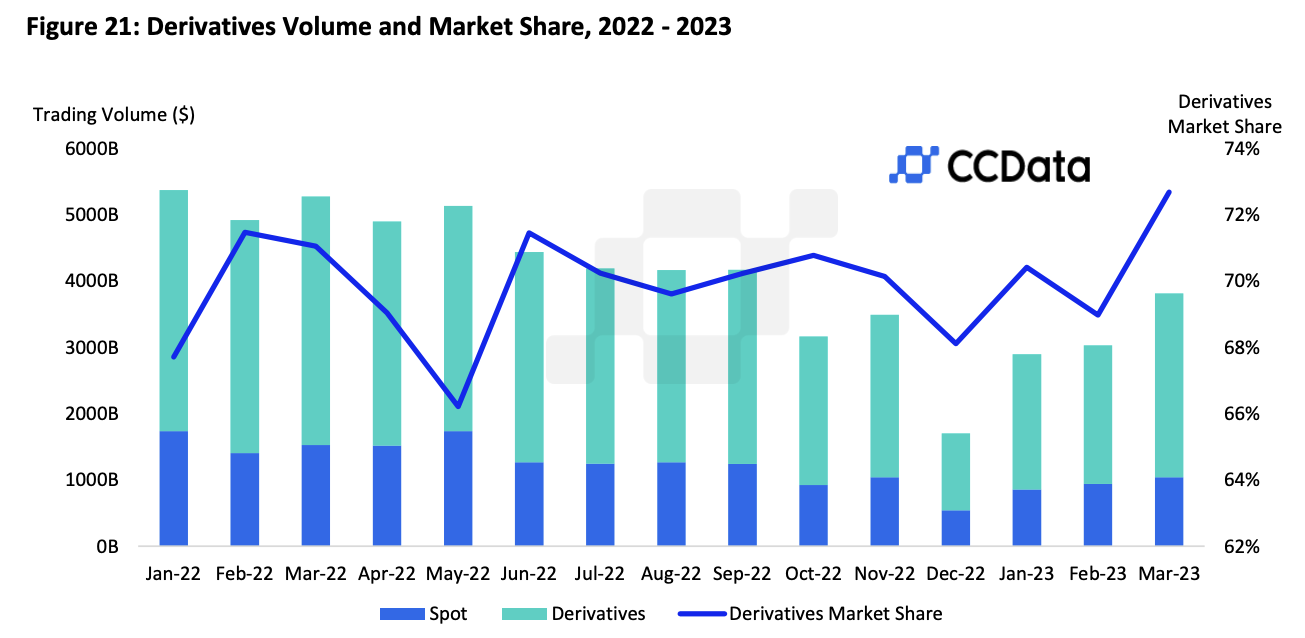

Crypto derivatives trading volumes across both centralized and decentralized exchanges rose for a third consecutive month in March, the first three-month streak since at least January 2022, according to figures from CCData.

Crypto derivatives are financial contracts such as futures and options that relate to cryptocurrencies. They are popular because they allow market participants to hedge their positions or to speculate on market direction.

CCData

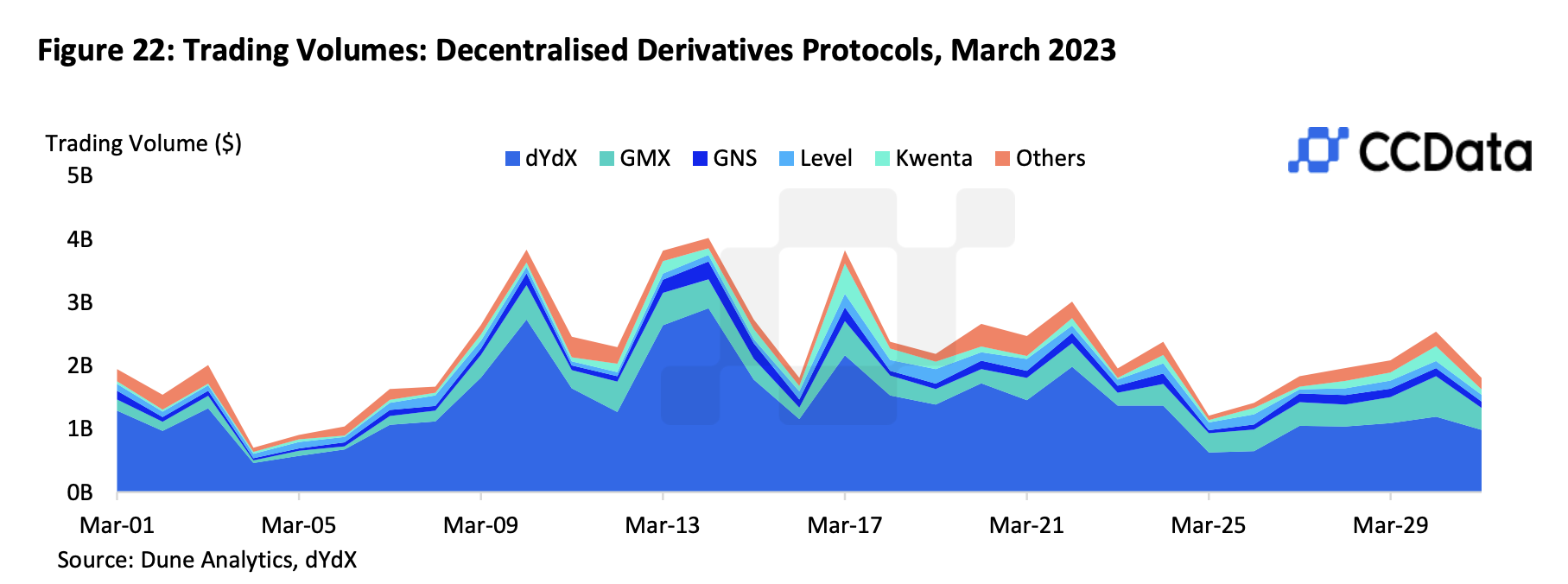

Derivatives trading accounted for about 74% of the roughly $4 trillion crypto market volume last month, the data show. While the bulk of derivatives trading took place on centralized exchanges, decentralized exchanges accounted for $68.7 billion, with dYdX taking a 62.6% share.

CCData

“We expect decentralized derivatives protocols to continue performing well and gain market share in the next quarter,” said CCData in a report.

There has been an increasing trend of spot DEXs adding derivatives trading to their platforms as they notice the potential of derivative DEXs, according to CCData.

Recommended for you:

- What Hic et Nunc’s Resurrection Says About Decentralized Infrastructure

- ‘I Knew I Was Here to Stay’: Talking the Future of Web3 With David Bianchi

- UST Stablecoin Veers Wildly From Dollar Peg. Here’s the Latest

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

In March, DEX PancakeSwap announced it was partnering with ApolloX to introduce trading of perpetual swaps. Quickswap, a decentralized exchange built on Polygon, is also launching perpetual products soon, CCData said.