The recent loss of rally momentum that started in January leaves investors in the dark about bull timing. An important analysis on this issue came from Young Ju, CEO of CryptoQuant. On-chain analyst commented on how far we are from the bull for Bitcoin (BTC).

“Bitcoin (BTC) is now in bull phase”, here is why

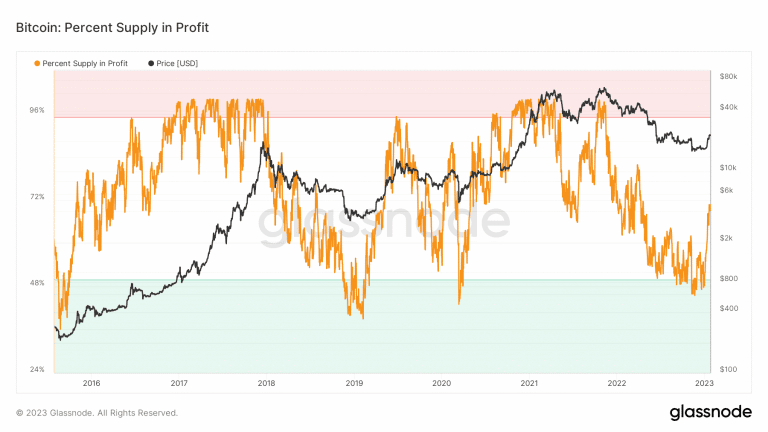

CryptoQuant CEO Young Ju believes that Bitcoin has already entered an ‘uptrend’ as he put it in his analysis today. According to the analyst, indicators based on PnL (profit-loss) show that most investors are still “at a loss” and the majority do not want to sell at a loss.

Ju also assumes that the current selling pressure is part of the liquidation process that started due to the bankruptcy of large funds or crypto-related companies. In addition, assets seized by the state are also sold on the market almost instantly.

Most investors are still underwater if you see on-chain PnL-related indicators like MVRV.

No one would want to sell here at a significant loss.

If someone sells a lot, it's highly likely forced & unwanted selling due to bankruptcy, government-seized coins, etc.

— Ki Young Ju (@ki_young_ju) January 25, 2023

Whales support the bull

This interest, which Santiment has included in its recent reports, is based on the breakdown of BTC transactions that emerged on January 5. According to its analytics platform, the whales were active again before BTC picked up momentum earlier in the year. However, several identical transactions were made, which was a major factor in volatility.

For example, on January 5, two significant transactions involving 15,477.92 BTC took place. After these transactions, the BTC price started to rise. In Ju’s view, the Bitcoin whales did not even move to sell their funds in the market at a good price. This could mean that the targets of big investors are much higher. On the other hand, whales may prefer to wait for a much larger bull despite the damage.

CryptoQuant CEO, at this point, said, “From an on-chain perspective, BTC whales have not moved Bitcoins despite the recent price spike. The market may not have reached its target yet.” All in all, the lack of whale-level Bitcoin selling is a bullish factor that allows the market to move upwards without having to deal with pressure from investors. However, the momentum we had at the beginning of this month has faded and the industry is looking for a new wave of investment to move forward. Still, BTC is currently in a position to meet this expectation; It is trading in the $23,000 region.

Failure percentage in snow at 7-month peak

The recent BTC price increase has also affected the percentage of supply in profit. The Glassnode chart shows that the profit percentage of the BTC supply is over 70%. Taking a closer look at the indicators, current supply in the profit phase is at its highest in more than seven months.

At this point, MVRV Z data suggests that the downtrend has lagged behind, Ju said. According to Ju, BTC’s MVRV Z score may be signaling a reversal in the short term. cryptocoin.comWe have included Binance CEO CZ’s current Bitcoin commentary in this article.