Crypto-tracked futures lost over $1 billion in the past 24 hours, weighed down by a weak sentiment for bitcoin and other cryptocurrencies amid a weak global economic outlook, data shows.

Liquidation refers to when an exchange forcefully closes a trader’s leveraged position due to a partial or total loss of the trader’s initial margin. It happens when a trader is unable to meet the margin requirements for a leveraged position (fails to have sufficient funds to keep the trade open).

The losses came as bitcoin lost a major support level at $25,000 on Monday, with crypto market capitalization reaching levels previously seen in January 2021. Major cryptocurrencies declined by an average of over 15%, as reported.

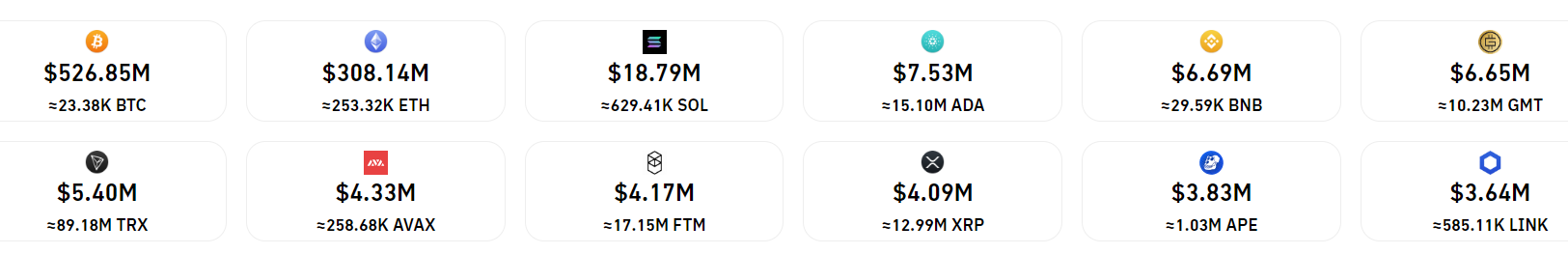

Bitcoin accounted for over $532 million of all liquidations, followed by ether at $317 million and Solana’s SOL tokens at nearly $20 million. Futures tracking Cardano’s ADA, Stepn’s GMT, and Binance ecosystem tokens BNB saw over $6 million in losses each, with some 213,000 individual trading accounts seeing liquidations in the past 24 hours.

Cryptocurrencies lost over $1 billion in the past 24 hours. (Coinglass)

Longs, or traders betting on higher prices, saw over $510 million in liquidations. Shorts, or bets on lower prices, saw $554 million in losses, suggesting futures traders added to market volatility and affected traders almost equally in either direction.

Crypto exchange FTX recorded over $417 million in liquidations, the most among its counterparts, followed by OKX at $251 million and Binance at $198 million.

Open interest – or the number of unsettled futures contracts – decreased by 7% in the past 24 hours to $23 billion, suggesting a considerable number of traders closed their positions expecting further market volatility.

Bitcoin traded at just over $22,000 in European hours on Tuesday, continuing a nearly 12-week slide. The asset has lost some 66% of its value from lifetime highs of $69,000 in November.

Much of the decline in the past few months has come as the U.S. Federal Reserve (Fed) plans to hike rates in the coming months to battle the ill effects of record inflation – a move that has inadvertently caused a slide in global stocks and subsequently cryptocurrencies as investors take money off assets deemed risky.

Sentiment among market observers remains bearish with some warning of ‘severe losses’ ahead.

Read more about

Save a Seat Now

BTC$22,265

BTC$22,265

7.18%

ETH$1,188.74

ETH$1,188.74

3.87%

BNB$223.31

BNB$223.31

0.84%

XRP$0.312715

XRP$0.312715

0.77%

BUSD$1.00

BUSD$1.00

0.09%

View All Prices

Sign up for Crypto for Advisors, our weekly newsletter defining crypto, digital assets and the future of finance.