Crypto analysts, famous for their accurate predictions, are split on the next levels for Bitcoin. According to some, a drop of up to $20,000 is possible. However, S2F inventor PlanB surprisingly suggests that the bull is starting…

DonAlt reports that Bitcoin chart is ripe for selling

Foreshadowing this year’s crypto rally, DonAlt predicts that Bitcoin will gain downward momentum after falling below $29,900. Earlier this month, the analyst said that “the lights will be off” for Bitcoin if it loses the key psychological level of $30,000.

According to DonAlt, a sustained move below $30,000 risks dropping Bitcoin as low as $20,000. While BTC is currently trading below the key level, the crypto strategist says Bitcoin has until the end of the week to reclaim $30,000.

Technical analyst Cheds says $20,000 is not possible

Unlike DonAlt, another crypto analyst, Cheds, says that while BTC is currently trading below $30,000, it is unlikely that it will revisit the $20,000 price area anytime soon. In his current analysis, he says that while Bitcoin may do the unexpected, he has not seen the crypto king drop to $20,000.

According to the crypto strategist, BTC has multiple support levels up to $25,000 that buyers can step in to stop the bleeding. The analyst also said, Of course, you can talk about $25,000. I think this is a possibility. But a lower probability is (approximately) 15% to 20%. But I think 27,500, 28,000, 28,500 range is more likely to be retested and then continued.

Finally, Cheds says the “most likely scenario” for Bitcoin is the possibility of retesting the $28,000 price range. It gives a 70% chance of that. The analyst also sees that Bitcoin is currently consolidating in an uptrend. According to Cheds, Bitcoin ended the downtrend after removing the higher timeframe resistance at $25,000 with the 200-week moving average acting as support.

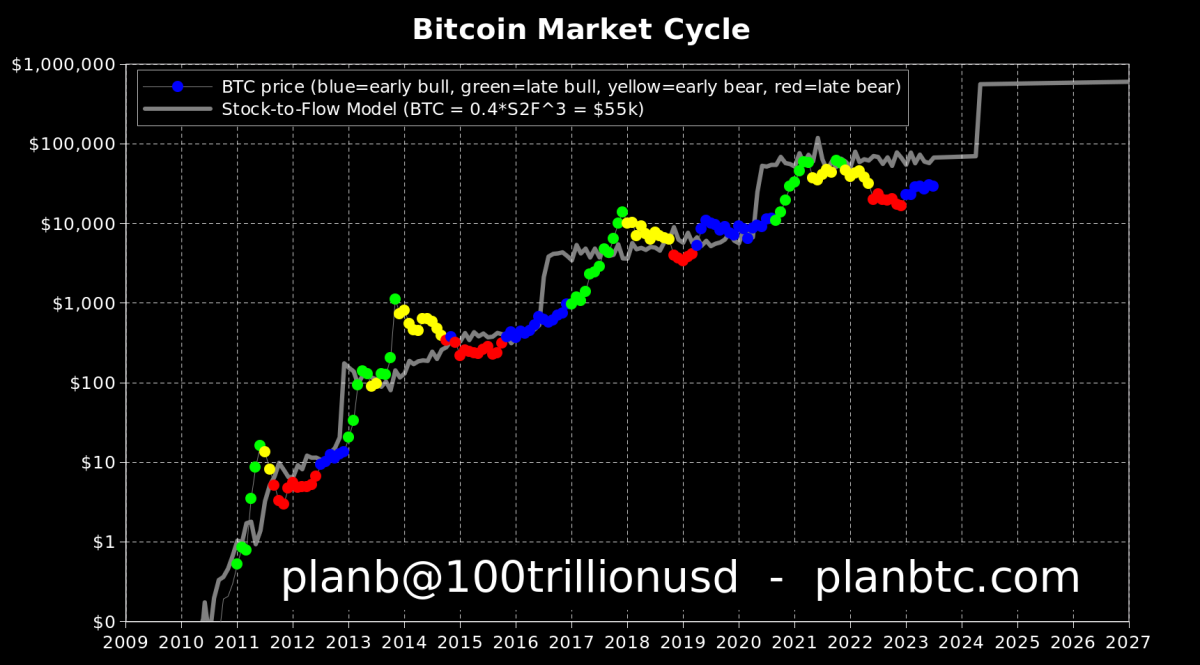

PlanB says it shared that the Bitcoin bull market has begun

PlanB, one of the bull-expectant analysts, says that Bitcoin is currently on its way to expand by trillions of dollars to compete with some of the biggest asset classes. The inventor of the S2F model states that Bitcoin is currently in the early stages of a bull market that could allow big players like BlackRock to accumulate BTC while it is low:

Phase 1 is in an early bull market (blue). Of course, BlackRock wants to buy cheap just before ETF approval and just before the phase 2 full blown bull market.

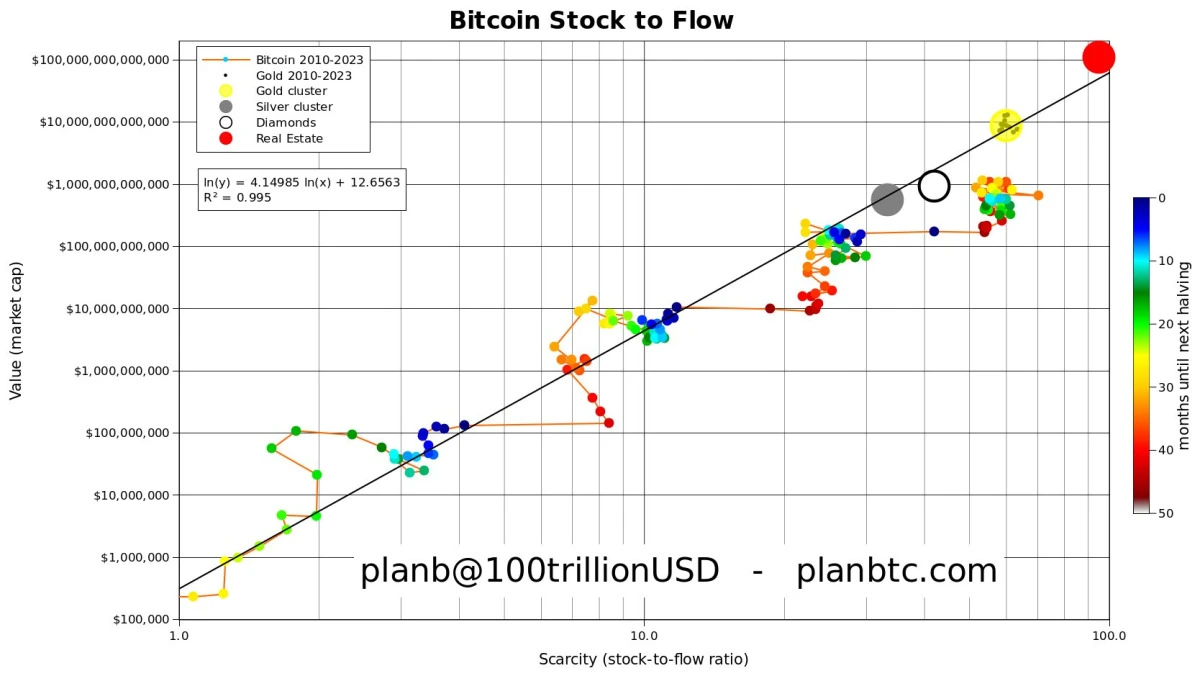

PlanB is the inventor of the stock-to-flow (S2F) model. Following Bitcoin’s next halving cycle that halves the newly created BTC issued to miners, PlanB says S2F will suggest that king crypto will eventually become more scarce than real estate and will be extremely undervalued compared to other commodities like gold, silver and diamonds:

Bitcoin (S2F 58, market cap of $400 Billion) is extremely undervalued compared to:

– gold (S2F ~60, market cap ~$10M)

– diamond (S2F ~40, market cap ~$1 Million)

– silver (S2F ~30, market cap ~$500 billion)

How will the markets react when BTC goes to S2F ~110 (>real estate) after the 2024 halving?

Also, PlanB said that he expects the price to rise to $50,000 as Bitcoin approaches its next halving. For this, whales must first overcome short-term resistances.

Bitcoin price faces critical resistance

Bitcoin price extended its decline below the $29,200 support zone. Even BTC traded below the $29,000 level. A bottom was formed near $28,880 and the price is now attempting a recovery wave.

The first critical resistance is near the $29,350 level. The first major resistance is near the $29,600 level and the 100 hourly simple moving average. It is close to the 50% Fib retracement level of the bearish move from the $30,334 high to $28,880 low.

Specifically, a close above the $30,000 level will start a fresh rise. In the stated case, the price is likely to head towards the $30,400 resistance. On the other hand, if the price fails to clear the $29,350 resistance, it will continue its downside move. An initial support on this side is near the $29,100 level and the channel trend line. Technical indicators point to the following levels as critical resistance and support:

- Hourly MACD – The MACD is now losing momentum in the bearish zone.

- Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is currently above the 50 level.

- Major Support Levels – $29,100 followed by $28,880.

- Major Resistance Levels – $29,350, $29,600 and $30,000.

Tonight’s Fed rate decision is critical

cryptocoin.com As we have reported, the FOMC will announce the new interest rates this evening at 21:00. Markets are expected to experience a minor push, similar to their predecessors. However, current market movements suggest that the Bitcoin price is likely to enter a pre-FOMC bearish. At a time when market participants set lower targets and drastically bearish on Bitcoin, a glimmer of hope emerges for the bulls, with an imminent rise.

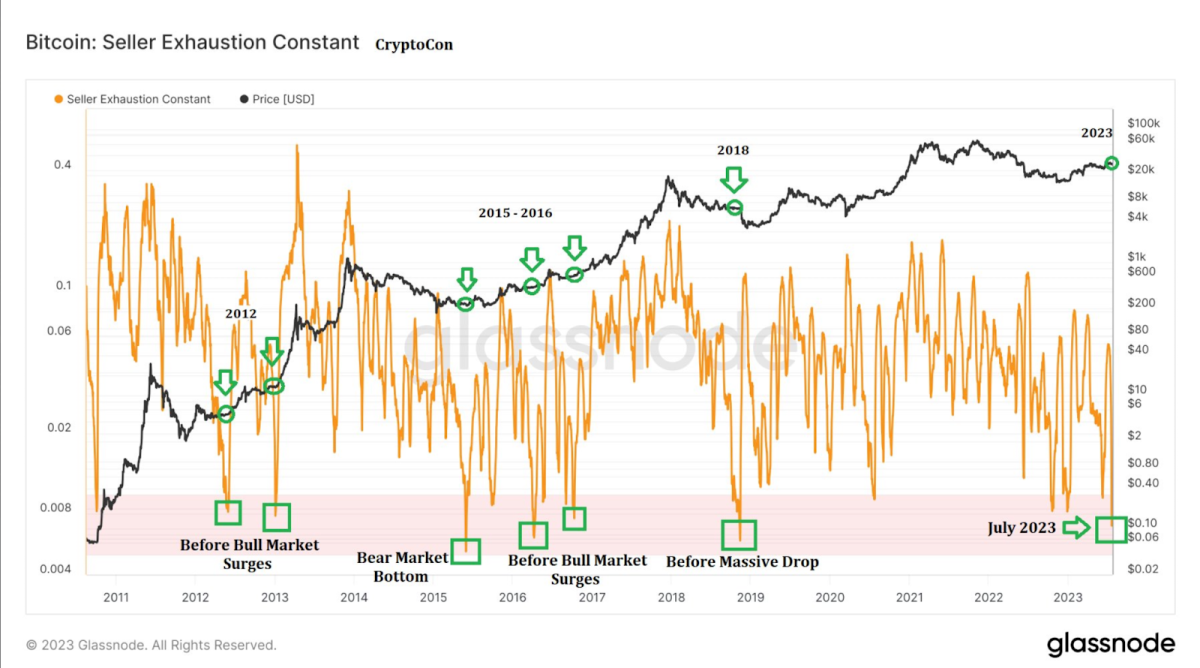

BTC price has been trading in a parallel consolidation for over a month. In the meantime, it fails to rise above the resistance. It remains above the lower support. This caused volatility to reach the bottom level. With the drop in volatility and volume, sellers are failing to make a profit. They are forced to sell with serious losses. This led to a massive drop in seller exhaustion levels reaching levels not seen since the start of 2019.

In summary, it is expected that BTC will test the intermediate support of $ 28,700 after the Fed rate decision in the evening. Then it is expected to close the end of the month at levels above $30,000.