking of the best crypto exchanges.

However, the Winklevoss twins haven’t given up in the current crypto winter. They continue their long-term bullish momentum in BTC. They also stick to their predictions that Bitcoin will continue to be the best investment of this decade. So how did the two billionaires arrive at this assumption?

Claims: Leading cryptocurrency will rise to at least $ 500,000!

cryptocoin.com As we reported, the twins gave an interview to The National News recently. In this interview, they explained why they are convinced of the future of cryptocurrency. The main reason for this is Bitcoin’s revolutionary and technical characteristics as well as its potential to act as a store of value similar to gold. In addition, cryptocurrency has other advantages, primarily programmability. This is why the Winklevoss brothers believe that Bitcoin could even replace the precious metal in the long run. In this context, Tyler Winklevoss says:

If you look at the features that make gold valuable, Bitcoin fits or does every single feature. Bitcoin’s story of beating gold is very strong. we believe that

Tyler Winklevoss explains his rationale for the $500,000 price:

If you do the math, consider the supply of 21 million Bitcoins, the market value of gold, let’s say $10 trillion, maybe $11 [trillion], that puts one Bitcoin (if it spoils the gold and gets that market value) at $500,000.

The two brothers do not want to give specific investment tips. It’s hard to time the market exactly, after all. But Cameron Winklevoss explains that the strategy they use is often the simplest: HODL. Generally speaking, if you think of Bitcoin as a store of value investment, this strategy is the HODL [hold on for dear life] strategy. In the same way you HODL gold. It is a long-term buy and hold investment. According to the two brothers, it is difficult to predict when the Bitcoin price will reach $500,000. But they predict that BTC will reach the milestone in ten years.