The amount invested in cryptocurrency investment products has climbed for a fourth straight week as rising prices continue to boost sentiment.

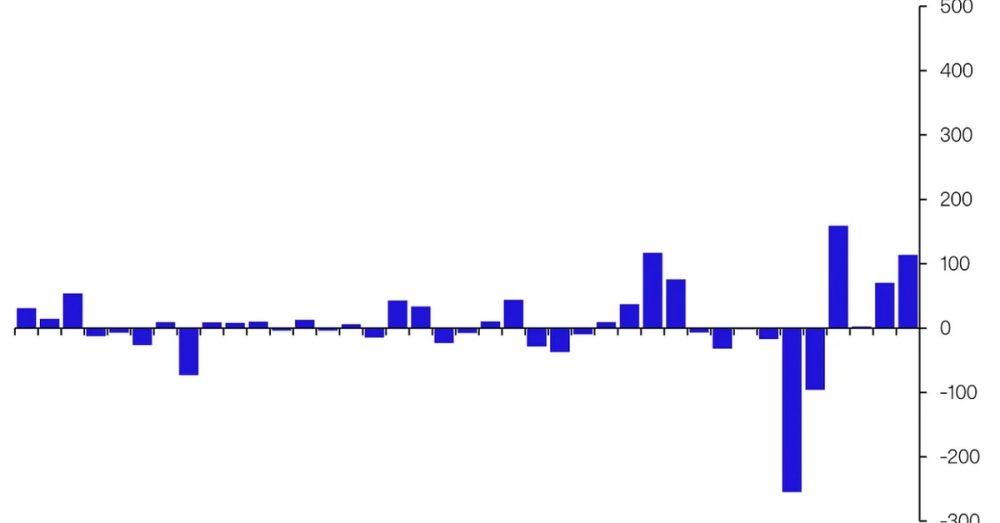

Digital asset investment products saw net inflows totalling $114 million last week, according to data from CoinShares, with bitcoin-related products receiving the overwhelming majority of that new money at $104 million. Bitcoin began the week by crossing $30,000 for the first time since June 2022.

The four-week run of inflows now totals $345 million, said CoinShares.

Coinshares called the focus on bitcoin-related products “a flight to safety by investors fearful of the ongoing traditional finance challenges.”

Ethereum witnessed only $300,000 of net inflows last week, even as the successful completion of the Shanghai upgrade led to a surge in that crypto’s price to above $2,000 for the first time since August 2022.

Recommended for you:

- DeFi Giant MakerDAO Integrates Blockchain Data Provider Chainlink for DAI Stablecoin

- ‘I Knew I Was Here to Stay’: Talking the Future of Web3 With David Bianchi

- Crypto Execs Ask for Clearer US Regulatory Policy After FTX Collapse

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

Blockchain-related equities garnered a net $5.8 million in inflows last week, according to the report, pushing total assets under management to $1.9 billion, the highest since October 2022 – prior to the collapse of crypto exchange FTX.