This week, Glenn Williams Jr. explains how his process of researching small and microcap oil and gas companies compares to that of digital assets and AI.

Then, Joe Orsini shares how two on-chain metrics, realized capitalization and holding trends, demonstrate belief in bitcoin as a store of value (SoV).

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Lesser-Known, Lesser-Capitalized AI Companies Present Opportunities in Crypto

What is to become of the opportunistic investor in the digital asset space?

In my former stint I was an equity research analyst. Anyone who has spent time performing this role can tell you about the intellectual fulfillment when researching assets, and the mental exhaustion that occurs during “earnings season.” (I could spend an hour ruminating over how much I truly do NOT miss earnings season, but I digress.)

As is the case for many analysts, I was assigned to cover a set of companies. As an analyst, you usually don’t receive carte blanche to write about whatever you want. Each business sector has its own nuances, and so industry custom is to specialize in one. What will be interesting over time is whether this applies to digital assets.

My coverage universe focused on small and microcap oil and gas companies – those with small market capitalizations, and ones with little “coverage.”

The rationale for this focus was that alpha lay in small, unknown firms. These types of organizations go unnoticed not because of a lack of quality but because they haven’t been widely discovered. This dynamic exists in crypto as well.

Of the thousands of digital assets, all but about 25 of them would be considered small cap, given the $2 billion market cap top I used with equities. So lowering that threshold (perhaps to $500 million) makes sense, at least as a first step.

Because the crypto space is a nascent field, fundamental analysis is constantly evolving. Technical analysis translates well in my view, but you must be willing to shift your opinion rapidly when the facts change.

A second step is to start with a theme. Perhaps there’s an area or development that you feel strongly about, and you wish to participate in digital assets that connect to it.

Perhaps you think the overall market regime is ripe for value investing because of recent turmoil. Clearly, the initial impact of both Silvergate Bank and Silicon Valley bank closing negatively affected markets, which seemed to provide favorable valuations of which some investors have already taken advantage. Alpha is often found in the shadows of down markets, although most times it’s seen in hindsight.

Artificial Intelligence may be a theme worth exploring – potentially transformative in the way that cryptocurrencies have been.

AI is a branch of computer science that allows machines to mimic, and possibly improve upon, processes that the human mind controls. Early AI results have been promising with such technologies as Alexa, Siri, self-driving cars and ChatGPT becoming increasingly accepted.

What AI-related assets have potential? Consider the following:

Asset: SingularityNET. Token: AGIX. Market Capitalization: $596 million. Correlation (BTC): 0.86

SingularityNET bills itself as the “world’s leading decentralized AI marketplace, running on blockchain.” Its most up-to-date white paper states that most AI tools today are fragmented and running within a closed loop environment.

By contrast, SingularityNET plans to facilitate coordination between different AI tools while allowing developers to monetize their efforts.

Year to date it has increased 996%, with trading volume that is 0.10% of BTC. Technically, its RSI is 75, indicating that the asset is currently overbought.

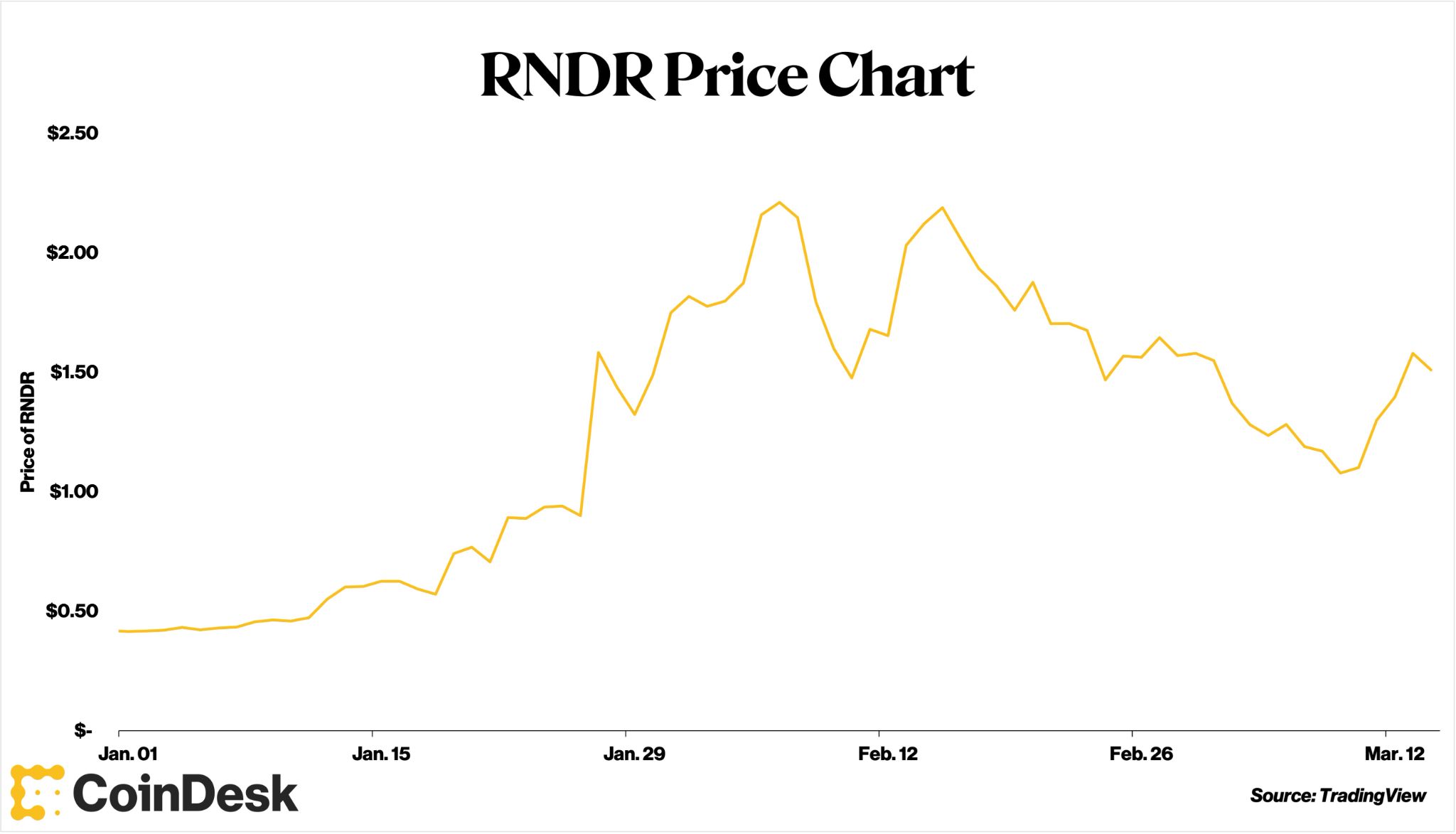

Asset: Render Token. Token: RNDR. Market Capitalization: $491 million. Correlation (BTC): 0.88

Render token’s (RNDR) value within the AI ecosystem relates to storage and infrastructure. The RNDR token allows for graphics processing unit (GPU) renderings to be distributed via the blockchain.

Much of the developing AI that has taken center stage recently (ChatGPT, for example), requires significant computing power and is becoming too robust for GPUs to handle efficiently.

Render token as a network attempts to solve this problem by allowing anyone with a modern GPU to exchange their GPU power for RNDR tokens, which can increase the size of GPU compute power for developers.

Year to date, RNDR is up 252% and has daily trading volume of $157 million.

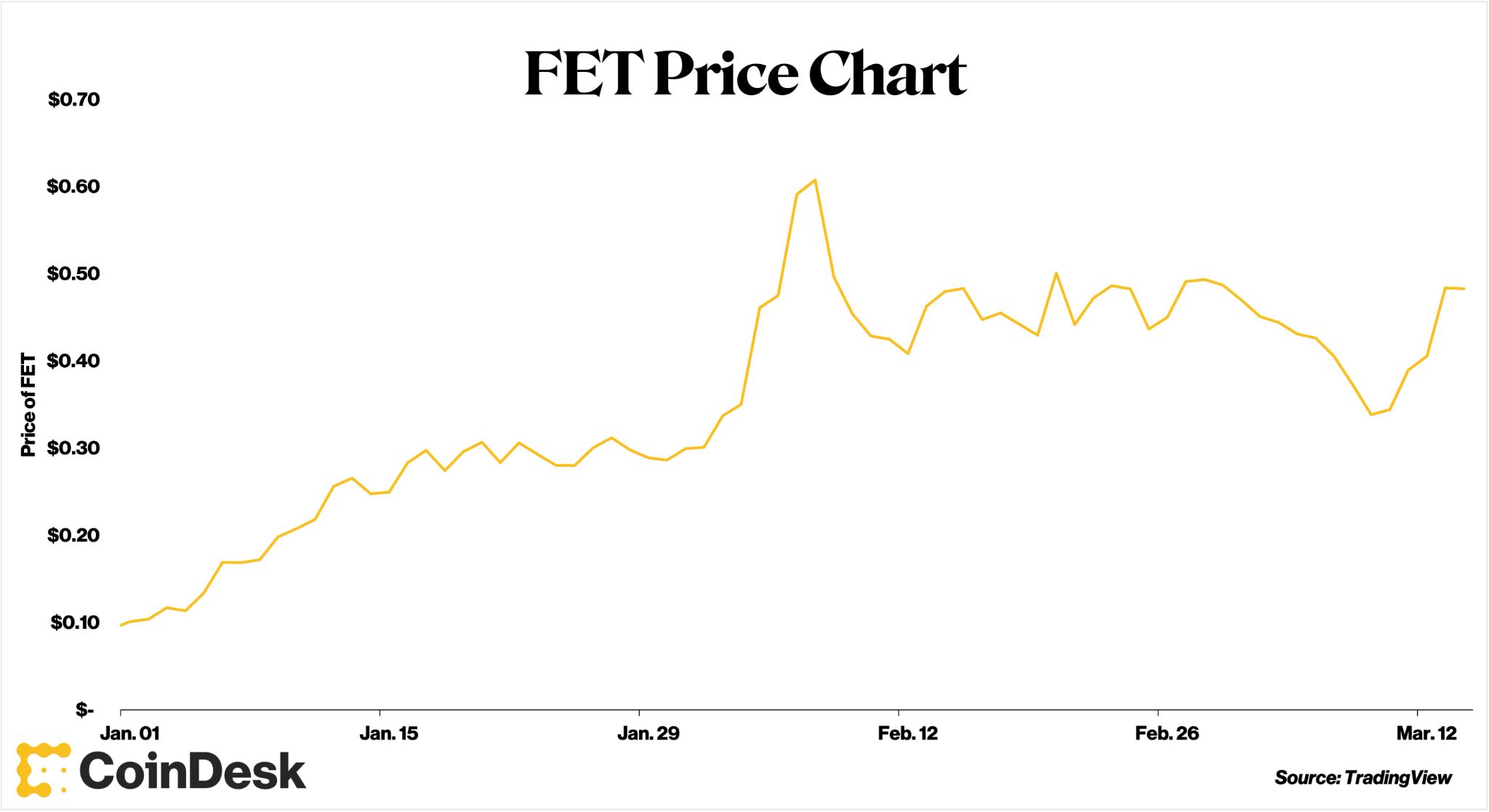

Asset: Fetch.ai Token: FET Market Capitalization: $355 million. Correlation (BTC): 0.91

Fetch.ai, the machine learning platform aims to facilitate the exchange of data across a decentralized, distributed ledger.

Fetch.ai is the AI lab, and its native token (FET) is the medium of exchange/currency within the Fetch ecosystem. Developers wishing to access datasets within the Fetch.ai ecosystem would acquire FET, allowing them to deploy it for their own development purposes within FET, and/or benefit from its price appreciation.

Year to date, FET is up 394% and has daily trading volume of $360 million.

Takeaway

All told, the three platforms mentioned are only a sliver of the burgeoning technologies within the crypto landscape. Whether they succeed remains uncertain. (Nothing in this column should be considered investment advice.)

However, one thing that I remain confident about, as was the case in my past stint in traditional finance (TradFi), is that opportunities for alpha are more likely to be found in lesser-known, lesser-capitalized assets that are waiting to take center stage – much where AI as a technology was a few years ago.

– Glenn C. Williams Jr., CMT

Evaluating Bitcoin as a Store of Value

It’s a common question: Is bitcoin (BTC) a store of value? While proponents say, “Yes” without hesitation, skeptics note its historically large drawdowns. And that’s fair. Not long ago, in November 2021, bitcoin reached nearly $70,000 but is now around $20,000. That said, BTC also used to trade below 1 cent so, using just prices, the answer to the initial question is, “It’s hard to tell.”

For an asset in its speculative, price-discovery phase, volatility should be expected. New opportunities and technologies often capture the attention of speculators and traders, often resulting in wild fluctuations as participants seek to determine true value.

Pair growing interest with the skepticism, controversy and industry speed bumps experienced thus far, and the roller coaster of highs and lows makes sense at just 14 years of age.

While the asset exhibits qualities of sound money (it’s durable, portable, scarce, uniform and divisible), acceptance is the final uncertainty.

Through the following on-chain metrics, I aim to prove that bitcoin’s users believe it’s a store of value (SoV), despite the volatility.

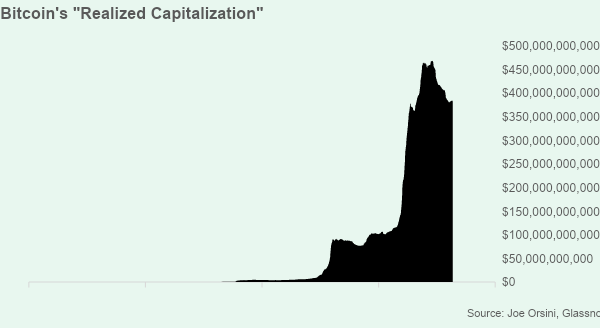

Realized capitalization

One measure of bitcoin’s use as an SoV is its “realized capitalization.” Different from traditional market cap, this alternative considers the last transfer price of each bitcoin rather than the current market price.

In doing so, realized capitalization is an aggregate cost basis of bitcoin’s on-chain users. The total realized cap is the amount of money that has been stored in the network over time.

To me, this is a proxy for inflows. Realized capitalization rises when transfers are made at higher prices than before and declines when transfers are made at lower prices.

According to Glassnode data, bitcoin stores a total of about $380 billion in value, down from a peak of $460 billion. But, importantly, this is four times more than in December 2017 – when bitcoin was priced around where it is today. So, money has flowed into the network – to store value.

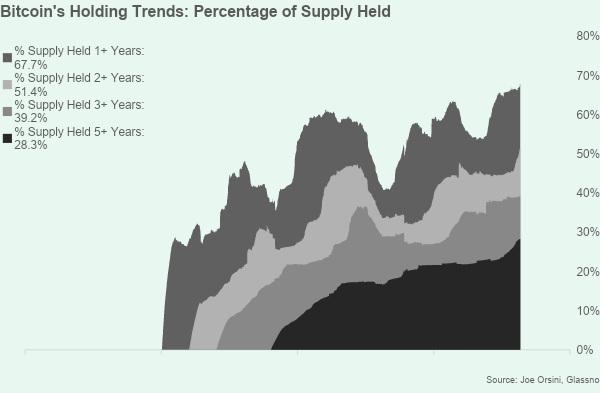

Holding trends

Not only that, but bitcoin’s users also are holding the asset for longer and longer. Just last week, the percentage of supply that has been held for long periods has hit all-time highs despite the drop in prices since late 2021. As of March 7, according to Glassnode data:

Conclusion

There is a saying that “perception is reality.” Remember, bitcoin has essentially been willed into existence. Despite the noise and skepticism, money continues to flow into the network and its users are holding their assets for longer periods of time.

The next time somebody questions bitcoin’s use as a store of value, show them these charts. As Satoshi Nakamoto wrote, “If enough people think the same way, that becomes a self-fulfilling prophecy.”

– Joe Orsini, CFA, CMT, Signal vs. Noise blog

Takeaways

From CoinDesk’s Nick Baker, here’s some recent news worth reading:

To hear more analysis, click here for CoinDesk’s “Markets Daily Crypto Roundup” podcast.