In a new report dated Dec. 10, DappRadar has listed the most melting altcoin projects by total locked value (TVL). Despite all the high-profile partnerships, the decline of Polygon (MATIC) was striking.

Data says MATIC and Solana melt

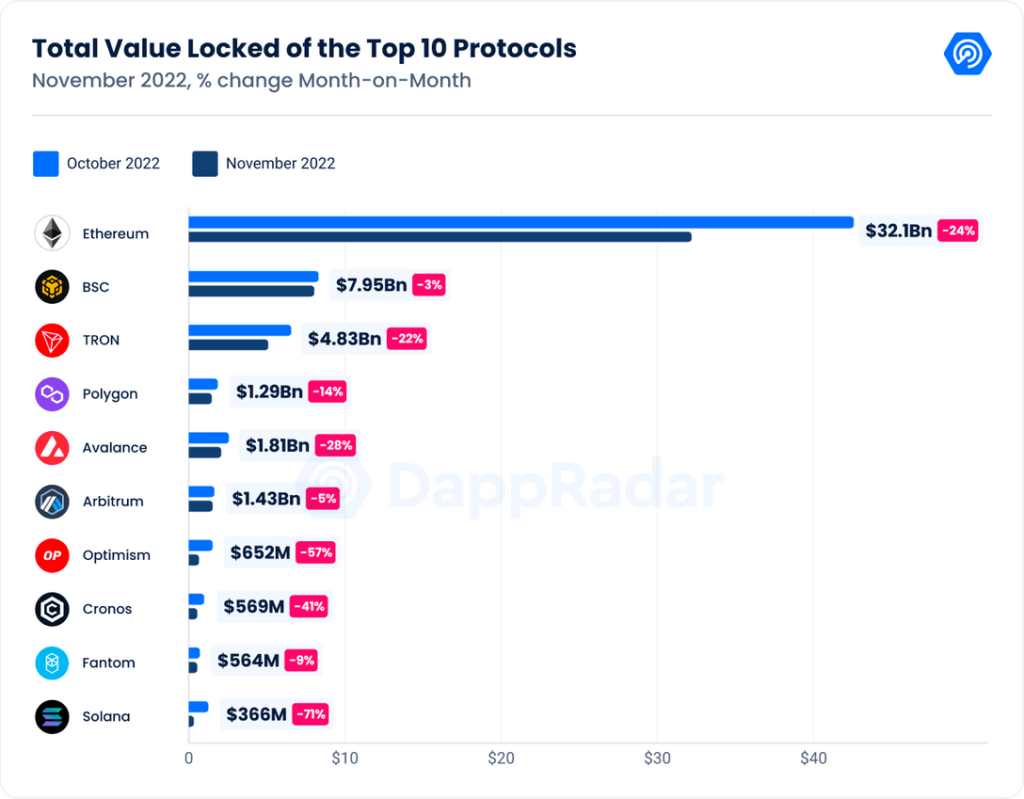

TVL represents the total capital held in their smart contracts. Data provided by DappRadar shows Solana in free fall on this metric. Of all DeFi projects, Solana suffered the largest volume loss from the event around FTX. According to the analytics platform, Solana’s TVL dropped 71% on a monthly basis from October to November. Thus, it fell 71% from the peak of $1 billion in October to 366 million.

Solana is trading at $13.65 at the time of writing. While the TVL value was below $300 million, it fell to 16th place by market capitalization. On a price basis, it’s down more than 57% from its price of $32.24 on Nov.

Also Polygon (MATIC) is experiencing a similar drop. In November, NFT reached $6.34 million in trading volume. This means a 42% reduction. Interestingly, the number of sales on the protocol increased 135% this month to 556,434. This increase is due to the large number of cheaper NFT collections initiated in the protocol. Lens Protocol and Crypto Unicorns stand out among the NFT collections. Sales of these two projects increased by 21.77% and 203%, respectively.

General view of the market on the basis of TVL

The DappRadar report showed that Binance Coin (BNB) suffered the fewest TVL losses, as opposed to MATIC and Solana. The Binance-backed crypto is down just 3% month-to-month. The total locked value of BNB is currently around $4.83 billion. However, its price on a token basis is moving around 290.

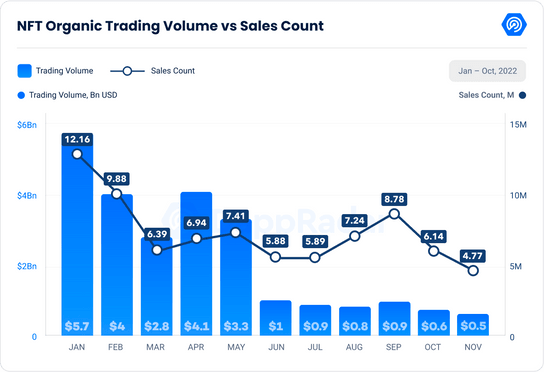

Another big drop in TVL basis came from Ethereum. The leading altcoin lost 24% of its TVL of $32.1 billion. Still, DeFi remains the market leader. It maintains this position despite the TVL-dominated decline from 61.97% in October to 49% in November. In a broader picture, the total value of the crypto market locked down fell 22% to roughly $65.01 billion. The NFT market also fell 7.47 percent from October to $546 million, according to DappRadar. Additionally, NFT sales fell 22.24% month-on-month.

NFT market continues its downtrend

According to the data, NFT trading volume measured in dollars this month decreased by 17.47% compared to October, reaching $546 million. The good news is that this drop is the lowest we’ve recorded this year. In addition, the number of sales decreased by 22.24% compared to the previous month.

Regarding NFT, it is noteworthy that Polygon experienced a decrease of 42%. cryptocoin.comAs you follow, Polygon has taken important steps with Starbucks and Warner Music Group in recent weeks, as well as high-level partnerships such as Meta and Disney.