A platform that shares data for bitcoin and altcoin projects drew attention to Cardano (ADA). According to the data, “deep-pocketed investors,” that is, “rich” investors, are investing in ADA. Here are the details…

Rich investors focus on altcoin project

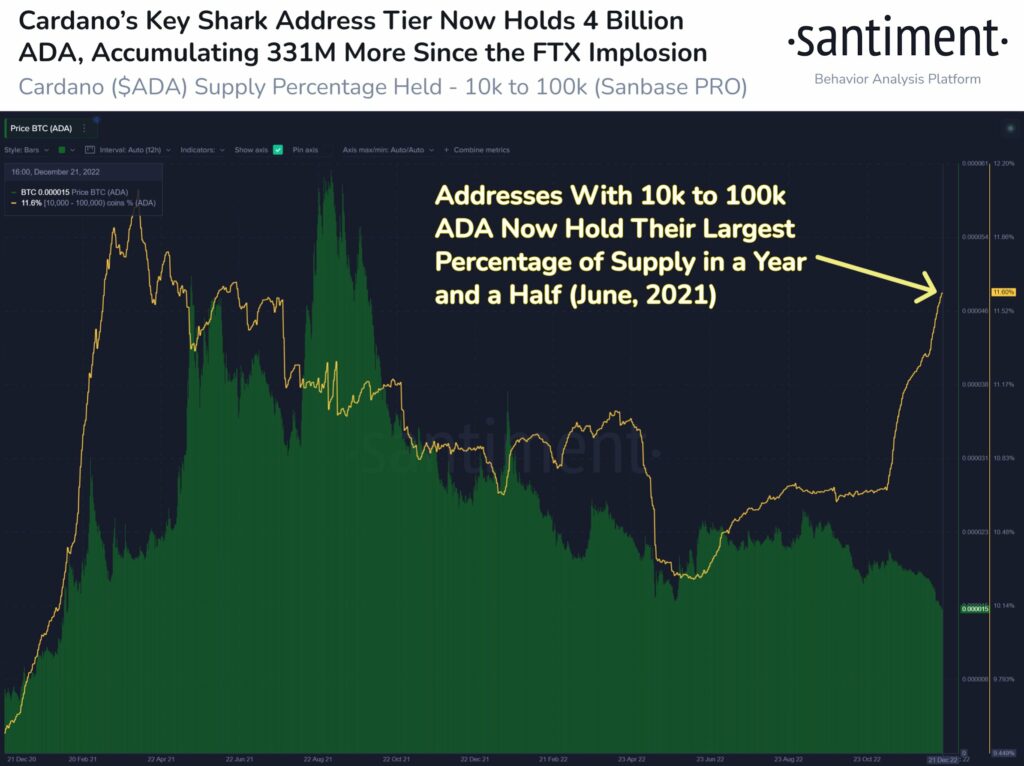

Santiment, a leading analytics firm, surprised with its latest data. He stated that his deep pocket investors have loaded on ADA. Moreover, he says investors are “buying at the bottom” on ADA as a result of the massive dips since FTX collapsed. Santiment says addresses with 10,000 to 100,000 Cardano balances currently hold the largest percentage of supply in a year and a half, with four billion ADA tokens. The platform used the following statements:

Key Cardano sharks have been accumulating steadily since June. They’ve taken this low-end buying to a new level since the FTX drop in early November. Addresses holding 10,000 to 100,000 ADA have added $83 million worth of coins to their portfolios since November 7.

Latest situation in Cardano price

Meanwhile, Cardano (ADA) price is holding its last line of defense, a week after it dropped below the critical support of $0.30. The cryptocurrency market has been in bad shape for the past two months. Notably, it has lost value like other cryptocurrencies, with Sam Bankman-Fried and FTX making the headlines. Due to the contagion from the fall of the FTX exchange, experts predict that the crypto winter will go by 2023. However, if trust is restored in the crypto sector, the trend will change.

Meanwhile, cryptocoin.com According to data, ADA is changing hands at $0.2572 at the time of writing. The data reported that the coin reached $126 million, down 38.78 percent in terms of trading volume. The token ranks ninth in the market with a market cap of almost $9 billion.

Santiment also disclosed Bitcoin data

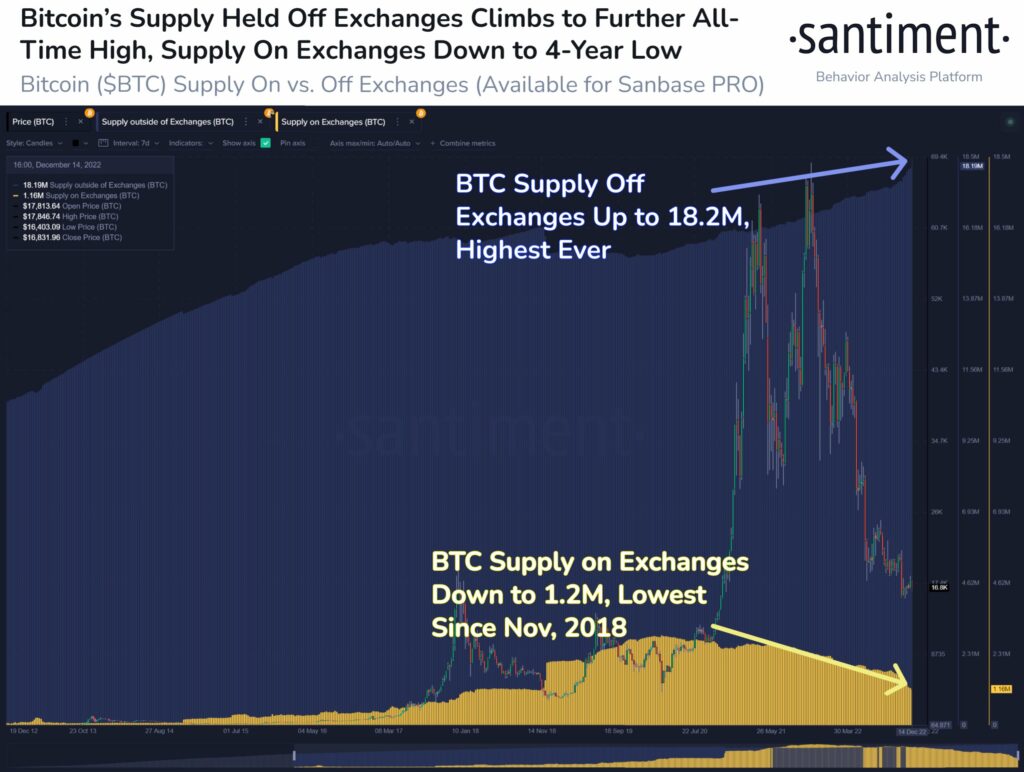

On the other hand, looking at Bitcoin, Santiment reveals that the amount of BTC held on central crypto exchanges is at its highest level ever. According to Santiment, crypto exchanges are witnessing the exit of over $304 billion BTC from their platforms. Santiment discussed the BTCs in and outside the exchanges in an image he shared. He stated that these funds paint a 10-year long-term outlook.

It is stated that the amount of coins that people take care of their own storage has increased. According to Santiment, 18.2 million BTC is now held by investors. That is, it does not hold any third-party funds like exchanges. The amount in question constitutes an all-time high. Currently, Bitcoin has a circulating supply of 19.24 million BTC, according to crypto tracking site CoinGecko. This shows that more than 94.5 percent of the supply of the largest cryptocurrency has been withdrawn from exchanges.