Decentralized finance (DeFi) protocols are surging in popularity – just as signs pile up that big centralized crypto exchanges are going in reverse.

According to data analytics platform Nansen, most DeFi protocols have experienced double-digit percentage growth in users and transactions in the past seven days, a sign of vitality following the collapse of FTX.

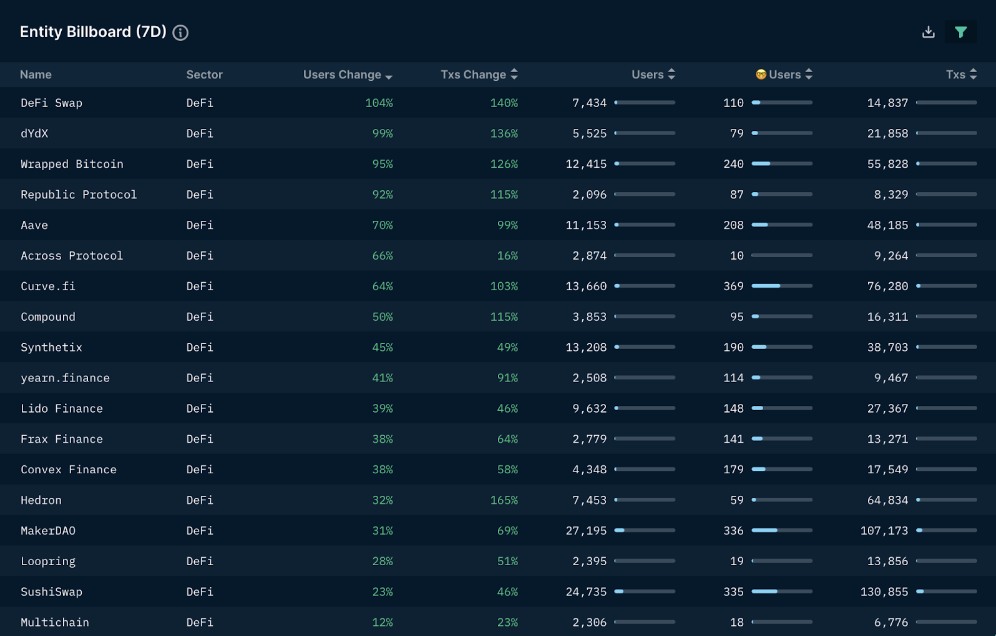

Dashboard showing growth in users and transactions on DeFi protocols. (Nansen)

For example, dYdX, a decentralized crypto exchange on the Cosmos blockchain ecosystem, has seen users increase by 99% and transactions climb by 136%.

The growth is reflected in digital-asset markets: Despite 88% of digital assets in the DeFi sector declining in the week through Tuesday, amid the fallout from FTX’s collapse, the price of the dYdX token (DYDX) is up 77%.

Within the CoinDesk Digital Asset Classification Standard (DACS), the DYDX token is categorized as a member of the CLOB (central order limit book) industry – the only one among 36 industries with a positive week-over-week return, according to CoinDesk Indices.

Aave, a decentralized lender, grew users by 70% and transactions by 99%.

Walter Teng, vice president of digital asset strategy at Fundstrat Global Advisors, told CoinDesk via Twitter, “As we are seeing the contagion from FTX unfold, users realize the importance of self-custody and transparency that DeFi protocols offer. As such, usage metrics across DeFi protocols have surged.”

Decentralized exchange Uniswap

Even though trust in centralized exchanges have fallen dramatically following the downfall of FTX, Uniswap, the largest decentralized cryptocurrency exchange, has experienced a 19% increase in users and 21% increase in transactions over the past 30 days, suggests Nansen data.

Uniswap’s 24-hour ether trading volume stands at $900 billion, at press time, which is more than Coinbase, OKX and Gate.io combined, according to CoinGecko.

Additionally, daily new transacting wallets of Uniswap’s Web App stands at 55,550, a 2022 high.

Uniswap Labs tweeted, “Self-custody and transparency are in demand and users are flocking to what they know and trust.”

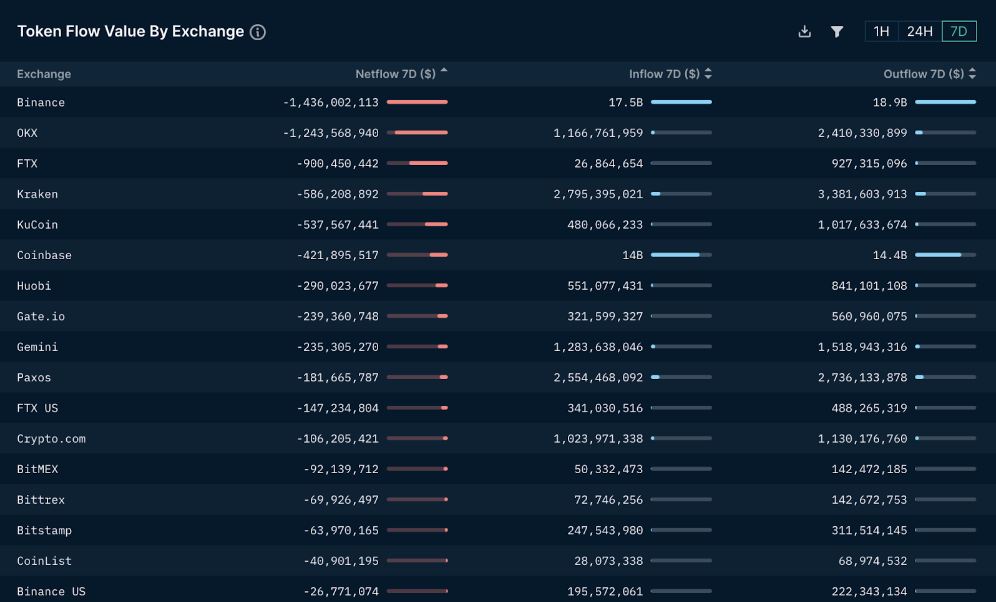

Token flow value of centralized exchanges

Centralized exchanges have experienced a mass exodus of wealth as users are opting to store their cryptocurrencies elsewhere.

Dashboard showing token flow value by exchanges (Nansen)

Among the centralized exchanges, Binance experienced the largest net outflow – outflows less inflows –, of roughly $1.44 billion among exchanges in the past 7 days. This means that users on Binance have removed $1.44 billion more than they have deposited. (Nansen’s token flow value by exchange accounts for only ETH and Ethereum-based ERC-20 tokens.)

OKX ranked second with a negative net flow of $1.24 billion. FTX has the third largest net outflow of $900 million, while Kraken suffered a net outflow of $586 million.

According to Nansen, in the past 7 days, Binance, OKX, FTX, Kraken, KuCoin, Coinbase, Huobi, Gate.io, Gemini, Paxos, FTX US and Crypto.com have experienced a combined net outflow of $6.33 billion; Users have deposited $42.03 billion into those exchanges but withdrew $48.35 billion.

The significant outflows likely highlight a lack of user confidence and trust in holding funds on centralized exchanges.