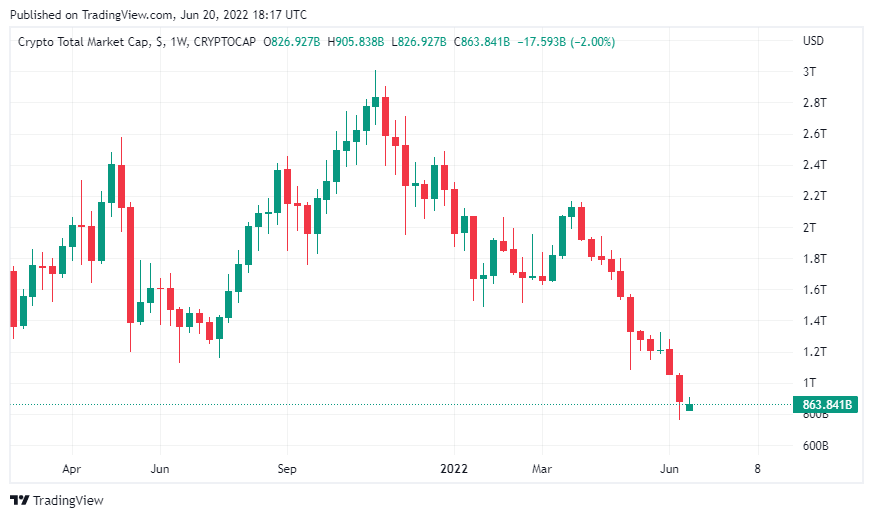

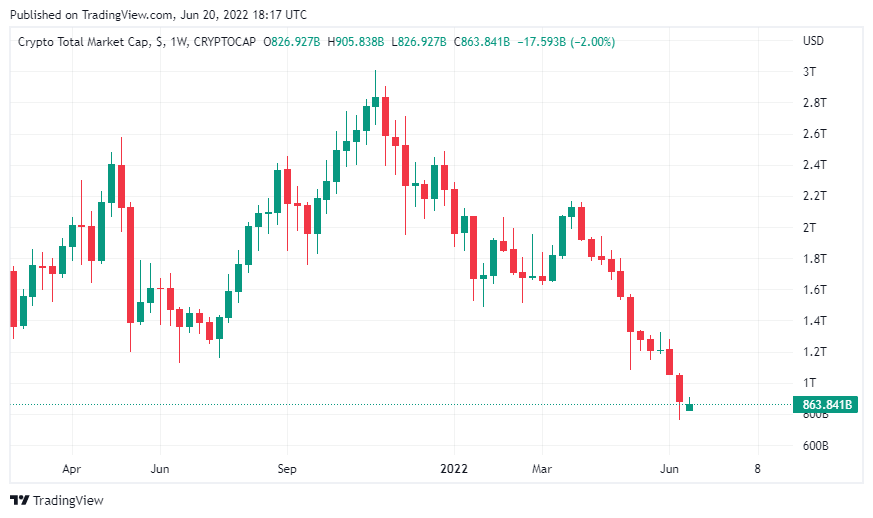

Before recovering today, the cryptocurrency market has seen serious losses in recent days. The Fed’s tightening fiscal policies are the “root cause” of Bitcoin (BTC) and altcoin collapse, according to the FTX CEO.

The root cause of Bitcoin (BTC) and altcoin collapse, according to Sam Bankman-Fried

Sam Bankman-Fried, the billionaire founder and CEO of FTX, claimed that the exchange has a “duty” to support struggling cryptocurrency businesses in tough times. In an interview with NPR over the weekend, Bankman-Fried says he felt it was his duty to “seriously consider intervening to stop the crash, even if it costs us” in response to the recent crash.

“Fed is responsible for BTC collapse”

BTC price saw around $18,000 as a result of recent sales. The leading crypto later made some headway towards the recovery. But at $20,600, it’s still much lower than it was at the start of the year. Bankman-Fried, on the other hand, describes the Federal Reserve’s decision to raise interest rates by 0.75 percent, the most since 1994, as the “main driver of the crash”:

The Fed has aggressively increased interest rates to combat inflation. In response to this, cryptocurrencies also experienced sharp drops.

When financial policies tighten, investors turn away from riskier assets like cryptocurrencies. This has a knock-on effect on the value of cryptocurrencies. Markets are literally scared, according to Bankman-Fried:

Rich people are afraid.

SBF assisted crypto companies in BTC sales

According to Bankman-Fried, the exchange’s acquisition of Liquid Group is an example of how FTX is helping small businesses. To help Liquid Group recover from the $90 million attack that occurred after their wallet was hacked, FTX secured a $120 million loan in August 2021.

In the cryptocurrency community, Bankman-Fried is recognized as a thought leader. His Twitter is often filled with current business events and predictions about the direction of the cryptocurrency.

SBD shares its thoughts on the bankruptcy of Three Arrows Capital (3AC)

Hedge funds that fail to meet their margin calls, including BlockFi and Genesis, are on the verge of bankruptcy. In fact, many major lenders, such as the cryptocurrency exchange BitMEX, have started selling their shares to 3AC.

cryptocoin.com As we have reported, the SBF recently said on Twitter that “regulation can help here”. Prior to that, he said that “DeFi can also help” and that collapse would not be possible with transparent on-chain DeFi applications. Bankman-Fried was responding to a tweet asking market leaders how they could prevent another bankruptcy like 3AC.