U.S. productivity cooled and cryptos shrugged.

Bitcoin, ether and most of the other major cryptocurrencies by market capitalization continued to hold about where they stood on Wednesday, same time. BTC and ETH both inched up a few fractions of a percentage point. BNB, APT and ADT, among others, were in the green. Bitcoin was recently holding steady over $23,000.

Cryptos’ resilience came even as the U.S Commerce Department reported that gross domestic product (GDP) expanded at an annual rate of 2.9% for the fourth quarter of 2022, down from 3.2% in the third, although better than expectations for a 2.6% increase.

The largest contributions to economic growth came via inventory investment and consumer spending, while the smallest contributor to GDP was business investment. Investments in housing declined. Equity markets initially had a more mixed view of the data but later were feeling upbeat as the tech-heavy Nasdaq Composite recently jumped 1.5%, while the Dow Jones Industrial Average (DJIA) and S&P 500, which has a strong technology component, were up 0.9% and 0.5%, respectively.

Meanwhile, BTC and ETH trading volume were slightly above average on the day. An uptick in volume in conjunction with higher prices is generally a bullish sign. Flat prices however, signal that bullish and bearish investors are both actively expressing their market views.

In other macroeconomic news, initial jobless claims of 186,000 were lower than expectations for 205,000, indicating that the labor market remains tight and that the economy has not cooled enough to satisfy central bankers trying to tame inflation. The Federal Reserve’s monetary policy has lowered prices in recent months through a series of steep interest rate hikes, but Fed governors remain concerned about their hawkishness spurring a steep recession.

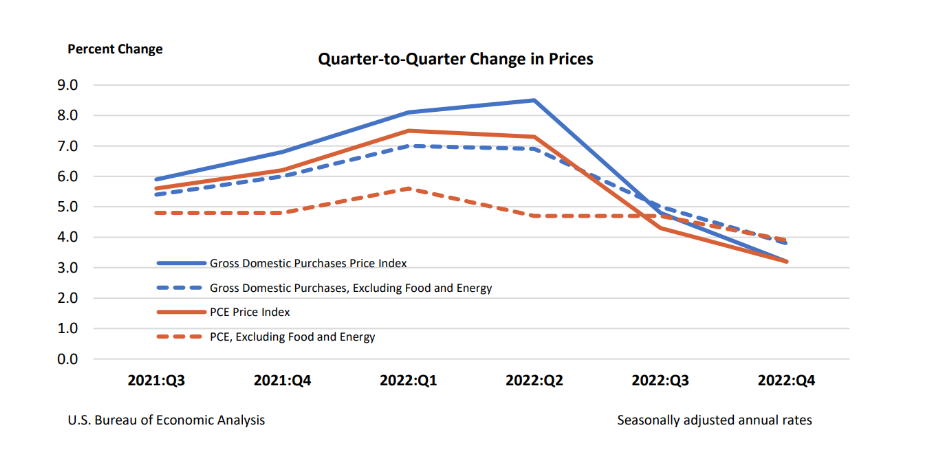

Financial markets appear to be reacting positively to what they saw in the latest data. “Real disposable income,” which represents personal income after adjustments for taxes and inflation, increased 3.3%, while the quarter-to-quarter change in gross domestic purchase prices increased 3.2%, down from 4.8% in the third quarter.

Signs of economic slowdown were present in the data as well, as a 2.1% increase in consumer spending arrived below expectations of 2.5%. With consumption accounting for 70% of GDP, investors in risk assets, particularly crypto, will likely be monitoring additional weakness in coming months.

Still, the data Thursday barely changed expectations for the size of the Federal Open Market Committee’s (FOMC) next rate decision at its two-day meeting starting next Tuesday. Target rate probabilities for a 25 basis point rate hike are now at 99.1%, up slightly from 98.3% on Wednesday.