Bitcoin has gained in the $19,000-20,000 range this month. This month, BTC has been less volatile overall. However, the US CPI data dropped Bitcoin sharply to $18,190 on October 13. However, BTC quickly recovered from the lower range. It performed some more stable trading sessions. So what are the expectations for cryptocurrencies such as BTC, ADA, ETH, SHIB? Will altcoin season finally arrive?

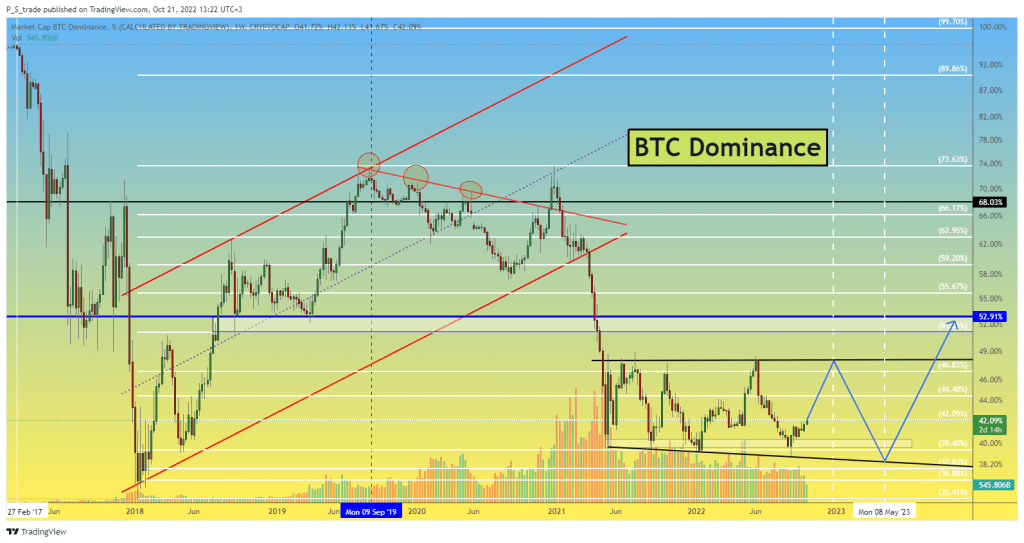

Bitcoin created these patterns in market dominance

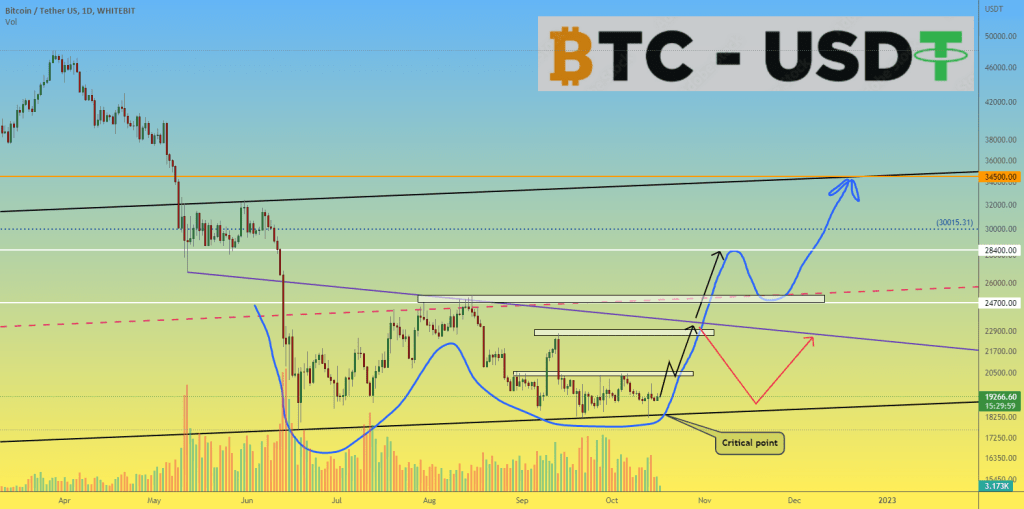

According to Bitcoin’s market dominance, BTC followed the same pattern in 2018 and 2020. Therefore, before climbing to the tops, it realized a double bottom formation. Bitcoin’s market dominance graph measures the ratio of Bitcoin’s market cap to other cryptocurrencies in the market. According to BTC’s market dominance chart, Bitcoin has already formed a “W” pattern on the chart. According to previous trends in 2018 and 2020, there are some bullish prospects. According to experts, there are two critical price levels that will determine the further movement of BTC. These are $18,000-18,300 and $23,400.

According to analyst Shayan Chowdhury, “double bottom” analysis becomes invalid if BTC breaks the critical support level at $18,000. As BTC can trade near the $10,000 price level, it could present a harder time for its investors. If BTC price reaches a resistance level of $23,400, traders can witness positive momentum. From the $23,400 level, BTC can move in two ways. If double bottoms follow, it is thought that BTC could drop below $19,000.

If BTC breaks out to the upside, it risks rejection at the $28,400 resistance level. Next, it could correct a slight downside to $24,700. Then we can expect Bitcoin to generate exponential growth to $34,500 by the end of this year. If BTC is rejected at $23,400, the price could decline to its current price level. It could make another attempt to break $23,000 by the end of December.

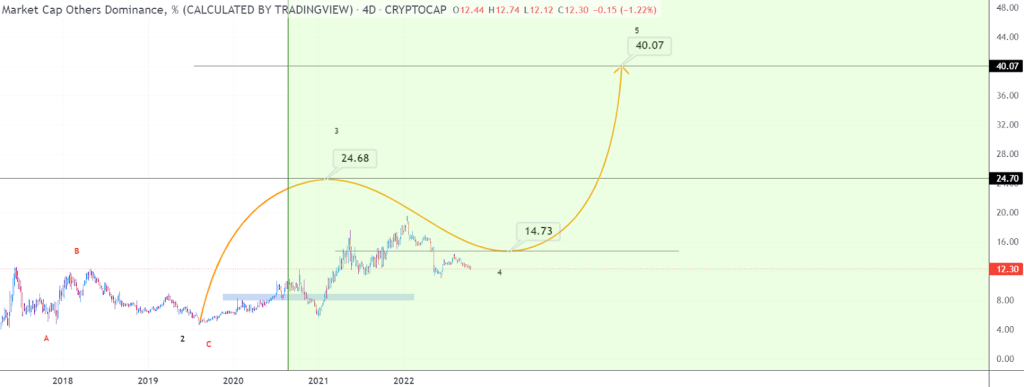

Is it altcoin season for SHIB, ETH, ADA?

At the beginning of 2023, altcoins such as XRP, SHIB, ADA, and BNB are thought to be preparing for a crypto boom in 2023. Meanwhile, BTC is expected to reach the bullish zone of altcoins. According to the expert, the altcoin season will likely continue until the end of May 2023. This, in turn, can act as a catalyst to get a jump in crypto investment portfolios.

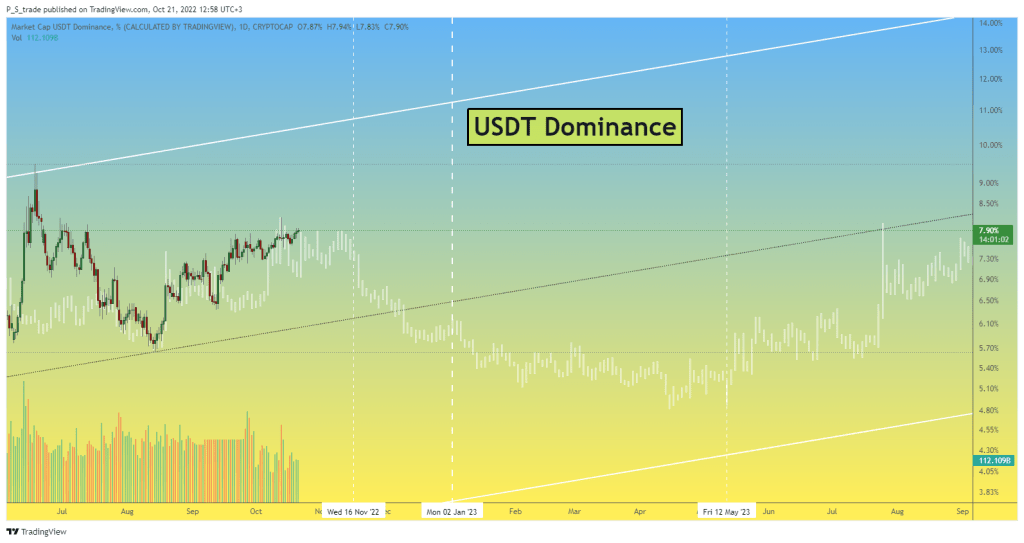

The underlying sentiment behind this lies in keeping asset prices in a consolidated range. It also tracks investors who invest their funds first in stable crypto assets like Bitcoin or Ethereum to force market dominance. cryptocoin.com As we reported, the market saw an excellent altcoin season during the crypto pump of 2018 and the DeFi hype of 2020. Back in 2017, when investors started investing in altcoins during the crypto boom, it was mainly dominated by cryptocurrencies like Bitcoin and Ethereum.

However, Bitcoin’s dominance has dropped from 90 percent to 35 percent in 2018. Then, in 2020, the same thing happened as Altcoins started pumping. Bitcoin’s dominance has dropped from 70 percent to 40 percent. USDT’s dominance chart falls in parallel as investors start buying altcoins and stablecoins with USDT. This, in turn, shows the sentiment of the crypto market during a bullish and bearish trend.