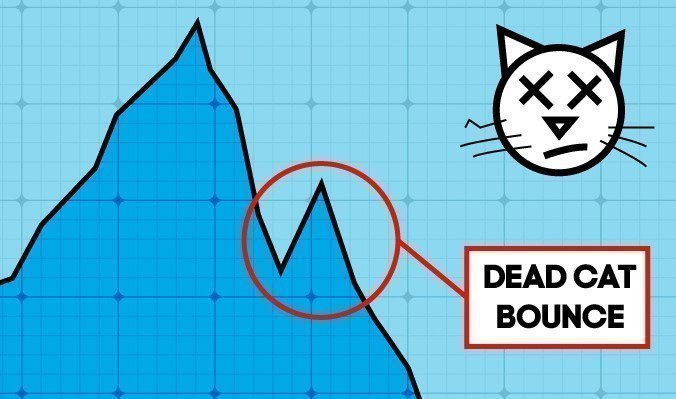

Dead Cat Bounce, the term dead cat bounce, is used to describe the long-term declining asset to rise for a short time and then continue to fall again.

The term Dead Cat Bounce originated on Wall Street. And it is said to be derived from the logic that “even if a cat is dead, if it falls from a height it will jump”. This idea has been applied to situations where a reversal is likely to occur with a small rise during a major decline. Prolonged declines also bring corrections. With these corrections, prices go up. The uptrend is expressed as a bounce, after which the bounce continues to move downward.

Dead Cat Bounce can be used in some situations to predict future market behavior. It is also preferred as a technical analysis model in some cases by financial markets and crypto investors.

In financial markets, price movements progress by forming highs and lows. It does not move in a straight line. The term Dead Cat Bounce refers to this. The price, which moves down for a long time, turns up for a short time and after a rise, a downward trend is observed again. And it even breaks previous support levels, creating new lows.

The point to note in the Dead Cat Bounce pattern can be confused with a general trend reversal in the early stages of the formation and new lows can be created. Therefore, Dead Cat Bounce Patterns can also result in a bull trap where traders open long positions hoping for a trend reversal.

The term Dead Cat Bounce was first used in the news media in December 1985. Financial Times journalists, Horace Brag and Wong Sulong, quoting a broker, “This is what we call a dead cat spatter.” he said. The broker referred to the financial markets of Singapore and Malaysia, which started to recover after strong downward moves. After that, the economies of Malaysia and Singapore continued to decline and would only recover in the following years.

In March 2009, Nouriel Roubini of New York University described the stock market recovery as the Dead Cat Bounce, predicting that the market would soon reverse the course and the decline would lead to new declines. In reality, it marked the beginning of a protracted bull market in March 2009.