As we discussed last week, the first quarter was a great time for cryptocurrency prices, but a terrible time for sentiment about the industry. I’d like to expound on the latter point, given that crypto is clearly in the crosshairs of regulators and politicians – including some who seem to not want this sector to exist at all.

Sen. Elizabeth Warren’s (D-Mass.) tweet about building an “anti-crypto army” is one of the more pronounced indications of that sentiment. CoinDesk has actually seen fit to recently post two editorials regarding the federal government’s crackdown on crypto and the Biden administration’s politicizing of it. I’ve voiced my own belief that bad actors, not the asset, should be the target.

But instead of critiquing the critics, I’d rather talk about what drew me into crypto, which is illustrative. My initial interest in 2018 was based on speculative interest, which may be dirty words to many. Why is speculation spoken of in the pejorative? I don’t know anyone who deploys capital with the expectation that it will decrease in value. If you are that person, feel free to just pass your asset on to me and I can hold onto it for you.

Here are the questions I asked myself when crypto got on my radar:

Intellectual curiosity, the desire to generate wealth and a goal to increase my knowledge of a nascent technology led me to bitcoin (BTC). In hindsight, though, it wasn’t just bitcoin. It was the concept of layer 1 blockchains, because ultimately that’s what we are accessing: space on a blockchain.

The value of a layer 1, or L1, network comes from people conducting peer-to-peer transactions with that blockchain. The native token of any given blockchain – BTC in the case of Bitcoin – acts as an incentive mechanism to get people to ensure that the data stored on the blockchain is secure and accurate.

The value is especially relevant in areas of the world where central bankers have caused local currencies to hyperinflate. One of the mistakes being made by U.S. lawmakers and regulators is looking at cryptocurrencies from a U.S.-centric perspective only.

It appears regulators don’t care about the functionality or reliability of blockchains, especially as some of the loudest opponents of crypto are in favor of central bank digital currencies – a type of digital currency issued by a central bank. The animosity feels more related to the decentralized nature of crypto – the ability to take fiat currency and exchange it for another asset of value, without the need for a central body (central banks, regulators, politicians, conventional banks, etc.).

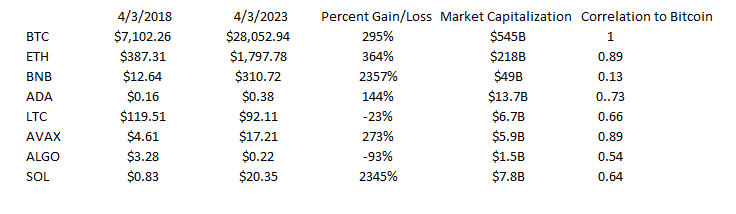

Here are some of the larger layer 1 protocols and their recent performance:

(Note: data for ALGO and SOL is from April of 2020. Data for AVAX is from 2021)

The performance runs the gamut from impressive to anything but, which is how it probably should be. On a technical level, BTC is correlated most to ether (ETH), the second-largest cryptocurrency after bitcoin, with its lowest correlation being to crypto exchange Binance’s BNB token.

What I find intriguing about layer 1s is the nuance that exists between them. As one L1 comes into existence, another attempts to improve upon it on the basis of speed, scalability, etc. For instance, I am admittedly anchored to Bitcoin. Its foundation as a peer-to-peer network gives it a first-mover advantage and the largest market share.

The ability to develop smart contracts on top of the Ethereum blockchain, where predetermined conditions are met and executed via code, is another facet that I find value in.

In many ways, crypto forces someone focused on assets and prices to level up on technology, while the tech-focused person is incentivized to get up to speed on market dynamics. The discipline of tech and the discipline of assets are pulled together, much in the way that code links tasks within a smart contract.

In my own experience, doing so caused me to uncover differences between blockchains. For example, Avalanche uses a “heterogeneous network of blockchains.” Rather than all applications occurring in one blockchain, Avalanche uses an Exchange (“X”) Chain, Platform (“P”) Chain and Contract (“C”) Chain. In doing so, the goal is to increase scalability and reduce fees, things the Ethereum blockchain has struggled with.

Asset ownership is important. It makes little to no sense to ignore a burgeoning technology, unless you want to be completely left behind. If people can engage in peer-to-peer transactions while having complete confidence in their accuracy, and not having to compensate a third party, they will do so.

L1s are at the base of the crypto economy and should be understood and be used as a base network for applications. And, yes, sometimes even used to generate a profit, as well.

Takeaways

From CoinDesk’s Nick Baker, here’s some recent news worth reading:

Recommended for you:

- FTX Transferred $7.7B From Bahamian Estate to US Units Ahead of Bankruptcy Filing, Court Told

- SEC Rejects NYDIG, Global X Spot Bitcoin ETF Applications

- Usuario de Uniswap pierde $8M en ether por ataque de phishing

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

To hear more analysis, click here for CoinDesk’s “Markets Daily Crypto Roundup” podcast.