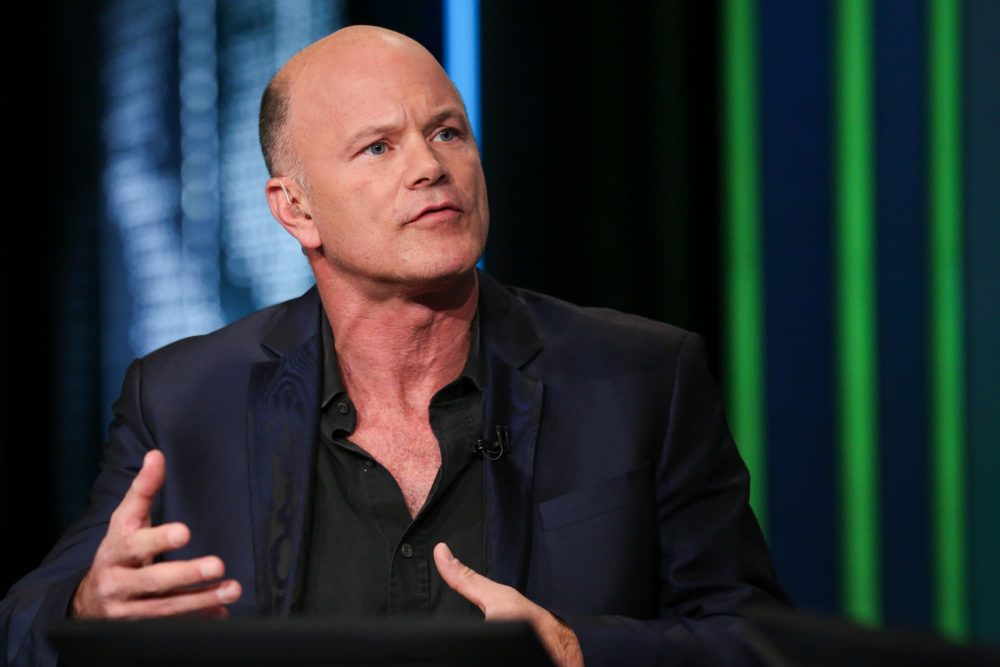

Billionaire Mike Novogratz, one of the famous figures in the cryptocurrency field, came to the fore with his comments on some coins. In addition, Novogratz touched upon some crypto currency statements made by the BIS President. Here are the details…

Mike Novogratz explained the cryptocurrencies in his focus

Mike Novogratz, CEO of Galaxy Digital, spoke about the latest comments made by Augustin Carstens, President of the Bank for International Settlements (BIS). Novogratz suggested that Carstens ignored the facts about Bitcoin (BTC) and Ethereum (ETH). cryptocoin.com As we reported earlier, Carstens recently claimed that fiat currencies “won the war” against cryptocurrencies. He also suggested that crypto technology “doesn’t make reliable money.”

Novogratz stated on Twitter that “Carstens has a stubborn opinion that does not reflect the facts.” He said that many fiat currencies have lost more than 50 percent in the last 10 years and noted that BTC and ETH have gained significant appreciation. Novogratz also noted that 200 million people trust BTC.

Binance CEO responds to Novogratz

In response to Novogratz’s comment on Carstens, Binance CEO Changpeng Zhao (CZ) said, “This is not a fight, technology does not have to fight anyone. If you like it, you use it. If you don’t like it, you don’t use it. This much.” said. CZ added that more people will continue to use cryptocurrencies.

It's not a battle. A technology doesn't fight with anyone. You use it if you like, and don't use it if you don't like it. That's all.

But more and more people will use it… Let's see.

— CZ 🔶 Binance (@cz_binance) February 23, 2023

The devaluation of fiat currency is not a new phenomenon. Because fiat currency can be produced endlessly and has no finite supply, which can eventually lead to inflation. Bitcoin was designed to address the inflation issue faced by many countries as the number of coins in circulation is limited and cannot be produced indefinitely, making its value more stable compared to fiat currency.

Travis Kling also joined the discussion

On the other hand, Travis Kling, founder of crypto investment firm Ikigai Asset Management, started the discussion by saying that Bitcoin does not act as a store of value and instead acts as an unprofitable Software-as-a-service/SaaS stock. While pointing to the use case of stablecoins, he underlined that these coins are not exactly a gain in the crypto space as they facilitate access to fiat currencies, especially the dollar.

This guy is head of the BIS. Today he said fiat has “won the battle” against crypto and “technology doesn’t make for trusted money”.

Hot Take- He’s not entirely wrong. It remains to be seen what will happen in the future. But at present, I wouldn’t characterize us as “winning”. pic.twitter.com/BwafoG2YZ1

— Travis Kling (@Travis_Kling) February 22, 2023

Kling also noted that no other projects in crypto are competing to become money, and that Ethereum may one day achieve this feat, but it is too early to make that call. He pointed out that none of the other cryptocurrencies on the horizon are even out of the question. He said that if the crypto market continues to pull itself down with the same cycle after cycle, Carstens will make the same speech five years from now.