Digital asset-based trusts and funds have boosted their bitcoin holdings as investor demand has rebounded in the weeks following a number of bank failures.

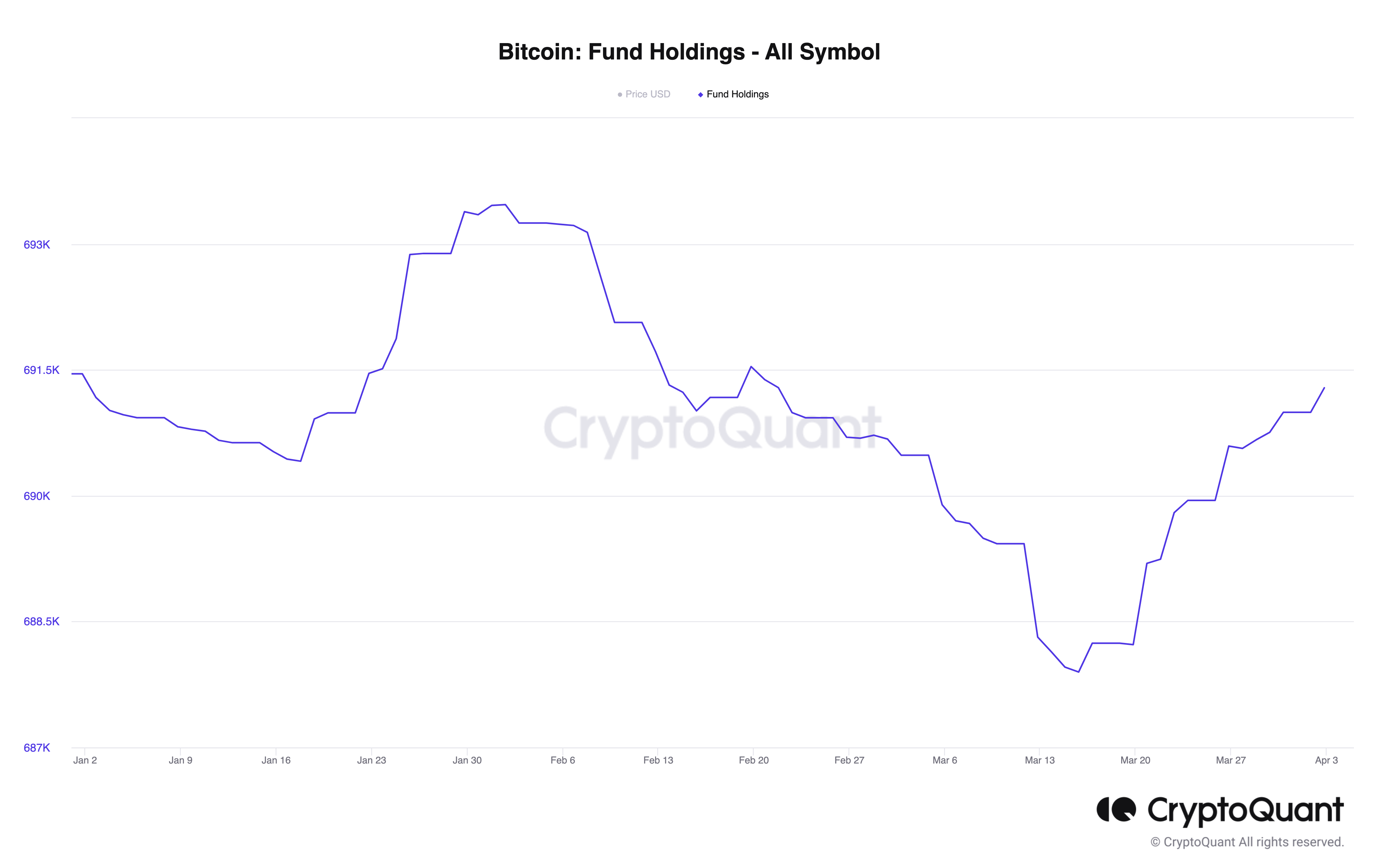

Data from crypto analytics firm CryptoQuant showed the amount of bitcoin (BTC) held by digital asset managers such as trusts and exchange-traded products (ETPs) started to fall sharply in early March, dropping below 688,000 bitcoins on March 14 in the immediate aftermath of the failures of Silvergate Bank, Signature Bank, and Silicon Valley Bank.

The chart showed that crypto fund managers have added about 4,000 bitcoins since March 14. (CryptoQuant).

In the weeks since, though, these fund managers have added back about 4,000 bitcoins, with holdings above 692,000 as of April 2, or nearly $20 billion worth at the current price just above $28,000.

“Recent reports suggest that trust has returned to holdings,” CryptoQuant Analyst Grizzly wrote in a note published on March 31. “This, I believe, is bitcoin’s first significant test in the face of a severe crisis,” he added when speaking with CoinDesk.

Grizzly further noted that widespread speculation that the U.S. Federal Reserve has reached the end of its rate hike cycle has persuaded investors to boost their holdings.

While Fed Chair Jerome Powell gave no assurances of a pause at his last press conference in late March, the CME FedWatch Tool currently shows 58% of traders are not expecting a rate hike at the next FOMC meeting in May.

“Investors seem to be adopting a wait-and-see approach since the initial rush back into bitcoin,” James Butterfill, head of research at European digital asset manager CoinShares, told CoinDesk. “It still isn’t clear if the Fed’s bailout program has stemmed the run on banks.”

Recommended for you:

- What Crypto Legislation Could Look Like for the US, UK and Europe

- Silvergate Stock Tanks on Report of DOJ Probe Tied to FTX, Alameda Dealings

- Leading the Best Business-Development Team in Web3

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

“We believe [the Fed] has only kicked the can down the road and that the Fed is stuck between not raising rates and causing an inflation problem, or raising rates and causing a banking crisis,” he added. “Either way, it is likely to be supportive for BTC in the longer run.”