Derivatives markets are signaling positive sentiment for bitcoin.

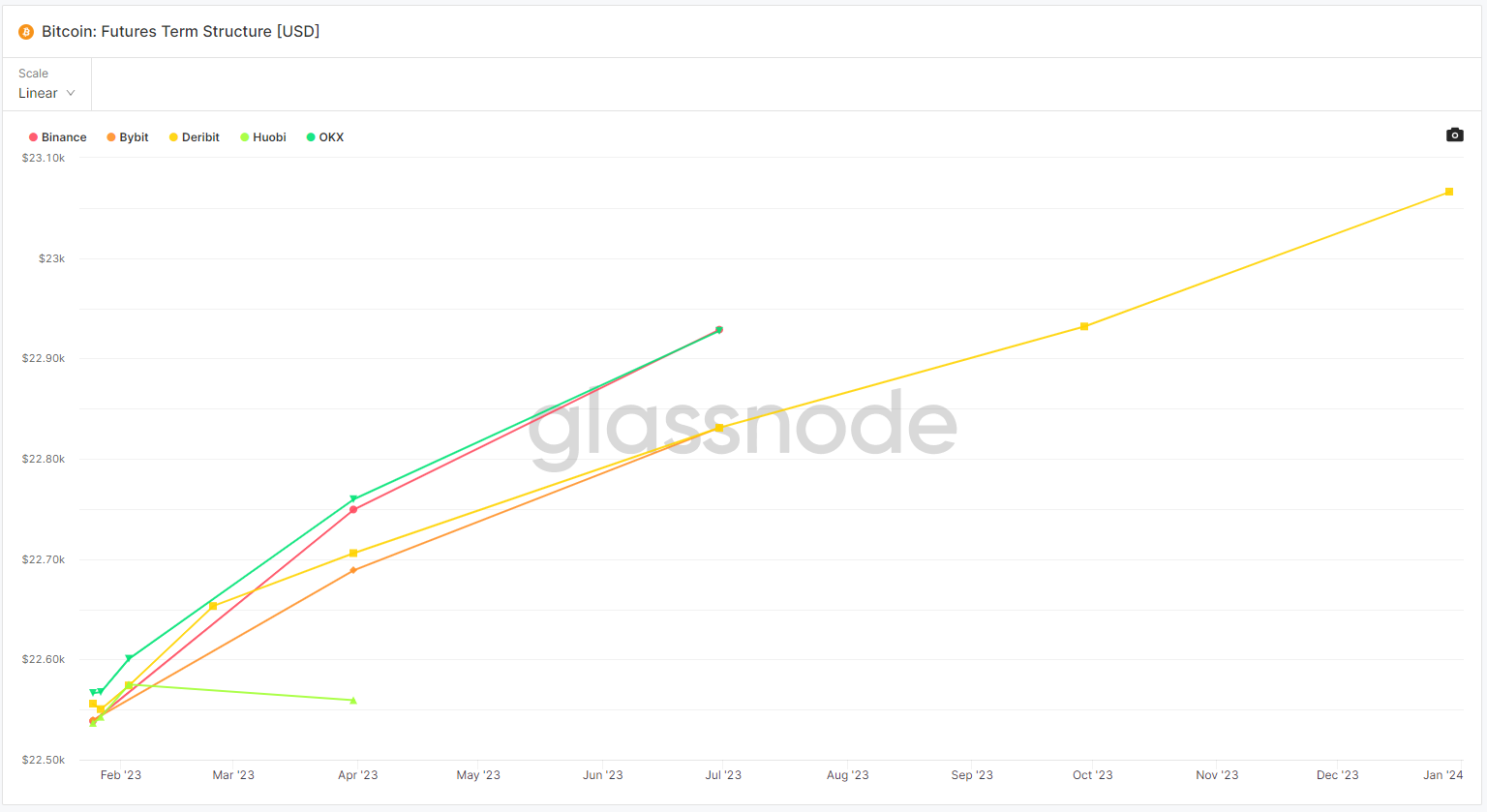

Bitcoin’s current term structure is in “contango,” a condition that exists when the price of bitcoin futures exceeds the price of bitcoin in spot markets. Graphically, contango is represented by an upward-sloping futures curve. The opposite condition is “backwardation,” where futures prices are lower than spot prices, and represented by a downward-sloping price curve.

(TradingView)

In traditional markets, where supply, demand and physical storage are significant factors, contango is often a bearish sign because the difference between the futures and spot price is based largely on the cost of transporting and storing that asset. For physical commodities, when a price curve is in contango the futures price is expected to move downward to meet the spot price.

Backwardation in physical markets represents the opposite. Supply shortages of the asset will drive its price higher in spot markets than in futures markets, as demand in the short term outstrips supply. This is often a bullish sign.

These trends are often counterintuitive, given the upward and downward slope of the curves themselves.

For bitcoin, where issues related to physical storage do not apply, a futures curve in contango simply represents increased buying in futures markets, and can indicate bullish sentiment.

Traders will likely monitor the extent to which the spread between BTC spot and BTC futures prices expands, however. As contango grows, the opportunity to quickly benefit from the spread will do the same, as traders may go long in spot markets while selling short in futures.

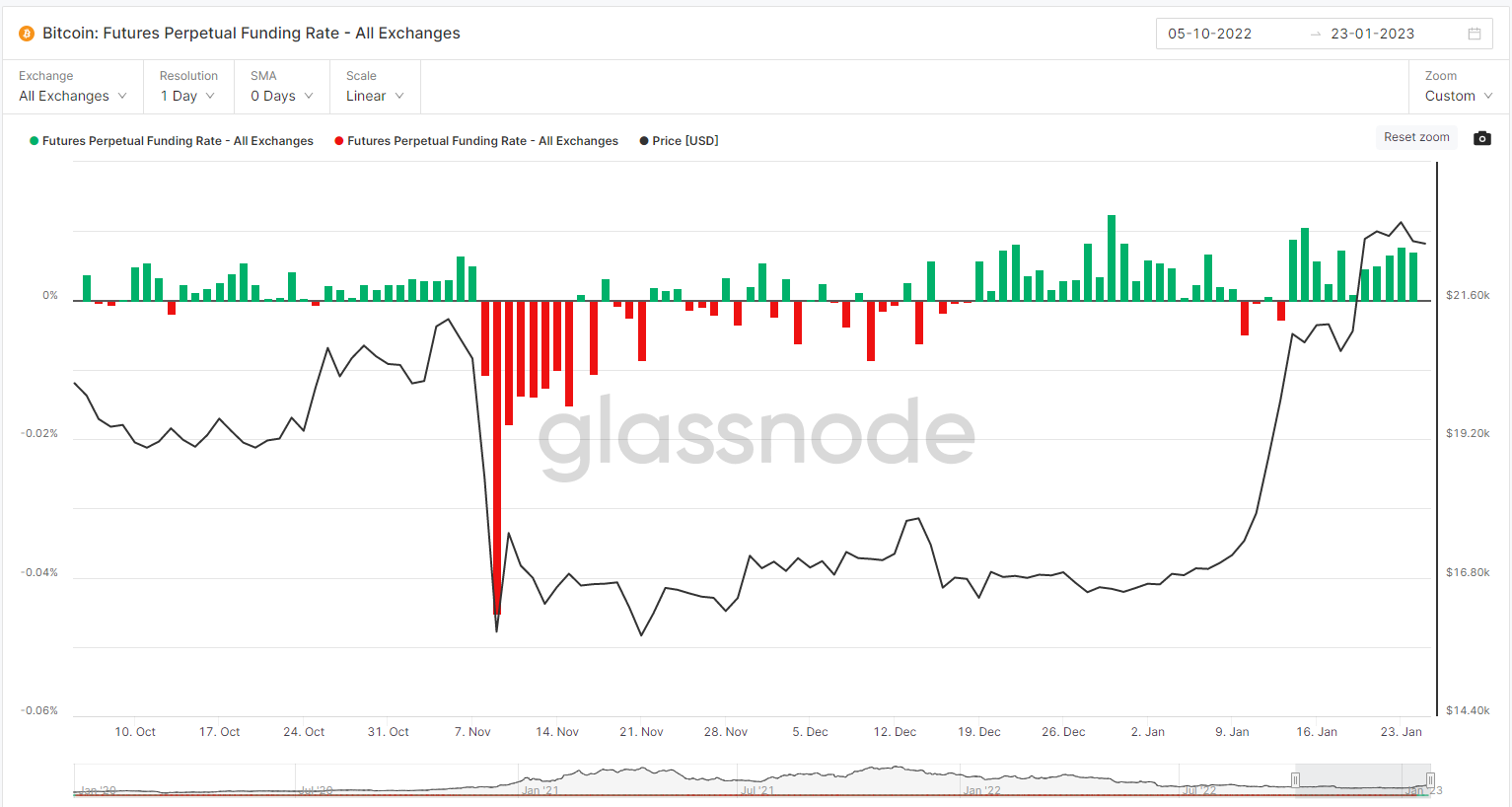

BTC’s current funding rate is also signaling bullish. The BTC perpetual funding rate represents the rate that exchanges set for futures contracts. When funding rates are positive, traders who are long BTC contracts pay a fee to traders who are short.

The opposite condition, where shorts pay a fee to traders long BTC futures, occurs when funding rates are negative.

BTC’s funding rate has been positive for 11 consecutive days, and 17 out of the last 20, implying that the plurality of traders hold bullish views of bitcoin.

(TradingView)