LTC price has maintained the $90 support zone this week despite the negative sentiment surrounding the upcoming Litecoin Halving. Historical price data shows that LTC price usually drops after a Halving event. However, on-chain data indicates that things will turn out differently before the upcoming Halving date. So, is it possible for LTC to fend off the historical halving collapse?

LTC price performance on historical Litecoin Halving events

cryptocoin.com As you follow, there are only a few days left until the Litecoin Halving event. As the countdown begins, historical data shows that LTC will likely pull back as the Litecoin Halving date approaches. The highly anticipated Litecoin Halving will take place on August 2, 2023. On-chain historical data reveals Litecoin’s unremarkable “price crash” trend in the weeks before previous halvings in 2015 and 2019.

Prior to Litecoin’s first halving event in 2015, LTC price peaked at $7.54 on July 10. It then fell 42% to $4.40 on the August 5 halving. A similar pattern occurred during the 2019 cycle. LTC price peaked at $142 on June 23, 2015. However, it later dropped 53 percent to $93 on the August 5 halving date. The post-halving bearish trend continued for several months before Litecoin entered another rally in January 2020. Let’s see if history repeats itself this year.

Litecoin miners stockpile their reserves ahead of Halving

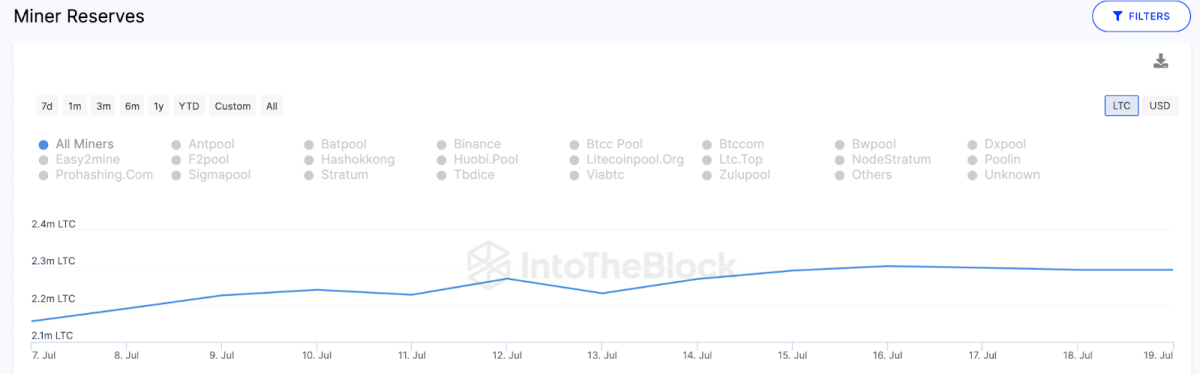

With the highly anticipated upcoming Litecoin Halving, Miners’ block rewards will be halved from 12.5 LTC to 6.25 LTC. In preparation for this, the Miners are accumulating their reserves. On-chain data from IntoTheBlock shows that LTC miners added 400,000 between July 1 and July 28. This brings its total reserves to 2.30 million LTC. It also equates to about $207 million at the current price of $90.

Is Litecoin Halving Crash coming? Miner Reserves. Source: IntoTheBlock

Is Litecoin Halving Crash coming? Miner Reserves. Source: IntoTheBlockMiner Reserves data tracks wallet balances of well-known miners and mining pools. When this data rises, it means that miners are making more HODLs rather than selling their block rewards.

With the block rewards halved to 6.25 LTC in less than a week, it appears that miners are in a race to accumulate as much of their current 12.5 LTC earnings as possible. Hence, less and less block rewards are flowing into exchanges. According to experts, the resulting drop in market supply could help LTC avoid a Halving crash this time around.

Network User Activity is on the rise again

Also, Litecoin has witnessed a significant increase in user activity this week. The Santiment chart below reveals how Litecoin Daily Active Addresses increased by 37% from 221,000 to approximately 303,000 active users between July 20 and July 26.

Is Litecoin Halving Crash coming? Daily Active Addresses. Source: Santiment

Is Litecoin Halving Crash coming? Daily Active Addresses. Source: SantimentThe Daily Active Address aggregates the number of individual wallet addresses that have transacted. Thus, it monitors real-time changes in network usage. Consistent increases in DAA, like this week, point to impending growth in trading activity. As a result, according to experts, if LTC Miners continue to stockpile their reserves and users start to process higher volumes, the Litecoin price may gain enough momentum to avoid the perennial Halving crash.

LTC price prediction: is 95 a viable target?

Crypto analyst Ibrahim Ajibade evaluates the technical picture of LTC. Given the on-chain bullish indicators described above, Litecoin has a fair chance to avoid the Halving crash. However, to be sure of this, LTC bulls need to climb above the $90 resistance first. Also, he should try to turn it into support.

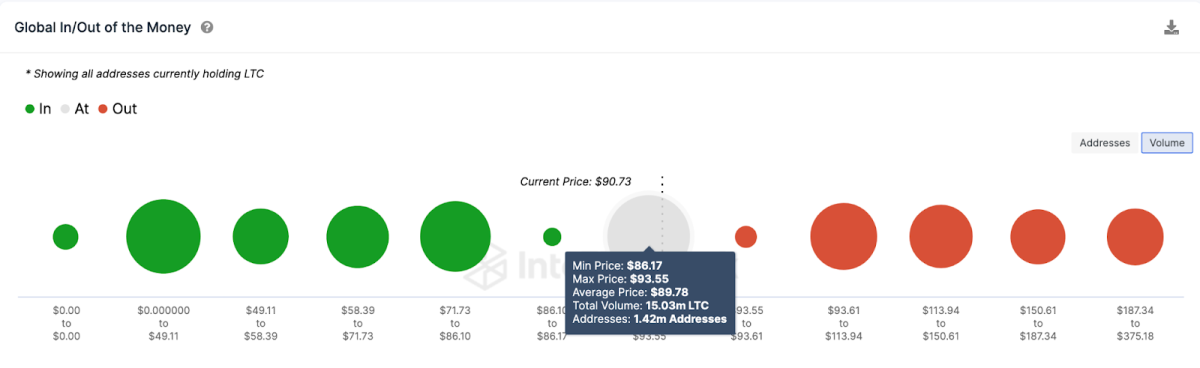

However, as you can see below, 1.42 million wallets that bought 15.03 million LTC at an average price of $90 are likely to stop a potential rise. However, if the bullish pressure from Miners intensifies, it is possible for LTC to break this resistance and eventually reach $95.

Litecoin Price Prediction. GIOM data. Source: IntoTheBlock

Litecoin Price Prediction. GIOM data. Source: IntoTheBlockThere is potential bearish pressure for LTC. Additionally, Litecoin’s drop below $85 is likely to be triggered by the upcoming Litecoin Halving. However, with 1.55 million addresses holding 9.75 million LTC at an average price of $86.17, LTC price could break through this key price range. Also, it is possible for LTC to find bullish momentum if it manages to stay above this. However, if this support does not hold, it is possible for LTC price to drop as low as $80.