Bitcoin breached a rare “Golden Cross” over the weekend, a bullish signal that typically foreshadows short-term gains.

Prices have increased 1% since the latest cross occurred.

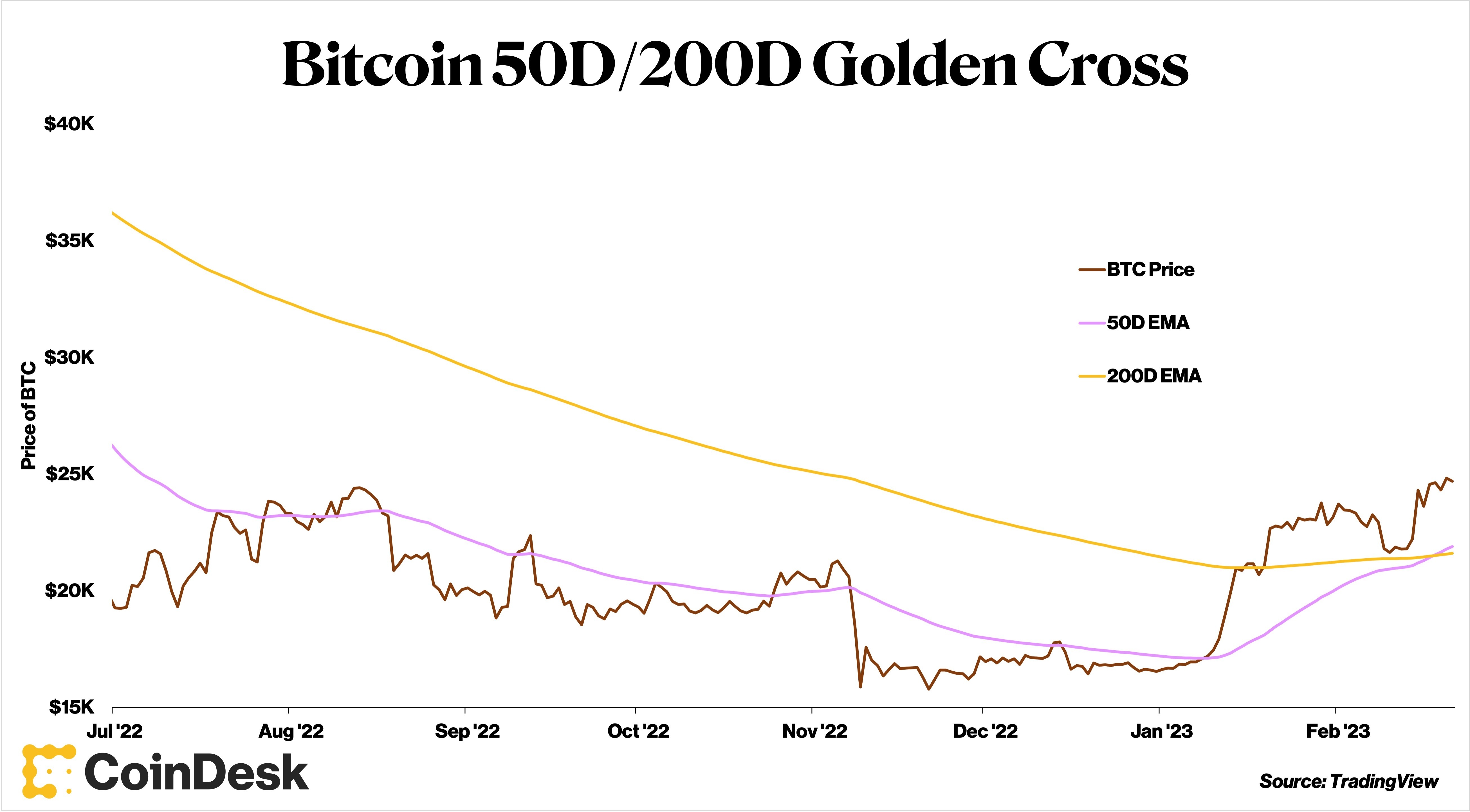

A Golden Cross occurs when the 50-day moving average for an asset crosses above the 200-day moving average. Bitcoin’s latest cross occurred on Feb 18. Bitcoin has seen only six other crosses since 2015. The most recent prior to this latest cross was on Aug. 14, 2021.

A cross reflects BTC’s exponential moving averages (EMA) and not the simple moving average (SMA). The calculation of an asset’s EMA weighs more recent pricing data, whereas SMAs measure each date equally.

Investors opt for one or the other depending on their personal preferences. The SMA group would have seen a cross occur Feb. 7.

(TradingView)

Prices initially declined 5.7% in the next two consecutive days but have since rebounded 13%, calculating out to a 6.6% increase since its occurrence.

Bitcoin’s performance following a cross has traditionally been strong, with the average seven- and 30-day returns of 3.8% and 8.3%, respectively.

These percentages compare favorably to seven- and 30-day returns of 1.6% and 7.5% over the entirety of the dataset, indicating the acquiring BTC following a golden cross has been positive. A look back at the SMA crossover shows six other occurrences since 2015, with average seven- and 30-day returns of 2.7% and 10.6%, respectively.

Performing to the average would imply that bitcoin prices will breach $26,500, given its closing price on Feb 18. The current price for BTC has been flirting with $25,000, a psychologically important level, which has been challenging for the asset to hold.

In each of the four most recent trading days, BTC has alternated between positive and negative gains on average volume, providing little clear direction for sentiment at the moment.