Despite bitcoin’s price surging, digital asset investment products totaled net outflows for a sixth consecutive week last week, a report by CoinShares shows.

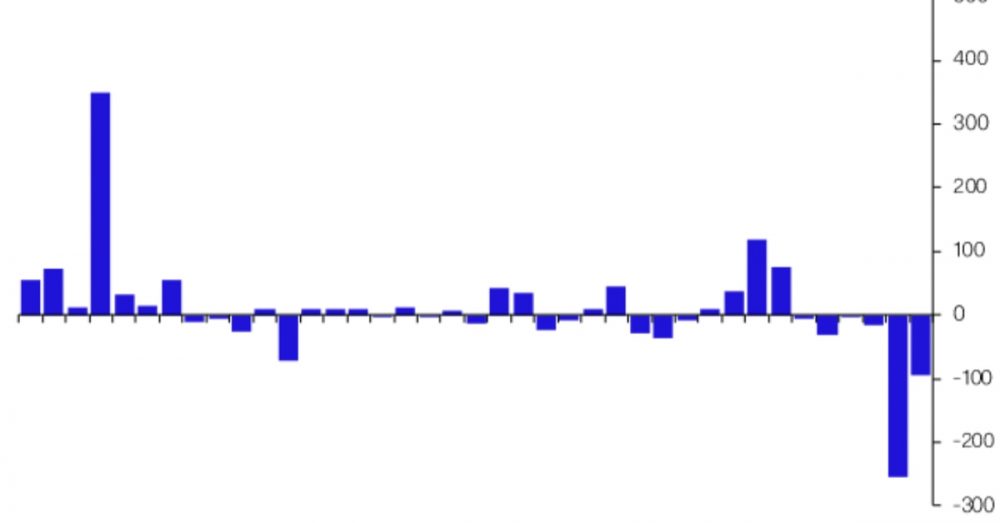

Digital asset net outflows totaled $95 million for the week ending March 17.

Outflows in digital asset investment products for the last six weeks totaled $424 million, the digital asset investment group found.

Bitcoin, ether and multi-asset outflows totaled a combined $130 million, although bitcoin also had $35 million in inflows. Those inflows were short bitcoin, meaning that investors were betting on bitcoin’s price falling.

Overall, the data may reflect a need for liquidity among investors, according to CoinShares. Meanwhile, the largest cryptocurrency by market value’s price has surged from a low of about $19,400 in early March to its current level near $28,000. Over the past week, bitcoin has risen almost 15%.

“It is evident this sentiment is contrarian relative to the rest of the crypto market,” the CoinShares report said. “It may be driven, in part, by the need for liquidity during this banking crisis, a similar situation was seen when the [COVID-19] panic first hit in March 2020.”

After having outflows of $13 million over the past week, Ethereum witnessed inflows totaling $1.3 million.

The positive Ethereum sentiment that led to investors pumping money into ether-related funds reinforces the narrative that the need for liquidity drove bitcoin outflows, according to CoinShares.