Tether (USDT), the largest stablecoin, had to lose its dollar peg today. The imbalance is due to the large amount of USDT sold by crypto whales in Uniswap and Curve pools. It is noteworthy that a certain investor group is behind the transactions…

Crypto whales put pressure on USDT

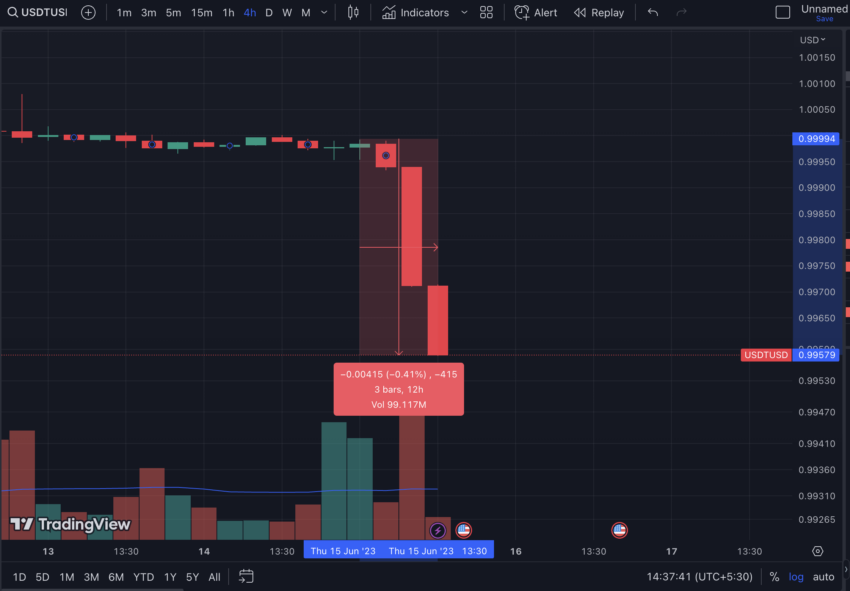

The largest stablecoin USDT deviated slightly from the dollar peg on June 15 due to an imbalance in Curve’s swap pool 3pool, which consists of USDT, USDC and DAI. Its price is holding around $0.9979 at the time of writing. It dropped as low as $0.9958 on the day.

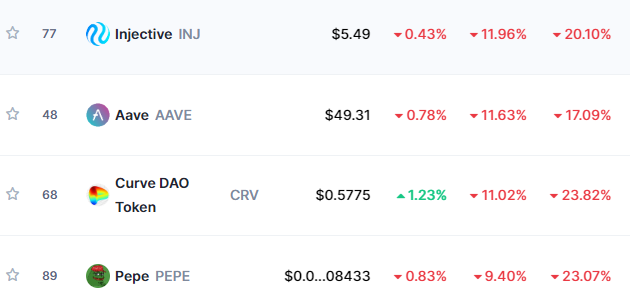

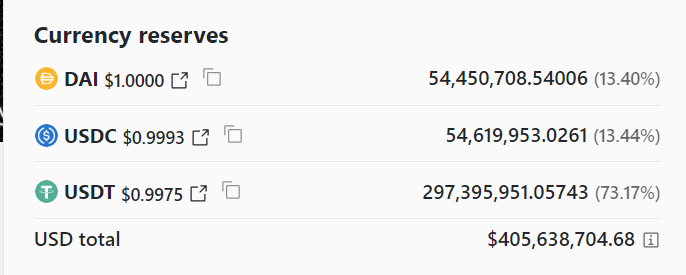

Crypto analyst Miles Deutscher tweeted, “Whales are draining USDT. As a result, USDT now accounts for more than 50% of the Curve 3pool pool.” This mobility seriously affects the Curve pools. According to the data, USDT currently accounts for 73.17% of the liquidity pool. This is the highest level since November 2022, when FTX went bankrupt.

What do whales have in mind?

It is not clear whether this spike in USDT inflows was simply a result of FUD or if there was insider information driving these actions. Much of the scrutiny for USDT comes from its stabilization following the Terra crash.

Meanwhile, on-chain detective Lookonchain shed more light on the situation by identifying addresses associated with activities surrounding USDT. According to his report, a notable whale is “CZSamSun”, who shorted Aave V2 while USDT price stabilized.

USDT is depegging!

CZSamSun shorted $USDT on #AaveV2 after USDT depegged.

He borrowed 31,544,278 $USDT from #AaveV2 and exchanged for 31,475,408 $USDC at a rate of $0.9978.

And he deposited 10M $USDC again on #AaveV2. pic.twitter.com/3rrfENocRk

— Lookonchain (@lookonchain) June 15, 2023

CZSamSun has borrowed a significant amount of USDT, specifically 31,544,278 USDT from Aave V2. He exchanged it for $31,475,408 USDC from $0.9978. It also invested 10 million USDC back into Aave V2. This seems like a calculated strategy to take advantage of the price imbalance situation. In this article, we have discussed in detail what happened in USDT during the day.

At risk in PEPE: 1 trillion sold

The crypto market has slumped as the US Federal Reserve announced yesterday evening that it will keep rates steady and “seems appropriate a few additional rate hikes this year.” cryptocoin.comExpectations of $ 24,500 in Bitcoin, which we have quoted as the coin, gained strength with this decision.

Most members of the crypto market, including BTC and ETH, are currently down over 5% over the last 24 hours. Pepe (PEPE), a popular meme token, lost double-digit value meanwhile. Lookonchain reports that there is a whale address named “0x1497” behind the drop. This huge investor recently sold a mind-blowing 972.84 billion PEPEs for 514 ETH, equivalent to $848,000.

Address 0x1497 sold all 972.84B $PEPE for 514 $ETH ($848K) ~2 hrs ago, the selling price was $0.0000008718.

This guy might be an inside trader.

He received 0.58 $ETH from #FixedFloat and spent 0.027 $ETH ($58) to buy 2.27T $PEPE within 10 minutes of $PEPE starting trading. pic.twitter.com/QflquoJu0l

— Lookonchain (@lookonchain) June 15, 2023

The huge sell-off caused the price to plummet and a mood of panic among investors. As a result, PEPE is currently among the top losers of the day: