A crypto phenomenon recently highlighted vulnerabilities in Chainlink’s 4/9 multi-signature convention. He thinks it might be a disaster.

DeFi ecosystem could be destroyed, according to crypto expert

Chris Blec, a popular crypto phenom who describes himself as an ardent proponent of immutable decentralized technology, claimed that the decentralized finance (DeFi) industry is collaborating to hide a key vulnerability associated with Chainlink.

The entire DeFi industry – VCs, DAOs, devs, everyone – is colluding to hide the fact that if 5 people, chosen by @chainlink, ever decide (or are forced) to go rogue, the entire DeFi ecosystem can be intentionally destroyed in the blink of an eye.

— Chris Blec (@ChrisBlec) February 7, 2023

According to Blec, developers, decentralized autonomous organizations (DAOs) and venture capitalists and others in the DeFi space could intentionally destroy the entire DeFi ecosystem in the blink of an eye if the 5 chosen ones by Chainlink decide (or are forced) to one day go rogue. .

multi-signature agreement

The vulnerability that Blec mentions is the 4/9 multi-signature contract that controls Chainlink. He believes the contract, which was previously a 3 in 20 multisig (Multi-signature), is not sufficiently secured. A 4/9 multi-signature is a security measure that requires four out of nine signatures to authorize a transaction.

A multisig contract is often hacked from within, in which case it would be Chainlink appointed key holders. Chris Blec believes that if this feature is compromised, it could trigger a domino effect with serious consequences for projects based on Chainlink oracles as Chainlink multisig can add or remove any resource from any price feed.

According to the crypto phenomenon, this risk extends to popular DeFi projects like Aave and MakerDAO, which use Chainlink’s prophecies for price data. Aave’s reliance on these price prophecies is of particular concern for Blec, given that they have helped generate over $2 trillion in transaction flow on Aave in 2022. The list of projects relying on Chainlink has been growing ever since the backup proof of service was introduced following the collapse of FTX.

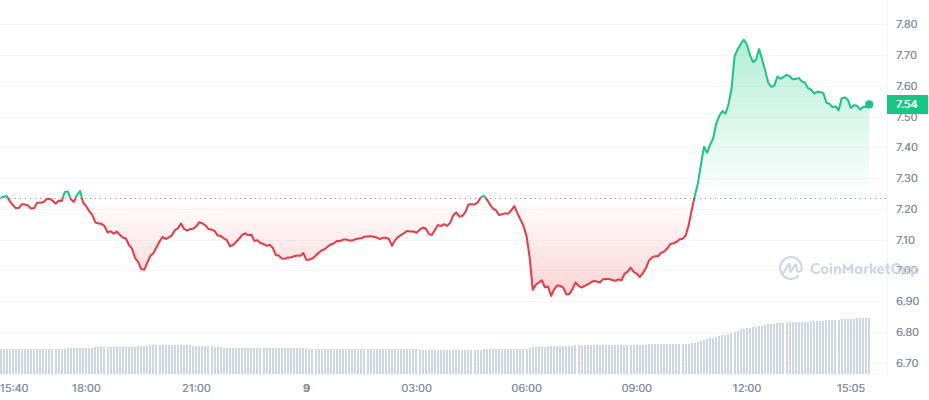

LINK tides live

LINK started going up in an almost diagonal pattern during the bull run, but encountered some uneven bumps on the way. LINK remained below the 50 EMA for two days. However, LINK survived this decline and started to climb upwards. cryptocoin.comAccording to the data, LINK is trading at $ 7.54.

The Relative Strength Index (RSI) is at 49.25, with LINK currently neutral. However, the RSI recently crossed paths with the SMA and broke below, which may indicate a downtrend to the downside. Because this intersection is new, there may be a small bump in the road and the RSI may change as it crosses paths with the SMA and goes up.