Blockchain-based lending platform Maple Finance severed ties with crypto firm Orthogonal Trading, alleging it was “misrepresenting its financial position.” The move is yet more fallout from the implosion of the FTX crypto exchange.

This article originally appeared in Crypto Markets Today, CoinDesk’s daily newsletter diving into what happened in today’s crypto markets. Subscribe to get it in your inbox every day.

-

The action came after Orthogonal was due to pay back a $10 million USDC stablecoin loan from a credit pool managed by M11 Credit on Dec. 4. Orthogonal has been a significant borrower on Maple, and also was a manager and underwriter of a credit pool on Maple.

-

M11 Credit has issued a notice of default to Orthogonal for all active loans outstanding on Maple’s USDC stablecoin pool, with $31 million of current liabilities in four loans.

-

The default notice also extends to Orthogonal’s wrapped ether (wETH) loans worth $5 million (3,900 wETH) from Maple’s another M11 Credit-managed lending facility, M11 Credit confirmed to CoinDesk.

-

Maple said in a statement that Orthogonal has been “operating while effectively insolvent,” and didn’t communicate that it would be unable to service the debt.

-

A default by Orthogonal could deal another blow to undercollateralized lending protocols grappling with liquidity crunch, and the fallout from crypto exchange FTX’s implosion.

-

Orthogonal’s default marks the second time a borrower defaulted on Maple after Babel Finance’s failure to service its debt in June. Earlier this fall, crypto firms Blockwater and Invictus Capital defaulted on their loans on rival unsecured lending protocol TrueFi.

Token Roundup

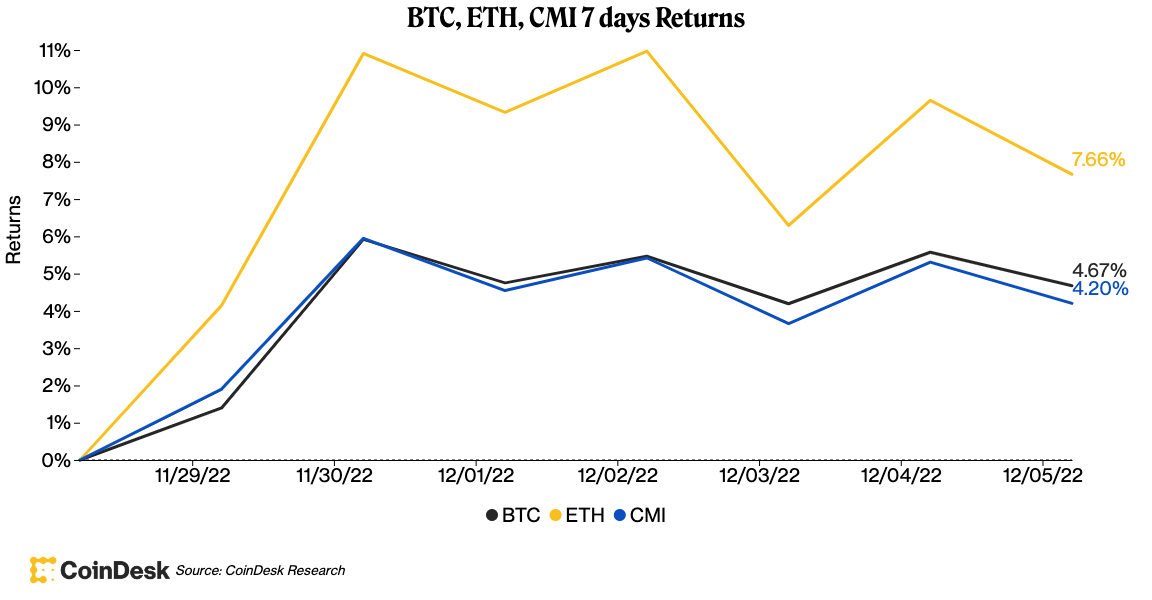

(CoinDesk Research)

Bitcoin (BTC) and ether (ETH): The top currency by market cap slid roughly 0.8% to $16,940 after holding above the $17,000 level earlier in the day. It traded as high as $17,412 in the past 24 hours before falling. Bitcoin traded at a significant discount to its 200-day average. Ether followed a similar pattern, trading down 1.8% to $1,250. Traditional markets seem to have re-embraced riskier assets, at least temporarily.

Crypto.com’s CRO token was gaining in value Monday following news that the exchange is teaming up with Coca-Cola to launch a series of non-fungible tokens (NFT) celebrating the 2022 FIFA World Cup in Qatar. CRO climbed as much as 10% after the press release hit, and though it slipped to a 4% advance at the time of publication, CRO remains one of the day’s top performing digital assets.

Equities lower on Monday: The S&P 500 and Nasdaq Composite closed down 1.79% and 1.93%, respectively, while the Dow Jones Industrial Average sank 1.4%. The downturn came after a higher-than-expected Institute for Supply Management November services report raised investor concerns about the Federal Reserve’s expected interest rate increase in December.

Latest Prices

Crypto Market Analysis: Consumer Savings Rate Suggests Continued Calm in Bitcoin Prices

By Glenn Williams Jr.

Many economic indicators now point to relatively mild price action in the short term for crypto markets.

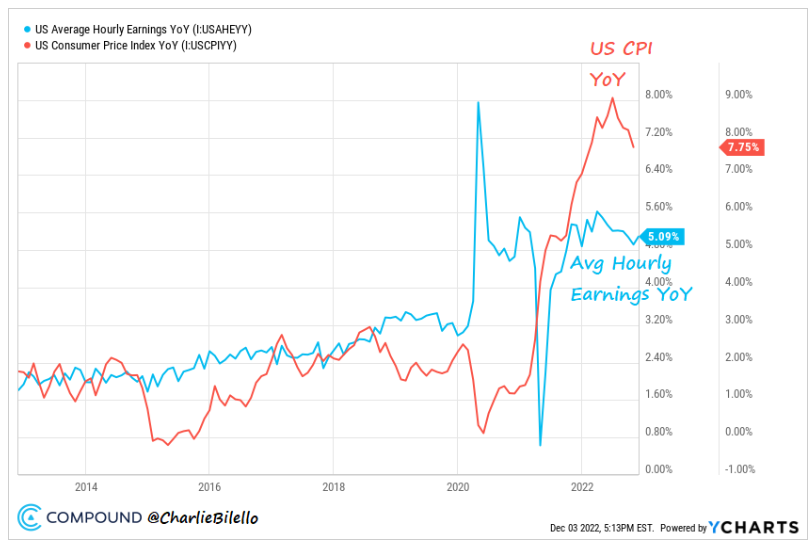

A decline in savings offers compelling evidence of cryptos’ likely, continued calm. Inflation growth has exceeded wage increases for nearly two years.

As shown in the below graphic from Compound Advisers, prices continue to increase at a faster pace than incomes. Not surprisingly, this trend has led to sharp increases in U.S. revolving debt balances. In turn, the personal savings rate in the U.S. has fallen to its second-lowest rate in close to 60 years.

(Ycharts)

Read the full technical take here.

Other News

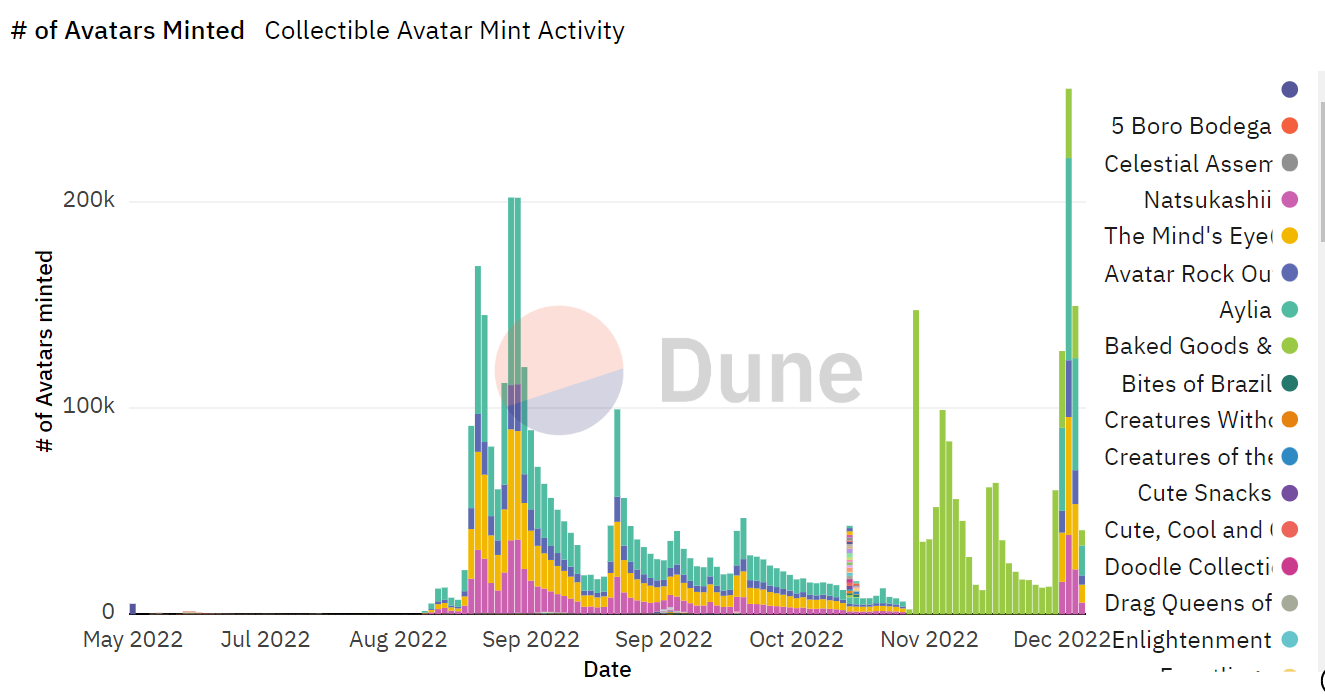

(Dune Analytics)

Collectible Avatars, a set of art tokens based on the Polygon blockchain by social network Reddit, set a minting record of more than 255,000 unique avatars on Saturday, data queried by Dune Analytics shows. The figures eclipsed the previous high of 200,000 in August, nearly a month after the collectibles went live. More than 98,000 avatars from The Singularity collection were produced, the most on that day, followed by 58,000 avatars from Aww Friends.

Crypto lender Nexo said Monday it would stop offering products and services in the U.S. in the coming months, would immediately halt access to its Earn Interest Product in eight states and is no longer signing up any new U.S. customers to the Earn product. Nexo said it had been in talks with both state and federal regulators in the U.S., but these had come to a “dead end.”

Genesis customers whose money is locked up on the trading and lending platform – and who have taken legal advice on the matter – currently account for some $1.8 billion of loans, according to a person familiar with the situation. And that number looks like it will continue to grow. Genesis is a CoinDesk sister company.

Trending posts

-

Listen

:Today’s “CoinDesk Markets Daily” podcast discusses the latest market movements and a look at some of the right questions to ask Sam Bankman-Fried.

-

Crypto Bank Silvergate Cut to Underweight at Morgan Stanley Following FTX Collapse

-

Kentucky Investigating 2 Proposed Contracts That Would Give Discounted Electricity to Crypto Miners

-

New FTX CEO Testimony ‘False,’ Bankman-Fried Says

-

Bankman-Fried Is a ‘Master of Deflection,’ Securities Lawyer Says

-

Waves Blockchain Founder Explores New DAO Model to Improve Crypto Governance

-

Aave’s Social Media Protocol Lens Acquires NFT Mobile Game Sonar

-

Bybit to Lay Off 30% of Staff Amid Crypto Winter