Curve Finance (CRV), the altcoin project that has come to the fore with its problems in recent months, has been losing value in recent days. Curve came to the fore with the hacking attack it suffered in the summer and the sales made by founder Michael Egorov. Crypto millionaires who bought CRV from Egorov at a large discount started to lose money with the recent decline.

How Did CRV Get This Way?

The leading ecosystem of the DeFi industry lost $73 million as a result of a cyber attack. However, shortly after the hacking incident, white hat hackers largely compensated for the loss of sub-entries operating on the platform. 52.3 million dollars of the said figure reached its owners again in early August.

After this incident, Curve Finance founder Michael Egorov had to sell his CRV tokens due to his personal financial problems. Important names were interested in the altcoin unit, which was traded around $0.60 in the market in those days. Egorov earned more than $40 million by selling his Curve tokens at a price of $0.40.

Who Bought It?

Crypto giants who wanted to support the founder of the struggling altcoin project bought CRV at a discounted price. Among the names that bought the cryptocurrency in question with a 33% discount are influencers, stock exchanges and various project owners.

Tron founder Justin Sun added 5 million CRV tokens to his wallet in August. Jun Du, one of the founders of Huobi exchange, bought 10 million cryptocurrencies, and NFT investor Jeffrey Huang bought 3.75 million cryptocurrencies.

Apart from all these, an anonymous organization attracted all the attention with 17.5 million purchases. All of these names, which bought cryptocurrencies from Egorov at a fixed price, have lost money today.

Curve Finance (CRV) Price

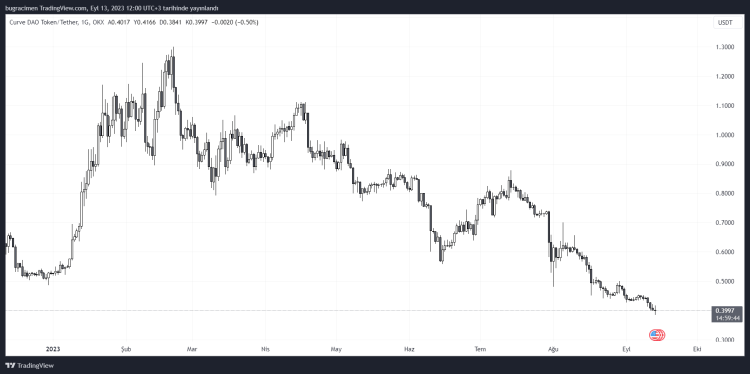

The altcoin unit, which reached its annual peak of $1.30 in late February, has lost value since then.

$CRV fell below $0.385 this morning, causing losses to its large investors. However, currently the cryptocurrency is trading at the $0.40 mark.