Crypto analysts are trying to predict the date of the next rally for Bitcoin. Ambitious predictions about this came from a tweet by crypto researcher Kevin Svenson on October 20.

According to technical analysis, the Bitcoin bull market will start on this date.

Market analyst Kevin Svenson gave the date of the next bull run for Bitcoin (BTC) in a tweet on October 20. Looking at the previous bear market trends, the analyst predicts that the next rally will start in April 2023. Svenson uses the Bitcoin cycles of 2013, 2017, and 2021 to identify bullish pivots of peaks. Looking at these years, it reveals how long bear markets last before turning positive.

The expert states that the bullish axis following the 2013 cycle peak started 81 weeks later. The ensuing rise began after a 68-week decline. As a result, Svenson concluded that the next bull market should start an average of 75 weeks after the cycle peak in November 2021. This date coincides with April of the next year.

If 2018 repeats itself

On the other hand, a number of technical indicators suggest that Bitcoin will suffer more due to the descending triangle formation similar to the 2018 bear market. However, another study revealed a short-term rally despite the dominance of bears. Michal van de Poppe, the analyst behind the forecast, stated that he still expects a breakthrough a week after predicting a “huge rise” for Bitcoin.

#Bitcoin still waiting for this breakout.

Preferably, I'm looking at longs around $19.3K if I were not into a long.

Or a flip of $19.6K.

Overall, I'm assuming we'll continue the rally towards $22K coming period. pic.twitter.com/W3GN8ljjpA

— Michaël van de Poppe (@CryptoMichNL) October 18, 2022

At the same time, according to Bloomberg’s commodities expert Mike McGlone, Bitcoin is diverging from products like crude oil because of its “discretionary advantage”, which marks an “unstoppable stage of maturation.” cryptocoin.comThe senior analyst you follow from said that Bitcoin will soon climb to $100,000.

The number of Bitcoin whales is increasing

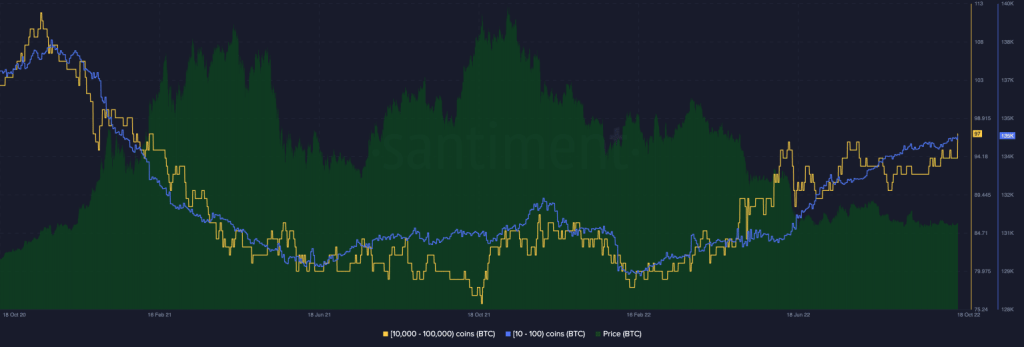

Meanwhile, new data from Santiment has revealed a gripping whale move for Bitcoin. According to the blockchain analysis platform, the number of addresses holding 10-100 and 10,000-100,000 BTC clinched the highest number of related addresses since February 2021. Currently, the number of addresses holding between 10 and 100 BTC is around 135,000. So far in 2022, this rate has increased by 3% despite the prolonged decline in the overall cryptocurrency market.

As for addresses holding between 10,000 and 100,000 BTC, these addresses currently total 97. In the last ten months, this has increased by 13%. According to Santiment, “utility should follow suit” as these numbers continue to rise.

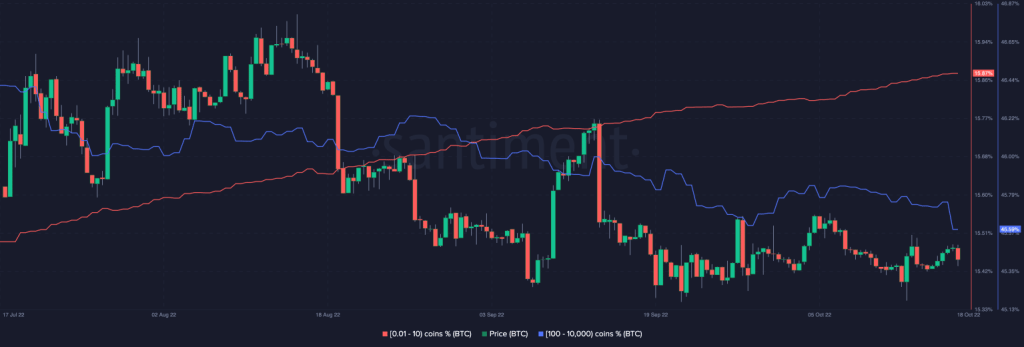

Interestingly, despite the increase in whale wallets, they currently have the lowest percentage of the total supply since 2019. According to data from Santiment, this group of investors currently holds 45.59% of the total supply of BTC. At the beginning of the year, this rate was 48.54%.

The percentage of total supply held by BTC’s whales is at a 3-year low. However, small to medium sized addresses currently have 15.9% of its current supply. This means that addresses holding 0.1-10 BTC in this new wallet distribution have reached a new peak.