Ethereum, one of Binance’s largest altcoin projects, remains in the headlines ahead of the upcoming merger. As expected, it is receiving significant demand and acceptance from institutions and individual investors. This interest has now peaked on Binance, the leading cryptocurrency exchange.

ETH futures contracts on Binance break records as Merge approaches

Popular on-chain analytics resource Glassnode has scrutinized the Ethereum network about a month before the merge, an expected upgrade since 2015. Detailed analysis includes metrics such as network efficiency, social dominance, supply disruptions and number of addresses. One of the standout stats is that Ethereum futures contracts open interest hit an eight-month high at $3.1 billion on Binance on Sunday.

📈 #Ethereum $ETH Futures Contracts Open Interest just reached a 8-month high of $3,103,501,977.07 on #Binance

Previous 8-month high of $3,091,962,814.04 was observed on 13 August 2022

View metric:https://t.co/vidXnCkWMH pic.twitter.com/dK9afvDyOy

— glassnode alerts (@glassnodealerts) August 14, 2022

cryptocoin.com As you follow, Glassnode analysts previously said that the merge was a “buy on rumor, sell on news” type of event. It seems that investors are expanding their ETH positions in order not to miss what will happen after the merger. Thus, Ethereum surpassed Bitcoin for the first time in history with an open interest of $ 6.6 billion. However, this was not the only metric where Ethereum ranked first.

Ethereum network activity multiplies as Merge approaches

The anticipated boost will help improve the network’s speed, efficiency, and scalability. This kind of bullish prospect has fueled a truly positive environment for those who are about to come.

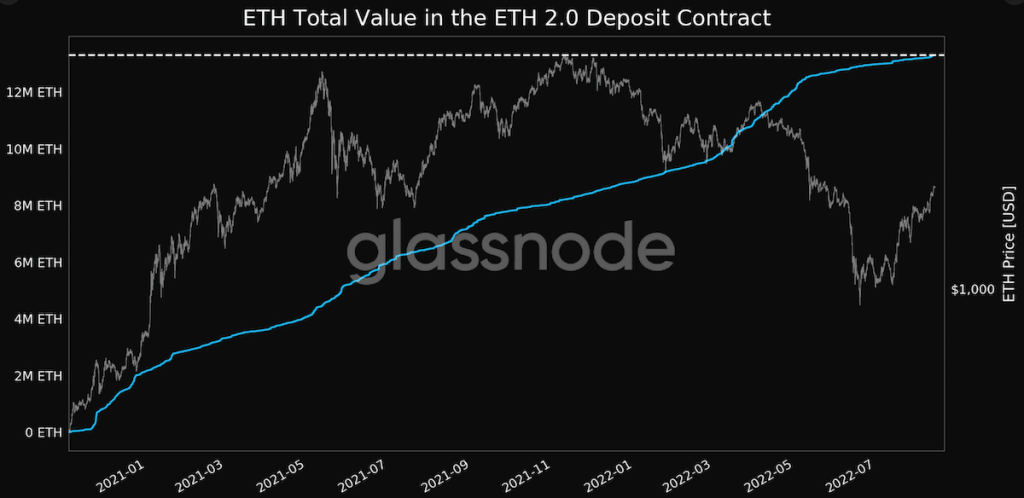

ETH 2.0 saw deposit growth from around 8 million to over 13 million in mid-May 2022. To be specific, the number of stake ETH 2.0 deposit contract addresses has reached 13,302,229, according to Glassnode. The deposit agreement on Beacon Chain, launched in November 2020, allows ETH holders to lock their holdings before the transition. This is indeed the case for the world’s largest altcoin.

Altcoin investors are once again walking away from fear

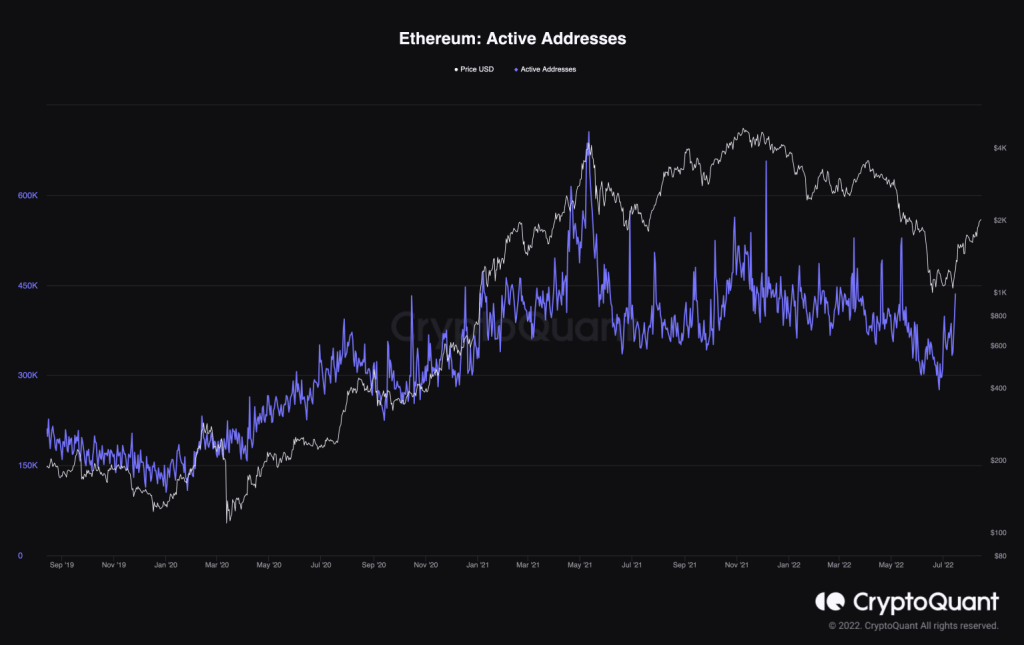

Supply disruptions and increased demand amid ETH addresses also helped ETH move beyond fear. For example, data from CryptoQuant revealed that active ETH addresses have risen to new highs (>400,000 per day) compared to previous figures.

This is a sign that new investors are jumping into this pool as well as committed long-term investors (hodl). Here, the second group continues to hold ETH regardless of market conditions. In fact, Glassnode’s latest analysis shows that the number of addresses holding 10+ ETH is currently in ATH.

📈 #Ethereum $ETH Number of Addresses Holding 10+ Coins just reached an ATH of 313,353

View metric:https://t.co/6ggy1nLbSD pic.twitter.com/tDERgRb6gn

— glassnode alerts (@glassnodealerts) August 14, 2022

On the other hand, Ethereum burned more than 2.58 million ETH in a year in an attempt to become disinflationary. Here, ETH transfers led the Ethereum burn actions, while OpenSea, USDT, and Uniswap V2 followed.

As a result, the week leading up to August 15 has been a bullish week for the leading altcoin. ETH is also outperforming Bitcoin ahead of the September merge event. For comparison, it has gained 61% against Bitcoin since June. What will happen in September is a matter of great curiosity.