dYdX and 2 other altcoin whales have seen a huge surge in transactions, with the foundation announcing that it has delayed token unlocking until December 2023.

This altcoin hits whales’ radar

The altcoin market has been showing good strength lately, with Ethereum and other top ten altcoins taking the lead. But in the last two-three months, there has been one altcoin that has consistently been performing well – Litecoin (LTC).

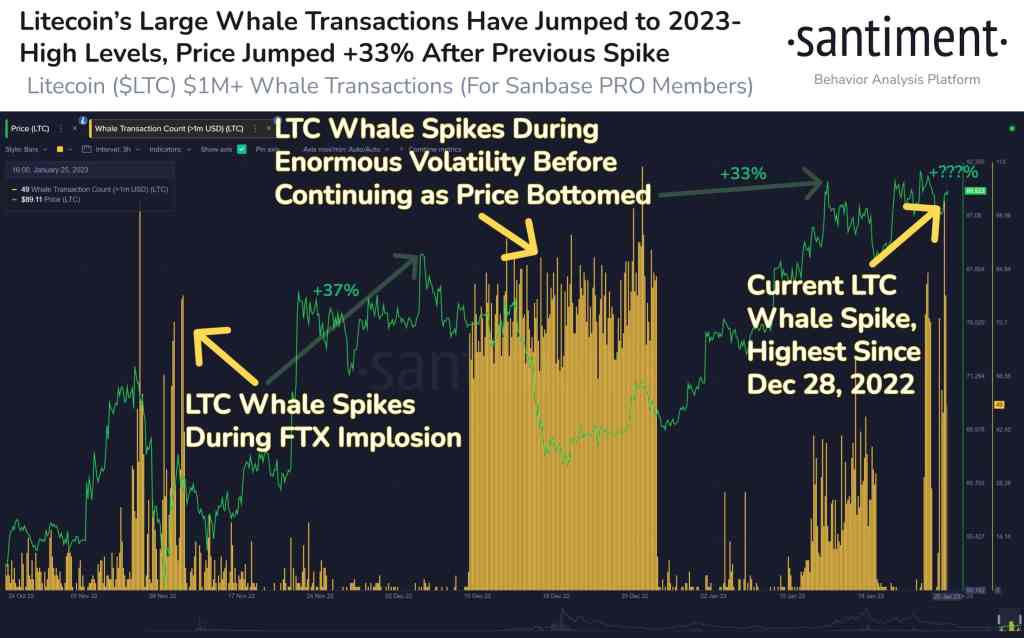

Over the past 90 days, LTC has gained more than 80% while attracting the attention of investors. Big whale addresses holding LTC exploded at the event, according to the chain data. On-chain data provider Santiment reported:

“Litecoin’s large whale transactions exploded with activity that saw a resurgence of transactions valued at $1 million or more. At the tail end of the last two similarly sized whale spikes, prices rose +37% and +33% at their peaks.”

Market analysts believe that LTC will continue to be on investors’ radar this year as the big halving event in the second half of 2023 approaches. This could act as an important catalyst for LTC to become even more. Some analysts expect the price of Litecoin (LTC) to rise as high as $150 and around.

dYdX joins Litecoin

In the last 24 hours, dYdX has increased by a staggering 30% as the dYdX Foundation says they will delay the unlocking of 150 million tokens from next February until the end of December this year. As a result, there has been a large whale participation in dYdX as of now. As of press time, dYdX is trading at $1.99. The Santiment report states:

“DYDX has been a bright spot, +22% for the day in a normally quiet altcoin market. There are already 986 active addresses in the DYDX network, which indicates a huge benefit increase. Additionally, there are already $10.1M + whale transactions today.”

Along with Litecoin and dYdX, several other small and medium altcoins have seen strong rallies this year. cryptocoin.comAs we mentioned, some of the altcoins that have increased by 20% in the last 24 hours are LCX, SONM, Aptos, Nervos, Concordium and others.

ETH whales stepped in

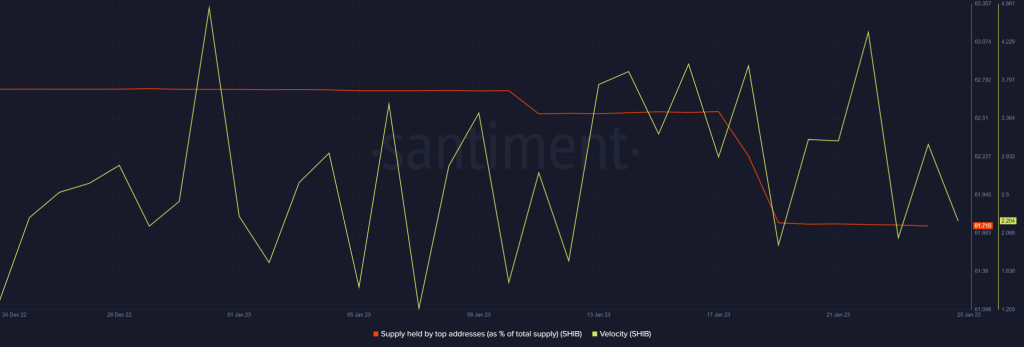

SHIB is currently going through a phase of increased selling pressure, as with many other cryptocurrencies and tokens. However, according to a recent WhaleStats alert, it has managed to become the most traded token by top ETH whales in the last 24 hours. Whale activity often highlights directional movement.

Maybe a price analysis will provide a better understanding of what’s going on at SHIB right now. The bears managed to correct up to 15% from the current monthly high to the 24-hour low. Instead of more downside, we’ve seen some bullish relief over the past few hours.

This bullish relief coincides with whale activity observed by WhaleStats. He suggests that ETH whales add to buying pressure. In other words, these whales may have blocked further bearish momentum.

Where is this altcoin going?

If the bears regain control, the slight increase could be a short-lived result. Alternatively, we could witness more bullishness if the market sided with the bulls. SHIB has been losing momentum for the past two days, suggesting that the bears’ momentum is low. This has been in favor of the bulls in the last 24 hours.

On the other hand, the supply of Shiba Inu in the hands of the best addresses has dropped significantly since the second week of January. This means that the big whales are making some profit, and so the upside is braked. The same metric is yet to signal any recovery or re-accumulation, so there may not be enough liquidity to support a strong bullish reversal.

On the retail side, things don’t look very exciting either. Daily active addresses are within the normal range, so sudden changes are unlikely to affect demand.

The average cryptocurrency age of SHIB indicates that there are zones of accumulation (probably caused by whales) protected against further losses. However, it is now in another bearish cycle, or at least the last two days, which confirms some profit has been made. However, if a strong accumulation is observed, the same thing is expected to return.