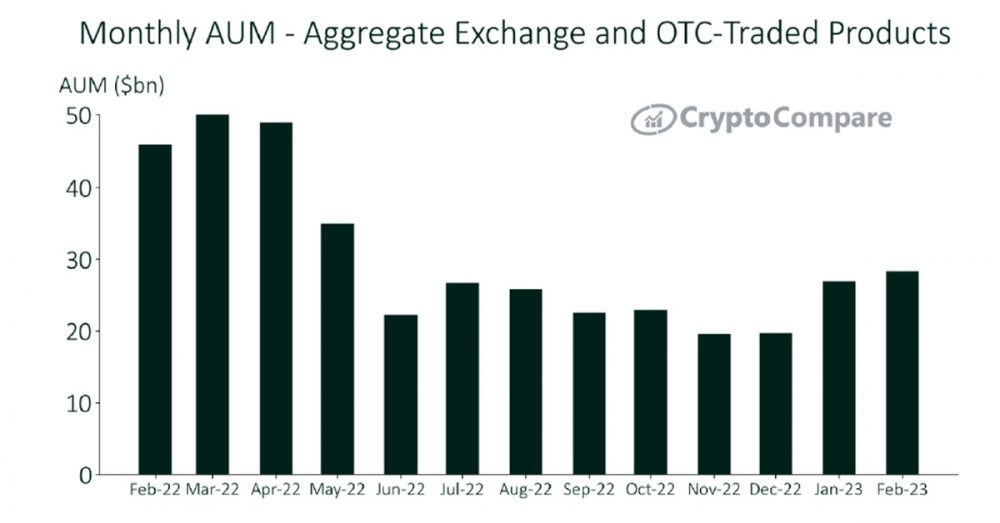

Digital asset investment products’ assets under management (AUM) last month reached their highest level since May 2022, according to a report by data provider CryptoCompare, released Wednesday.

The AUM for digital asset investment products rose 5.2% in February from the previous month to $28.3 billion, the third consecutive monthly increase, according to the latest Digital Asset Management Review, which charts monthly trends.

Despite markets’ increasing nervousness about U.S. regulatory actions and macroeconomic headwinds, the growth in AUM “signaled the bullish sentiment of investors and the increased appetite for digital assets,” CryptoCompare said.

The report noted that Grayscale Investments remained the dominant player in the space with $20.8 billion digital AUM – a 3% gain in February from the previous month. (Grayscale and CoinDesk share the same parent company, Digital Currency Group.)

CI Galaxy and 21Shares recorded more than 37% and 33% increases in AUM, respectively, in February – the biggest gains among companies included in the report.

By assets, the AUM for Bitcoin and Ethereum-based products shot up over 6% and 1.7% in February, respectively. These products now account for 70.5% and 24% of the total AUM market share.