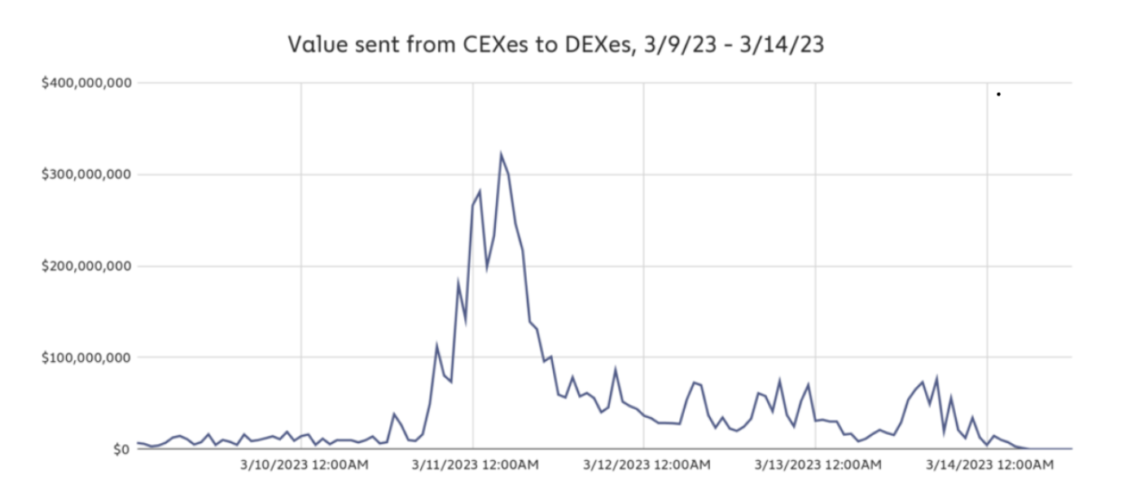

With the collapse of Silicon Valley Bank, crypto investors shifted from centralized exchanges (CEX) to decentralized (DEX) exchanges.

In the period when the banking crises had a great repercussion, crypto investors to DEXs looks even hotter. In the past period FTX crisis , the exchange had stopped users from accessing the funds, as a result of which interest in DEXs gradually decreased. Especially when the problems in banks reach a serious level, the DEX side seems to have been adopted again by crypto investors. Silicon Valley Bank’sbankruptcy, USDC The transfer of Coin (USDC) greatly affected onchain data. Popular onchain platform chainalysisif the situation reports published.

Bank Crises Increased Orientation for DEXs

starting with Silicon Valley Bank and Signature Bank The crises of the banking sector, which continued with the For investors after the recent events, The concept of centralized/decentralized has become more important.

chainalysisIn an article he published on March 16, when the stock markets are downinvestors got worried the possibility of not being able to withdraw funds “They said they were afraid. chainalysis data, Hourly outputs from CEXs to DEXsShortly after the SVB disaster 300 million dollarsconfirmed that he was on it.