Some sectors of the crypto industry were excited (and/or confused) by an apparent BlackRock XRP Trust filing in the state of Delaware, suggesting the massive asset manager may try to launch an XRP exchange-traded fund (ETF) after applying to launch bitcoin and ether ETFs. But, this filing was “false.”

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Trust, but verify

The narrative

BlackRock isn’t filing for an XRP exchange-traded fund (ETF). Let’s look at why that was a question that needed answering.

Why it matters

Part of the regulatory concerns around crypto is that it’s easy to manipulate. A token pumping some 10% before dropping again within an hour due to a fake corporate entity filing may not ease those concerns.

Breaking it down

Late Monday afternoon, someone filed for a Delaware entity called the iShares XRP Trust, a statutory trust whose details were identical to the iShares Ethereum Trust, an entity whose filing came hours before Blackrock and Nasdaq revealed they were applying to launch and make available to the investing public an ethereum ETF.

XRP’s price spiked for a hot second, according to CoinGecko, while Crypto Twitter tried to figure out if the application was real. As CoinDesk’s Danny Nelson pointed out, XRP is currently the subject of active litigation by the U.S. Securities and Exchange Commission, suggesting it may be a poor asset for an ETF.

Spoiler alert: It was not a real filing.

“This is false,” a BlackRock spokesperson told one of my CoinDesk colleagues.

The thing is, this isn’t the first time something like this has happened. Longtime CoinDesk readers may recall that in 2021, someone filed to create a pair of Grayscale trust products for the nahmii and theta tokens. The filings were similar to legitimate Grayscale filings but were not filed by the company itself, and were seemingly intended to pump the tokens’ prices (Grayscale is a subsidiary of CoinDesk’s parent, Digital Currency Group).

Monday’s XRP filing may be the result of a similar move. While the Delaware XRP filing was similar to the real iShares Ethereum Trust filing, it was different from the real iShares Bitcoin Trust entity record. The registered agent for the Bitcoin Trust was Wilmington Trust, National Association, while the Ethereum Trust’s registered agent was BlackRock Managing Director Daniel Schwieger.

The Delaware Division of Corporations website does not share a whole lot more information than the name of a trust and the registered agent. It does not suggest whether records are screened prior to being posted or if the person submitting the records genuinely represents whatever company they claim to represent.

Members of the public can purchase further information, though interestingly, the website suggested that buying these records would not answer any of those questions.

“If you are requesting the $20 detailed information option, this application will not return actual images of the documents on record. This application will return a page listing the 5 most recent filings, franchise tax assessment, total authorized shares if applicable and tax due. Officer and Director names and addresses are maintained on the images of the annual reports and are not available through this application,” the filing said.

I clicked through anyway and discovered that I couldn’t pay for the records using a credit card. Instead, I had to input my bank details for a direct ACH debit.

Since the notice on the prior page specified that hitting purchase wouldn’t get me the actual records I sought, I chose not to go through with the buy.

Instead, I called the Delaware Division of Corporations and found out that I can place an order for the documents (using credit cards!) on a different page, but will be receiving them via mail.

It’s unclear whether there is any way for someone to tell, based on just the immediately-public information available, if a filing is legitimate, which is perhaps why we’ve now seen this happen twice.

Stories you may have missed

Taxes

Last week, I wrote about the IRS’ proposed rulemaking to define a “broker” for the purposes of crypto tax reporting, and the industry’s responses (in general) at the time. It turns out many of the 120,000 comments may have been generated with the assistance of a large language model tool.

The IRS held a public hearing on Monday to discuss the industry’s concerns. The responses from the industry representatives were roughly the same as what people (or a so-called artificial intelligence) wrote, if perhaps a bit more on-topic. What was more interesting is that the IRS and Treasury Department officials on the call seemed receptive. While this is by no means definitive, questions about how the proposal would apply to decentralized finance entities, stablecoins and other issues suggest the regulators may be open to revising some of the wording in response to industry concerns.

These questions included how brokers might identify non-fungible tokens (which may or may not be financial in nature) and what issues DeFi platforms might have.

Still, it may take the IRS and Treasury Department some time to publish a revised version. Though more than 124,000 comments have been submitted, only around 44,000 have been posted. IRS staffers may still be working through the other 80,000.

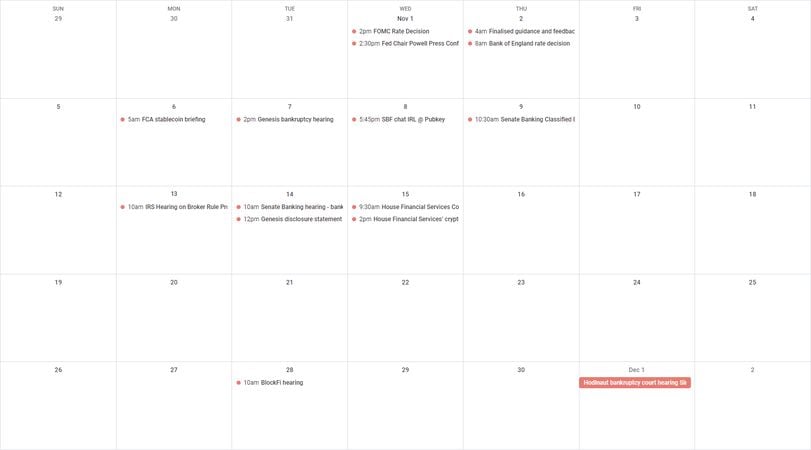

This week

Monday

Tuesday

Wednesday

Elsewhere:

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See ya’ll next week!