Crypto software and services company Luxor is launching a new product for investors and companies to lock in profits using bitcoin mining derivatives.

The product, called Luxor Hashprice NDF, will be traded over-the-counter and will be first of its kind, according to a statement. The financial instrument will be based on hashprice, a term coined by Luxor that refers to the bitcoin mining revenue miners earn from a unit of hashrate, or compute power over a specific period of time.

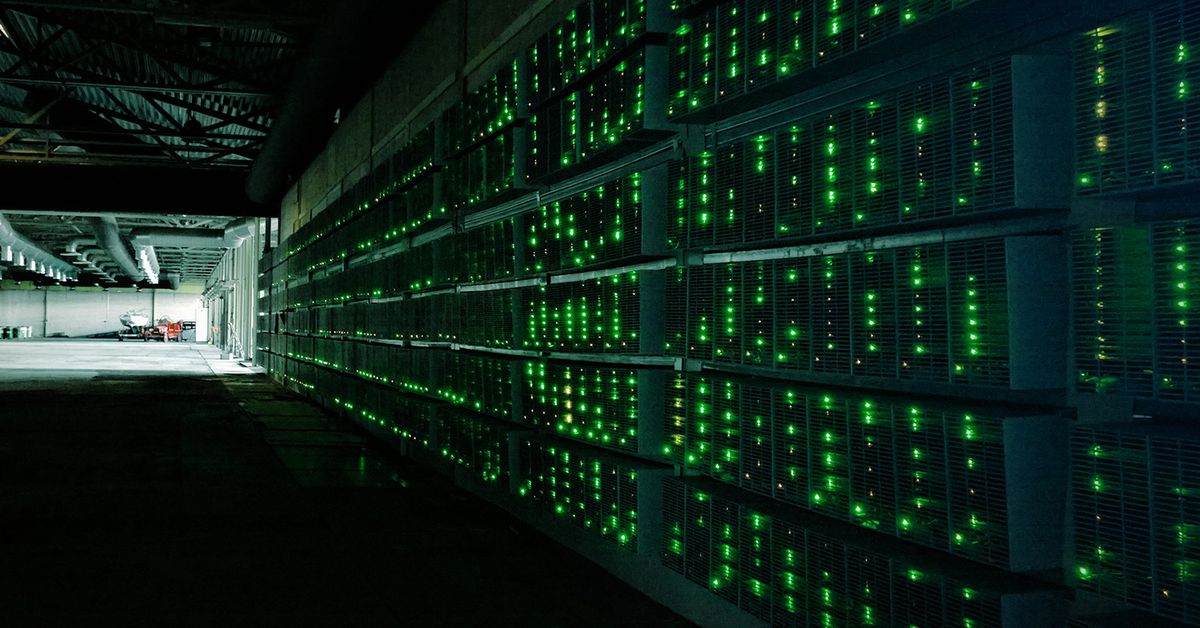

With the bear market wreaking havoc on the bitcoin mining industry, participants exposed to the sector require new ways of hedging their downside. Traditionally, derivative products have been used in the traditional finance (TradFi) world to protect against market downturns.

“Hashprice-based derivatives such as the Luxor Hashprice NDF forward contract will usher in a new era of financial instruments for bitcoin miners and give them a much-needed tool to hedge their mining operations,” the statement said. It will also help investment firms such as prop traders and hedge funds gain exposure to the mining industry, the statement added.

The contracts for the product will settle in U.S. dollars, with Luxor providing buyers and sellers of the derivatives the option to reconcile them in bitcoin or U.S. dollar equivalents. Luxor will facilitate the order matchmaking and settlement process, while making the contract durations flexible based on customer needs.

With the bear market being a good opportunity for some to build, some industry participants have taken the plunge to deploy capital or introduce ways to help the struggling mining sector. Most recently, crypto asset management firm Grayscale said it is forming an investment vehicle that will help investors take advantage of the low prices of bitcoin mining infrastructure amid the ongoing crypto winter. Grayscale is a CoinDesk sister company.

Meanwhile, last month, crypto billionaire Jihan Wu – the founder of Bitmain – was reported to be setting up a $250 million fund to purchase distressed assets from mining firms.

Read more: Crypto Miners Face Margin Calls, Defaults as Debt Comes Due in Bear Market