In May, the Terra (LUNA-UST) ecosystem collapse triggered a historic sell-off. Excessive selling pressure has wiped these two cryptocurrencies off the market. According to a crypto researcher, we may see another similar fiasco. Lido Staked Ethereum (stETH), a token representing Ethereum staked on DeFi platform Lido, has split sharply over the past 24 hours.

Lido Staked Ethereum (stETH), is LUNA next?

stETH is used for ETH on Lido. STETH is trading at $1,641.96, down about 5.87% in the last 24 hours. It needs to trade 1:1 to ETH, which is currently $1,727.03. However, the imbalance caused by Curve Finance broke this mechanism.

Crypto researcher “SmallCapScience” illuminates the event in a tweet. He states that the unbundling of the token is due to a large imbalance in the Curve Finance liquidity pool. According to the expert, the imbalance in the pool is likely to worsen, causing further losses in stETH.

This situation is exacerbated by the sale of one of the $1.5 billion stETH whales, Alameda. Now, a broader market crash could be imminent, with prices drastically lowering like those seen on Terra.

How will depegging work instETH?

Alameda is one of the seven largest investors in the DeFi token. The $1.5 billion loss through swaps on Curve Finance threatens a similar collapse to LUNA. STETH whales are made up of several giant investors involved in the LUNA collapse, including venture capitalists Jump, Three Arrows, and Andreessen Horowitz. Any sale by other whales, particularly through Curve, is fueling the stETH collapse. This threatens the value of the token by causing further imbalances in liquidity pools.

Thus making ETH usage a costly affair, especially for platforms that invest customer funds in stETH. As a result, there is a large risk of outflow of funds. At the same time, stETH is expected to fall as sharply as TerraUSD.

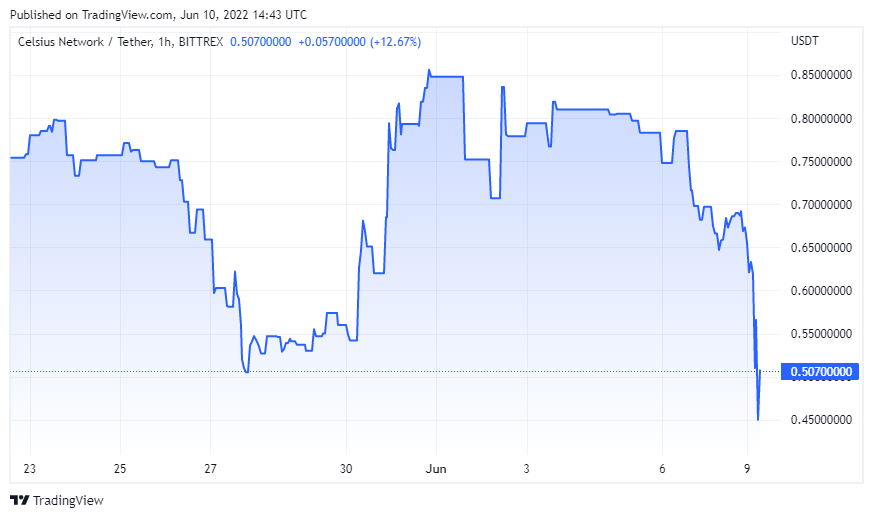

Celsius Network heavily staked Ethereum exposure

Researcher “SmallCapScience”, DeFi platform Celsius has a $1.5 billion position in stETH Said he had it. It also noted that it has accumulated approximately $1.2 billion in debt to its customers. If stETH continues to drop, Celsius will not be able to fulfill customer payments. The situation is exacerbated by data showing Celsius constantly losing liquid funds due to hacks, exploits and the LUNA collapse.

Given that investors are trying to use their positions at a rate of around 50,000 ETH per week, the firm may likely freeze redemptions soon. The firm’s native token, CEL, is already reacting to the potential scenario. As reported by Kriptokoin.com , the CEL price has lost about 30% in the last 24 hours. It is trading at $0.4735 at the time of writing. Thus, it fell to its lowest level since the end of 2020.