It appears crypto investors have been enjoying time away from the trading desk during the late summer months.

With some exceptions (a flurry of excitement around potential bitcoin spot ETFs and trading enforcing upper and lower price support levels), they appear to be less focused on their holdings and more focused on other matters, including taking much-needed R&R.

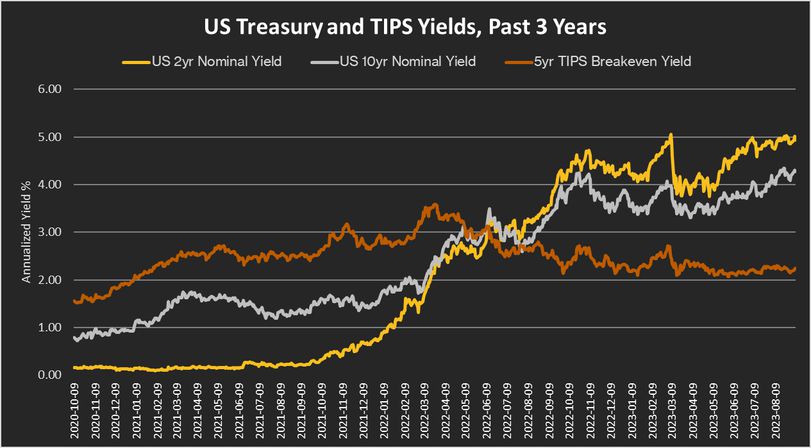

Amid that relative calm, the U.S. Treasury has been busy at work in the fixed-income market borrowing more and more via bond issuance. This increase has been significant enough to prompt Fitch ratings to cut the U.S. debt rating from AAA, joining S&P’s move to the same AA+ level more than a decade ago. Amped up issuance may also have pushed yields on 2- and 10-year Treasuries up in relation to inflation-linked TIPS.

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Source: Federal Reserve Bank of St. Louis

Should this have nudged digital asset prices, too? How do interest rates impact crypto asset prices?

Changes in rates can indirectly affect the price of bitcoin (BTC), although the relationship between these markets is complex and influenced by various factors, including:

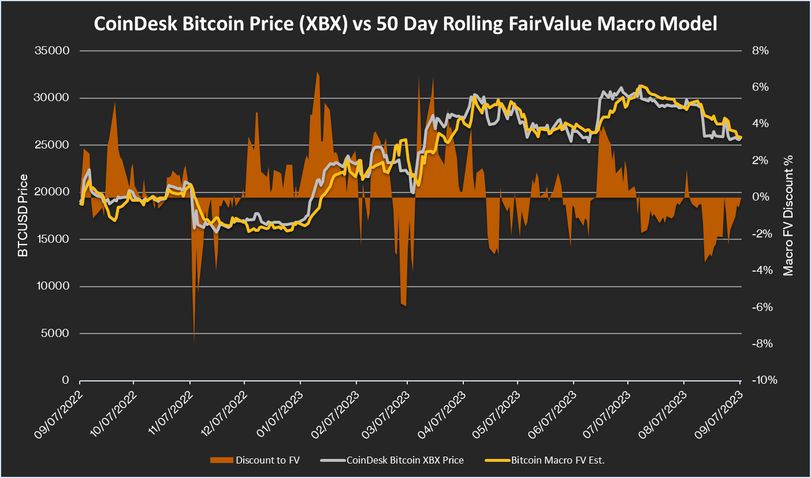

Source: St. Louis Fed, CoinDesk Indices

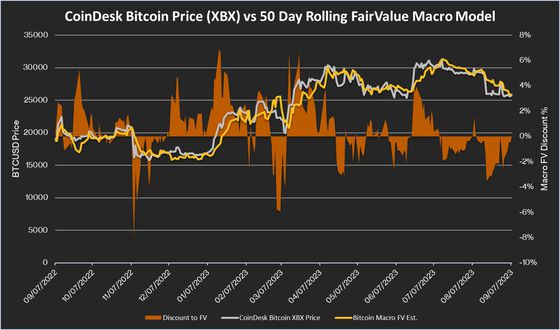

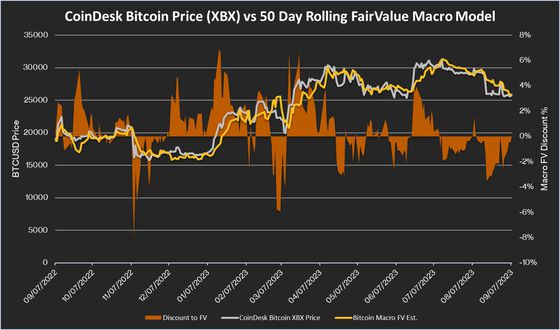

To answer whether or not bitcoin has been impacting by the recent moves higher in interest rates, I ran a quick rolling regression analysis on the recent bitcoin price history against interest rates (both the 2-year US Treasury yield and the 10-year inflation adjusted real interest rate) and the EUR/USD spot exchange rate to correct for moves in the U.S. dollar. From the results (see figure above), it appears that current bitcoin prices reflect the move up in nominal and real interest rates.

– Todd Groth, CFA, head of research at CoinDesk Indices

Takeaways

From CoinDesk Deputy Editor-in-Chief Nick Baker, here is some news worth reading: