Funding rates on the futures of major tokens have started to revert to normal levels after recent euphoria led to traders paying unusually high fees to remain in their long positions.

Large movements in spot markets led to open interest surging to over $35 billion over the weekend, indicating highly leveraged bets from traders hoping for even higher prices. This was a near 40% increase since the $24 billion level at the end of October, data shows.

The levered pile-on meant funding levels moved to some of their highest in recent months. Funding rates are periodic payments made by traders based on the difference between prices in the futures and spot markets.

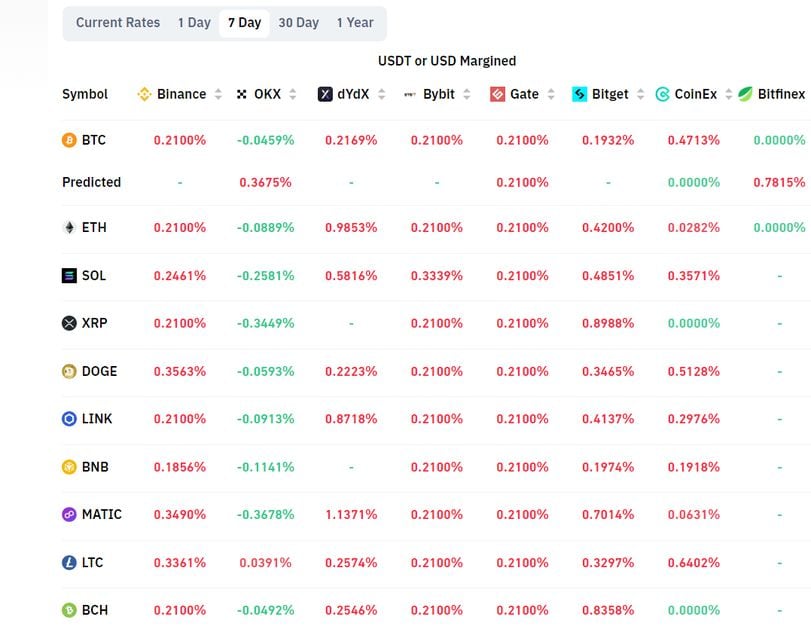

Data shows traders were paying anywhere from 0.2% to 0.5% in fees every eight hours on their borrowed funds to remain in their long positions. This meant speculators paid as much as 50 cents to exchanges on a $100 position.

Futures funding rates were at unusually high levels in the past week. (Coinglass)

However, some market watchers warned of a dump as traders were more incentivized to go short or bet against, a price rise as such positions earned fees from those going long. In futures trading, longs pay shorts when funding is positive, and vice-versa when funding is negative.

This likely culminated in Tuesday’s market drop as traders took profits on a week-long rise.

Nearly 90% of bullish bets were liquidated, amounting to over $300 million, with bitcoin traders losing $120 million as prices sank 4%. Ether traders lost $63 million, while XRP and Solana’s SOL-tracked futures saw over $30 million in cumulative liquidations.

Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open).

Large liquidations can signal the local top or bottom of a steep price move. As such, funding rates are back to normal levels of an average of 0.01% on most exchanges as of Wednesday morning.

Crypto markets added over 6% in the past week on the back of heightened expectations of a spot bitcoin exchange-traded fund (ETF) approval in the U.S., with some analysts reiterating a 90% chance of a January nod.

Elsewhere, traditional finance giant BlackRock filed for an ether (ETH) ETF – buoying the token higher, alongside alternatives such as Avalanche, Solana and Polygon.