Cryptocurrency whales have started accumulating DeFi coins. Moreover, they do it secretly. So which cryptocurrencies are popular? Here are the details.

DeFi Coins move from whales

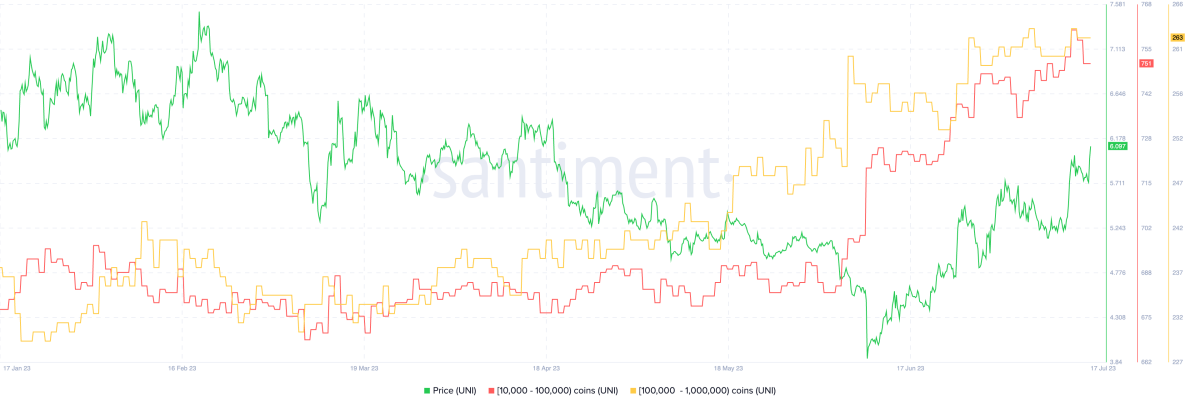

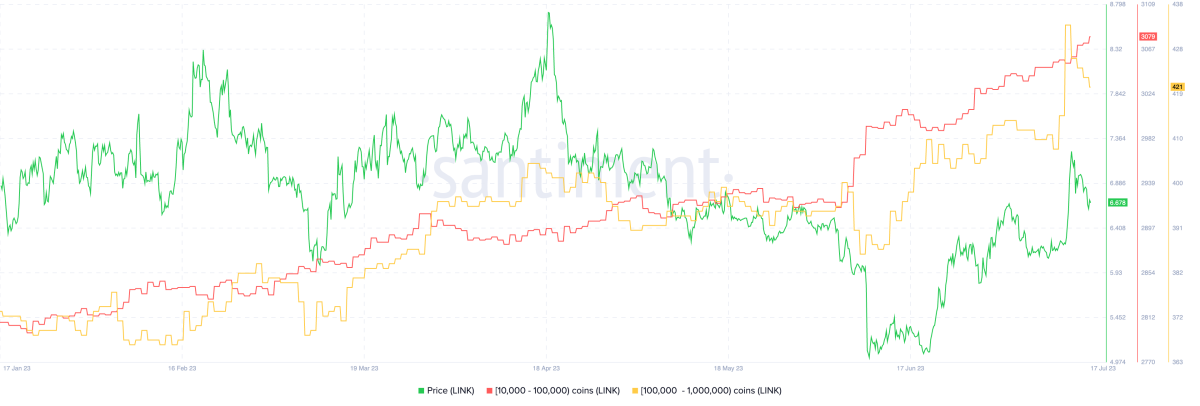

Major wallet investors on the crypto network are quietly accumulating massive amounts of DeFi coins Chainlink (LINK) and Uniswap (UNI). In-chain metrics for LINK are on the rise. For UNI, on the other hand, it has remained largely unchanged. According to data from crypto intelligence tracker Santiment, UNI and LINK whales have consistently accumulated DeFi coins.

Whale accumulation is often considered a bullish sign for altcoins as the asset’s tokens are withdrawn from circulation. It reduces the selling pressure on the asset. It also indicates the potential for a price rally. As seen in the Santiment charts above, the accumulation of whales is followed by a price increase. Accordingly, in April 2023, whales in the segment 10,000 to 100,000 accumulated LINK. The price, on the other hand, rose to $8.79 within a week. UNI price also exhibited a similar behavior in April 2023.

Catalysts raise the price of DeFi Coins UNI and LINK

On-chain metrics such as trade volume and daily active addresses have been climbing for both UNI and LINK over the past week. These metrics are indicative of the adoption and use of these DeFi Coins among traders. These metrics and increased activity in Uniswap and Chainlink are possible catalysts for the rise of DeFi Coins.

According to data from Binance, UNI price has gained 5.37% to its holders in the last 24 hours. However, LINK wiped out the gains made over the weekend. At the time of this writing, UNI is trading at $6.06 and LINK at $6.67 on Binance, respectively.

Significant accumulation for AVAX

Avalanche (AVAX), the native token of the Avalanche blockchain, has witnessed a notable 27.39% price increase over the past seven days. This caught the attention of traders and investors. It is currently facing strong resistance at the EMA50 daily level. Also, AVAX is showing promising signs of potential bullish momentum. Market optimism grows as buyers hoard AVAX in anticipation of a breakout.

As of the latest data, Avalanche is trading at $15.45 per AVAX. Accordingly, it has exhibited an impressive price increase over the past week. With a circulating supply of 345,845,505,008 AVAX, the token’s total market cap stands at $5,294,894,681.68. Also, AVAX saw a significant increase in trading volume, gaining $2,091,996,941.63 in the last 24 hours. Accordingly, this indicates a significant increase of 381.96%. Last day, approximately $547,703,576.77 worth of AVAX was traded.

AVAX: Strong resistance and accumulation

The daily EMA50 level has emerged as a tough resistance point for the coin. It also poses a significant challenge for buyers to overcome. However, the increasing accumulation of buyers in AVAX points to a positive sentiment and belief in the token’s potential to surpass the resistance level. Investors have noticed the similarities between AVAX and other successful cryptocurrencies. Accordingly, they make comparisons that indicate a potentially significant price increase.

Looking at the technical indicators, the relative strength index sits at 65 in the neutral zone between the oversold zone of 50 and the overbought zone of 75. The MACD indicator is currently in the buy zone, which is a bullish signal. In addition, histogram bars are green. It also indicates that the uptrend is continuing. On the other hand, if the bulls continue, the crypto could have a sustained uptrend in the coming days.

Increased investor interest and bullish sentiment

AVAX’s continued accumulation demonstrates a growing interest and confidence among investors in the token’s underlying technology and future growth potential. Buyers strategically position themselves in key support areas. They also aim to take advantage of the expected breakout and potential price increase. This accumulation activity is a positive indicator for AVAX. On the other hand, it strengthens the belief that the token price may experience a significant upward movement.

Market participants watching Avalanche closely have identified similarities between the current price pattern and other successful cryptocurrencies. In particular, the comparison with SOL, which experienced a significant spike after successfully breaking a key resistance level, adds to the overall bullish sentiment surrounding AVAX. These comparisons add to the growing optimism in the market.

cryptocoin.com Looking at it as a whole, the accumulation of AVAX and the prospect of a breakout show encouraging signs. However, it is important to acknowledge the highly volatile nature of the cryptocurrency market and the potential impact of various market forces. Traders should be careful and consider other technical indicators and market factors that may affect AVAX’s price trajectory.