Beyond just crypto, technology continues to evolve, and a basket of new solutions such as blockchain, machine learning and AI are contributing to the next iteration of the internet, referred to as Web3.

This week, Alex Tapscott, author of the new book Web3: Charting the Internet’s Next Economic and Cultural Frontier, takes us through the evolution of the Internet and how investors gain access to new investments. As Sir Tim Berners-Lee, the inventor of the World Wide Web, said, “Web 3.0 is the next phase of the Internet.”

Also, you heard it here first, Consensus by CoinDesk is offering an exclusive session for advisors. Reply to this email for early access and VIP entry while seats last.

– S.M.

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday.

Can Investors Gain Web3 Exposure from The Stock Market?

To those who don’t follow new technologies, innovations can sometimes look like overnight success stories. More often, they are decades in the making. Today is a rare moment as four transformational technologies, decades in the making, are hitting their stride at once: blockchains, AI, the internet of things (IoT) and extended reality.

These technologies are not separate but related. Just as the term ‘internet’ went from describing a narrow set of technologies to encompassing a range of technologies, business models, cultural upheavals, and social transformations, so too will the term Web3 come to capture this next era of progress.

Advisors and investors are searching for the best ways to gain exposure to these disruptive technologies. In the mid-1990s, we could choose among many emerging internet companies or other firms like Cisco that were seen to be capital on that first era of the web. Other legacy businesses deemed safe bets, such as Blockbuster, Borders, Compaq, JCPenney and Xerox, didn’t fare so well. Those companies had one thing in common: they were about to be disrupted or disintermediated by the first era of the web.

If viewed through the lens of the internet, investors would have evaluated them differently. Today Web3 requires a new lens on the markets. As with the early web of the 90s, Web3 will become an integral technology for business and will create winners and losers. So far, most of the value has been created in blockchains like Ethereum or private enterprises like OpenAI. But what about the public markets? Can investors gain exposure to Web3 by buying stocks?

We believe the answer is yes. Today, dozens of great companies are reaching into the Web3 toolkit to create new products and services, target new customers and unleash new capabilities.

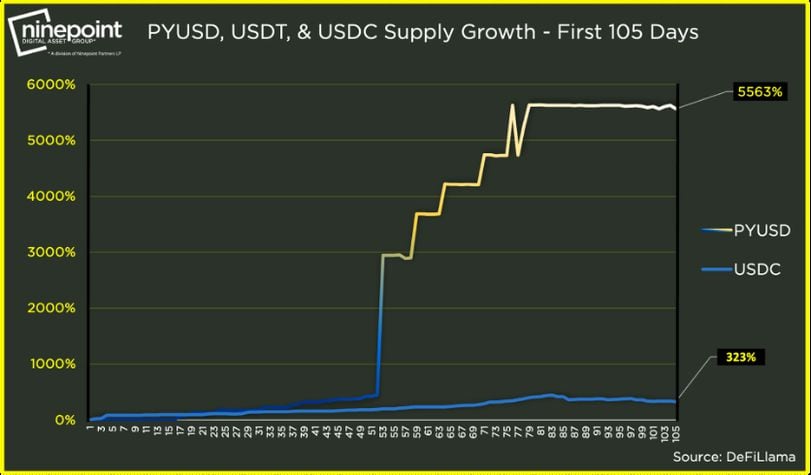

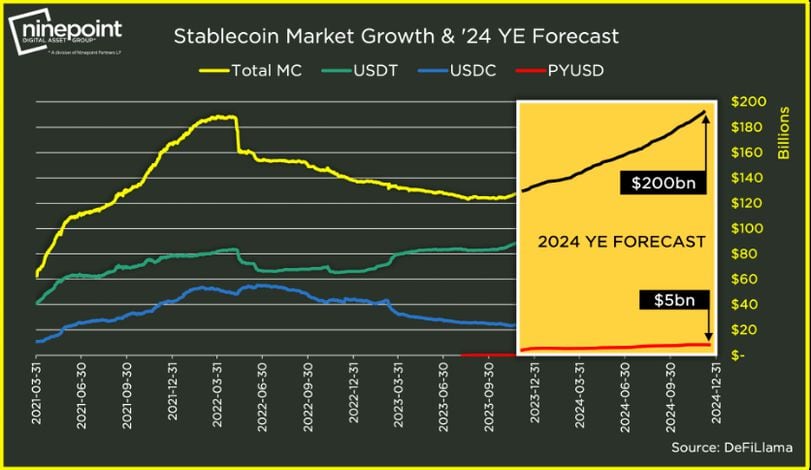

Consider U.S. dollar stablecoins, which we believe will become ubiquitous payment tools, with companies like PayPal (PYPL), which recently launched its own stablecoin, PYUSD. So far, PYUSD is a small part of the overall stablecoin market, but it is growing very quickly, having increased the total supply in the first 100 or so days to around $150 million in circulating supply (Figure 1).

Figure 1: PYUSD Growth Rate

We believe the stablecoin market could grow to $200 billion in 2024 with PYSD reaching up to $5 billion (Figure 2). Stablecoin economics are lucrative, as issuers invest deposits into U.S. government debt, yielding 4-5%. Circle, a highly innovative global financial technology firm, with its own popular stablecoin USDC (with a circulating supply of over $20 billion) is mulling a public offering of its own. Indeed, the growing investment universe of pure-play Web3 companies and those adopting the technology is a tailwind for managers and advisors.

Figure 2

Second, there are simple and easy ways to get exposure to crypto assets directly via the public markets and OTC-traded products in the U.S. In an earlier edition of this newsletter, I wrote how Grayscale’s Ethereum Trust was attractive, not only because it offered exposure to ETH but also because at the time it was trading at an implied discount of more than 30%. We believe an ETH ETF is a matter of when, not if, and when that happens ETHE will convert, all but eliminating the discount. Furthermore, spot bitcoin and Ethereum ETFs already exist in Canada.

Third, a growing number of enterprises are embracing tokens and starting to make a lot of money from them. Nike and other innovative companies have already embraced tokens. For example, Nike has generated $385 million in revenue across 25 different NFT collections since December 2021. Other brands following in Nike’s footsteps include Adidas ($150 million in NFT revenue), Dolce & Gabbana ($27 million), Gucci ($16 million), Tiffany & Co. ($15 million), and several others. Disney also announced a partnership with blockchain company Dapper Labs to launch its own Web3 initiative. Over time, the companies who embrace digital assets will be better positioned on the web’s next frontier.

– Alex Tapscott, managing director of the Ninepoint Digital Asset Group

Ask an Expert

Q: What are NFTs?

A NFT (Non-Fungible Token) is a tokenized record of ownership that is distinct, indivisible and has its ownership and properties accounted for and verified using a blockchain.

These tokens differ from other blockchain-based tokens because they are “non-fungible,” or something that cannot be substituted directly by another of the same type.

They can be used to represent ownership of any digital or physical asset, intellectual property or rights.

NFTs can be used to ascribe uniqueness and ownership to any digital file including pictures, music, videos, articles, social media posts, software etc.

The key features that make NFTs so useful are:

–Layne Nadeau, NVAL

Keep Reading

British investment managers have been given the green light to tokenize funds, providing the ability to fractionalize shares and offer lower cost and transparent trading.

Crypto spot ETF approvals could see $70 billion influx according to recent analysis.

Binance continues to face scrutiny from the Securities and Exchange Commission.