Cryptocurrency traders suffered $1 billion of losses in liquidations over the past 24 hours, according to Coinglass data, the most in 14 months, during a sell-off Thursday in digital-asset markets.

Bitcoin, the largest and original cryptocurrency, tumbled 7% to about $26,900, touching a two-month low earlier in the day close to $25,000.

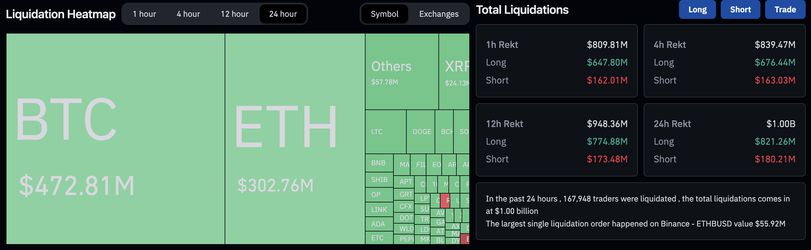

Some $821 million of long positions – traders who bet on prices to rise – were wiped out during the rush to the exits, CoinGlass shows. Bitcoin (BTC) traders took the brunt of the losses, enduring $472 million of long liquidations, followed by ether (ETH) with $302 million.

This was the largest level of BTC liquidations for a single day since June 2022, Coinalyze data shows, around the time when the leading crypto’s price plummeted to $17,000.

Liquidations in the last 24 hours (Coinglass)

The liquidations occurred as crypto prices fell through the floor during Thursday afternoon U.S. hours turning this month’s slow downtrend into a bloodbath amid financial markets jitters with crumbling foreign currencies, Chinese economic worries and bond yields ripping to multi-year highs. Crypto majors such as BTC and ETH saw near double-digit losses, falling to lowest since early summer.

Liquidations happen when an exchange closes a leveraged trading position due to a partial or total loss of the trader’s initial money down or “margin” – if the trader fails to meet the margin requirements or doesn’t have enough funds to keep the trade open. When asset prices nosedive, the dynamic can kickstart a cascade of liquidations, exacerbating losses and price declines.