Tellor (TRB) captured investors’ attention this week after racing to hit a new 2023 high of $35 on the cryptocurrency top gainers list. On-chain analysis reveals key drivers behind the ongoing altcoin price rally. Crypto analyst Ibrahim Ajibade explores how long it could take.

altcoin Why is the price rising?

Tellor (TRB) is a decentralized oracle protocol that provides Blockchain infrastructure to integrate valuable off-chain data into on-chain smart contracts. This month, the price of TRB increased by 134%, reaching $35 on Thursday, September 14. cryptokoin.com As you follow from , global payments platform SWIFT Network announced the completion of dress rehearsals to leverage Chainlink (LINK) oracle infrastructure to bring Tokenized TradFi and Real World Assets to the Blockchain. After that, Tellor (TRB) price gained momentum.

Early clues from on-chain data trends suggest that short-term speculators are driving the TRB price rally. But can they HODL long enough to rival Chainlink and other major players in the decentralized oracle industry?

Speculators are currently driving the TRB rally

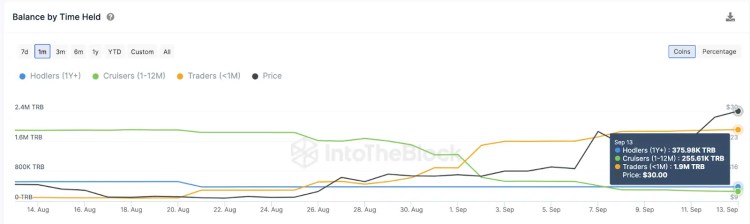

Bullish activity from short-term traders and price speculators appears to be the main driving factor behind the ongoing Tellor price rally. As an indication of this, on-chain data from IntoTheBlock shows that TRB short-term trader wallets have increased their balances by more than 2,000% in the past month.

As you can see below, short-term investors had only 91,130 TRB tokens in their cumulative balance as of August 13. However, as of September 13, this figure reached 1.9 million TRB tokens, an increase of 2,096%. During this time, the altcoin price increased by 135%. Additionally, “Cruisers” and “Long-Term Holders” gradually sold 137,000 and 1.64 million TRB, respectively.

Tellor Balances by Time Held. Source: IntoTheBlock

Tellor Balances by Time Held. Source: IntoTheBlockWhether the altcoin price continues to rise depends on these!

In crypto parlance, wallets that hold their tokens for 1 month or less are called “Short-term traders”. Those who hold it for 1 to 12 months are called “Cruisers”. These are diamond hands that have been held for 1 year or more. So, Long Term Holders. The chart above clearly shows that traders’ dominance in the Tellor ownership structure has increased from 3.65% of short-term traders on August 14th to 75% as of September 14th.

Meanwhile, long-term investors and partners of the Tellor protocol are closing their positions. This is a sign that the recent price increase is due to speculative trading rather than organic growth in the underlying value of the Tellor network. This indicates that there will probably be a higher token turnover in the coming days. Without significant growth in network demand or continued support from long-term investors who believe in the fundamentals of the altcoin project, it is difficult for the price to maintain its upward momentum.

TRB investors will wait for more profits!

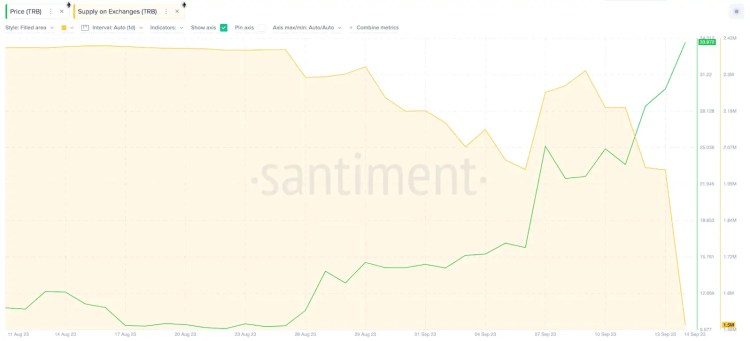

Despite this month’s triple-digit price increase, Tellor traders still want more. On-chain data shows TRB Exchange Reserves are rapidly dwindling as investors remove tokens from exchanges this week. As you can see below, the altcoin price rally gained momentum as investors began removing the tokens from exchanges around August 25. Since then, the TRP supply on exchanges has decreased from 2.3 million tokens to 1.5 million tokens.

TRB Supply in Stock Exchanges. Source: Santiment

TRB Supply in Stock Exchanges. Source: SantimentSupply on exchanges tracks real-time changes in the balances investors currently hold in wallets hosted by the crypto exchange. The rapid decline of stock market balances means that many investors are opting for self-storage. This shows that they will avoid selling in the short term. It is possible that the decline in these stock market reserves will continue in the coming days. In this case, the altcoin price can gain even more. However, it is difficult for TRB to sustain its price rally without significant growth in underlying network activity.

TRB price prediction: All eyes on $20 support for altcoin

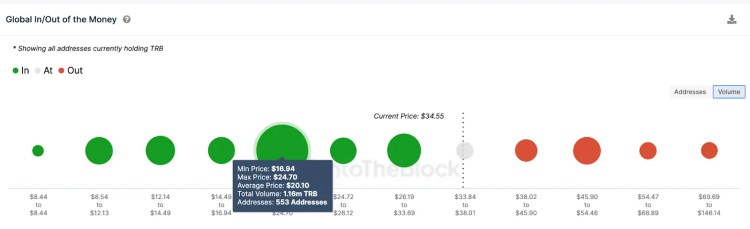

From an on-chain perspective, it is possible for TRB bulls to regroup around the $20 support in the event of a correction. For this, it is necessary to look at the purchase price distribution of current Tellor owners. Accordingly, In Profit/Loss Around Price (IOMAP) data also confirms this stance.

This data clearly shows that the $20 level is the largest cluster where TRB holders have entered the market. As you can see below, 553 addresses have purchased 1.16 million coins for an average of $20. If stock market reserves remain low, the supply squeeze is likely to trigger a recovery. However, things change if speculative traders set out to take early profits. In this case, an immediate pullback of the altcoin price towards $14 is possible.

Tellor GIOM data. September 2023 | Source: IntoTheBlock

Tellor GIOM data. September 2023 | Source: IntoTheBlockConversely, if TRB bulls get significant support in the network pull, the rally is likely to reach the $50 range. However, 974 addresses holding 78,500 TRB purchased at an average price of $42 are likely to form initial resistance. However, if the bulls break this selling wall, it is possible that the altcoin price rally could head towards regaining $50.