Gold price hits one-week highs above $1,850 as the US dollar weakens. Repeated Fed speeches, risk-off mood put pressure on US dollar ahead of FOMC minutes. Market analyst Anil Panchal says gold is starting to react to US rates, but bulls are hesitant. Positive yields on US Treasuries are limiting the rise in gold amid cautious optimism, according to market analyst Dhwani Mehta.

“Yellow metal may extend recent recovery moves”

Gold is intraday as bulls benefit from bearish US dollar and stronger mood during a calm Asian session on Monday gets bids towards its highest level. The precious metal, however, bounced from a two-year low at the latest, breaking its four-week downtrend as the dollar breathed amid mixed data and repeated talk of a 50bps rate hike, bolstered by optimism in China.

Kriptokoin.com , as you can see, a number of Fed policy makers, including Chairman Jerome Powell, will discuss the previous 50 basis points increase in the Fed funds rate in the next few meetings. While defending its forecasts, it avoided calls for a 75 basis point rate hike. The same is putting pressure on the US dollar, with mixed US data and cautious market optimism, according to market analyst Anil Panchal.

The gradual opening of Shanghai and the decline in Covid cases in the mainland, as well as virus-related deaths, bolster optimism for gold buyers as China is one of the world’s largest gold consumers. However, the US Dollar Index (DXY) posted its biggest weekly loss since January. Weakness in DXY justifies the 1.0% gain of S&P 500 Futures. DXY is ignoring recent strong US Treasury yields, which have soared as high as 2.81% as of press time. The analyst makes the following assessment:

Given the risky mood and the low US dollar, the gold price may extend its recent recovery moves. However, the latest Federal Open Market Committee’s (FOMC) monthly PMIs and Minutes will be crucial for clear direction.

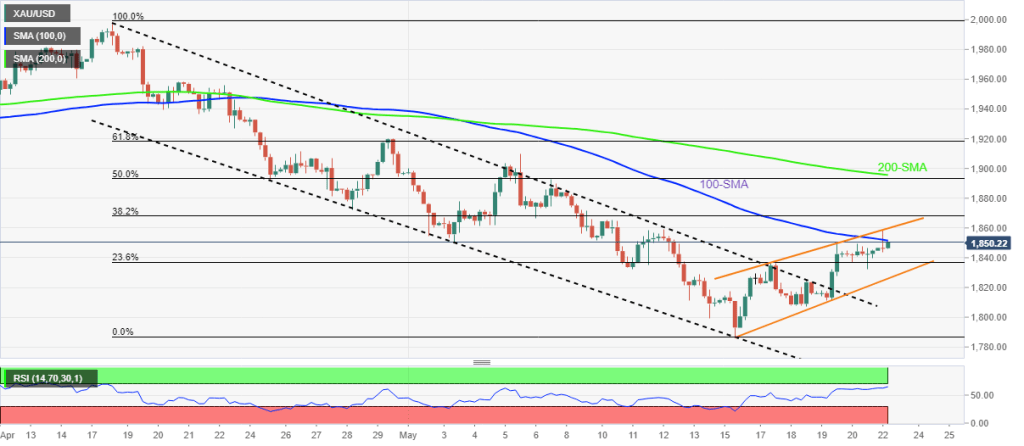

Gold price technical analysis

According to market analyst Anil Panchal, a net break of the monthly falling channel to the upside has resulted in the tighter RSI ( 14) keeps gold buyers hopeful within a one-week ascending channel formation. The analyst points out the following levels:

However, the 100-SMA surrounding $1,852 and the upper line of the indicated weekly channel near $1,860 are limiting the rise of short-term gold. On the contrary, it seems difficult for pullbacks to extend beyond the $1,825 support line of the said channel until press time.

Gold price four hour chart

Gold price four hour chart “Inverse correlation with DXY may limit upward movement”

Gold price starts a new week from the right fundamental and the substantial US dollar supply, extending the previous week’s recovery momentum. The dollar continues to correct lower despite cautious optimism and pushes gold to fresh weekly highs above $1,850. According to market analyst Dhwani Mehta, although the inverse relationship between gold and US Treasury rates has come into play again, it may limit the upside movement.

Treasury rates rise above the hawkish Fed outlook as Treasury rates move towards Wednesday’s FOMC Minutes. Growth and inflation fears continue to affect the market’s risk perception and ultimately affect dollar and gold trading.

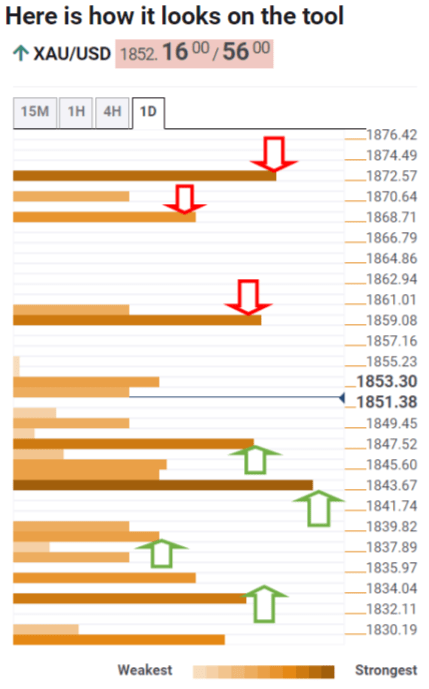

Important levels to watch for gold price

Technical Confluences Detector used by the analyst, gold price, Bollinger Band one-day middle pivot point The R2 one-day and the previous high four-hour convergence at $1,859 show a strong hurdle, halting the recovery momentum. The analyst states that acceptance above the latter will open an additional upside at $1,870 towards the one-week R1 pivot point.

According to the analyst, $1,872, the previous month’s low, will be the pass-through level for gold bulls if the renewed upward move continues. On the downside, strong support is visible at $1,848 at the one-month pivot point S1, below which $1,843 will be tested.

Noting that this demand area is the intersection of the one-day Fibonacci 38.2%, the four-hour SMA10 and the previous lowest four-hour rate, the analyst said that the intersection of the one-day Fibonacci 61.8% and the one-day SMA200 at $ 1,838. it means it will come in. The last line of defense for gold bulls is seen around $1,834, where the 23.6% one-week Fibonacci level coincides with the SMA10 one day and the low of the previous day.

Technical Confluences Detector

Technical Confluences Detector